Hyperliquid Strategies Files S-1 to Raise Up to $1 Billion via Chardan Equity Facility

- Hyperliquid Strategies files S-1 with SEC seeking up to $1 billion, planning Nasdaq listing under “PURR.”

- HYPE token surged nearly 10% after the filing, reflecting strong investor interest and optimism.

Hyperliquid Strategies has submitted an S-1 filing with the U.S. Securities and Exchange Commission (SEC) to raise up to $1 billion through a public stock offering.

The firm aims to issue up to 160 million common shares in this initiative, with Chardan Capital Markets acting as the financial advisor.

The filing states that the funds raised will be used for general business operations and potential purchases of HYPE tokens. The company currently holds around 12.6 million HYPE tokens.

The company stated,

Source: .sec.gov

Source: .sec.gov

Hyperliquid Targets Nasdaq Listing Under “PURR”

Hyperliquid Strategies was established through a pending merger between Nasdaq-listed Sonnet BioTherapeutics and Rorschach I LLC, a special purpose acquisition company. The merged company will be led by David Schamis as Chief Executive, while Bob Diamond, the former CEO of Barclays, will assume the role of Chairman.

The merger is expected to be completed before the end of the year. Once finalized, Hyperliquid will list on the Nasdaq Capital Market under the ticker symbol “PURR.” The filing stated,

This move positions Hyperliquid alongside other companies that incorporate HYPE into their balance sheets, such as Eyenovia and Lion Group Holding. Adding altcoins has become a preferred choice for companies expanding beyond traditional holdings such as Bitcoin and Ethereum.

HYPE Token Surges Amid Filing Momentum

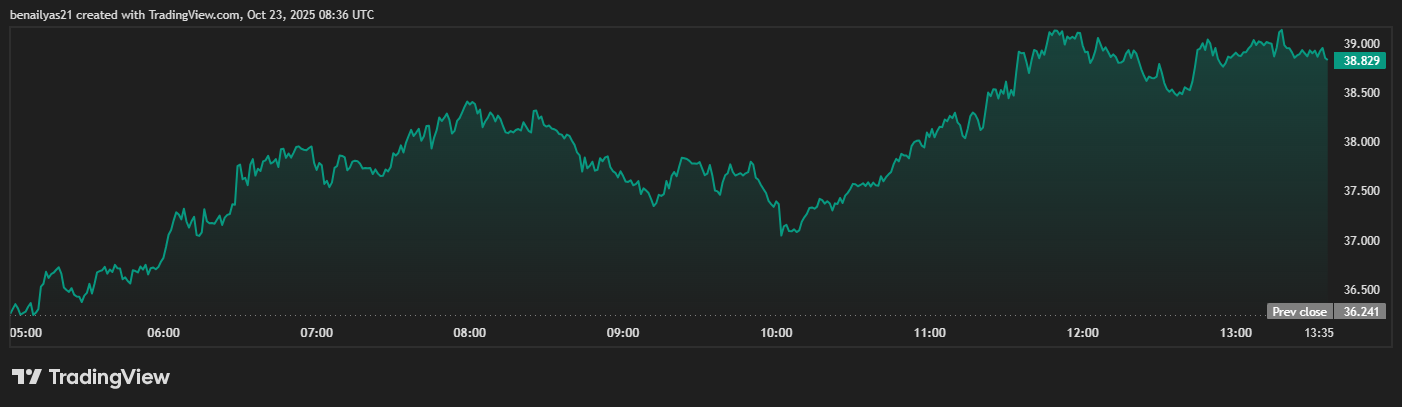

Following the filing, HYPE registered a strong increase in trading performance. Token rose by 9.84% in the last 24 hours, trading at $38.82. Volume increased 16% to $672 million, indicating increased investor interest and renewed market interest.

Source: TradingView

Source: TradingView

Analysts are watching closely the new token unlocks starting in November. Around ten million HYPE tokens are expected to be unlocked every month until October 2027. Such unlocks usually cause price fluctuation in the market. However, sentiment among market analysts remains optimistic.

An account on social media noted,

Another analyst Aylo, expressed similar optimism, added,

]]>You May Also Like

PYUSD Forensic Report: Total Circulation Exceeds 2.6 Billion, a New High, Up 125.5% from August

Huatai Securities: The decline in US CPI in September paves the way for the Fed to cut interest rates