Siren (SIREN) Surges 52% in 24 Hours: Data Shows Volume Spike and Risk Factors

The most striking aspect of Siren’s (SIREN) 52.3% surge isn’t just the magnitude—it’s the volume-to-market-cap ratio. With $31.78 million in 24-hour trading volume against a $157.45 million market cap, we’re observing a 20.2% turnover rate, signaling intense speculative activity that typically precedes either consolidation or reversal patterns.

As of February 16, 2026, SIREN is trading at $0.2161, having climbed from an intraday low of $0.1397 to a high of $0.2402—a 71.9% intraday range that reveals significant volatility and potential liquidity challenges for larger position sizes.

Volume Analysis Reveals Institutional vs. Retail Dynamics

Our examination of Siren’s trading metrics reveals several critical data points that warrant attention. The 24-hour volume of $31.78 million represents a substantial increase relative to the token’s historical averages, though without access to exchange-specific order book data, we cannot definitively determine whether this represents organic accumulation or coordinated buying pressure.

The market cap expansion from approximately $103.3 million to $157.45 million in 24 hours—a 52.4% increase—aligns almost perfectly with the price movement, suggesting minimal supply inflation during this period. With 728.86 million SIREN in circulation against a maximum supply of 1 billion tokens, approximately 27.1% of total supply remains unminted, presenting a potential dilution risk that investors must factor into longer-term valuations.

We observe that SIREN’s current price sits 40.6% below its all-time high of $0.3612, reached just nine days ago on February 7, 2026. This recent ATH followed by a retracement and subsequent recovery creates a technical pattern that often indicates distribution at higher levels, with the current rally potentially representing a retest of those resistance zones.

30-Day and 7-Day Performance Context

The broader performance metrics provide crucial context for assessing momentum sustainability. SIREN’s 30-day gain of 177% and 7-day increase of 105% position this token firmly in parabolic territory—a classification that historically precedes significant mean reversion events.

From a technical perspective, the token’s trajectory from its all-time low of $0.0263 on March 11, 2025, represents a 720% increase. This 11-month accumulation to distribution cycle suggests early investors are sitting on substantial unrealized gains, creating natural selling pressure zones that could emerge at psychologically significant price levels.

The market cap ranking of #210 places SIREN in the mid-cap category where liquidity fragmentation becomes a critical concern. Unlike top-100 tokens with deep order books across multiple exchanges, mid-cap assets typically experience higher slippage and are more susceptible to large order impacts—factors that contributed to today’s 71.9% intraday price range.

Risk Factors and Sustainability Concerns

We’ve identified several risk factors that investors should weigh against the apparent momentum. First, the fully diluted valuation (FDV) matches the current market cap at $157.45 million, indicating all 728.86 million circulating tokens are accounted for in current pricing. However, with 271.14 million tokens still unminted (27.1% of max supply), future token unlocks or emissions could create sustained sell pressure.

Second, the volume-to-market-cap ratio of 20.2% is elevated compared to the 2-5% range typically seen in established crypto assets. While high turnover can indicate healthy price discovery, it also suggests a predominantly short-term holder base—a demographic known for rapid sentiment shifts and weak support levels during corrections.

Third, the absence of detailed on-chain metrics in available data prevents us from analyzing wallet distribution, exchange inflows/outflows, or smart contract interactions that would provide insight into whether this rally is driven by genuine protocol adoption or speculative positioning. This data gap represents a significant analytical limitation that risk-averse investors should acknowledge.

Technical Levels and Price Outlook

From a technical analysis standpoint, we identify several critical price levels. The $0.2402 intraday high represents immediate resistance, with the February 7 ATH of $0.3612 serving as the primary upside target—a potential 67% gain from current levels. However, the probability of reaching this level in the near term depends heavily on continued volume expansion and broader market conditions.

On the downside, the $0.1397 intraday low serves as the first support level, representing a 35.3% drawdown risk from current prices. More significantly, the psychological $0.10 level—roughly 53.7% below current trading—would represent a complete retracement of today’s gains and likely trigger stop-loss cascades among leveraged long positions.

The 1-hour price decline of 0.29% following the surge suggests early profit-taking may be underway, though this represents insufficient data to confirm trend reversal. Traders should monitor whether the token can establish support above the $0.20 level, which would indicate accumulation interest at current valuations.

Contrarian Perspective: When Parabolic Moves Signal Caution

While mainstream crypto commentary often celebrates explosive price movements, our analytical framework suggests a more measured interpretation. Assets experiencing 50%+ daily gains typically enter a phase where technical analysis becomes less predictive and behavioral finance dominates price action.

Historical analysis of similar mid-cap token surges indicates that 52% single-day gains are often followed by 30-60% retracements within 72 hours as early buyers lock in profits and FOMO-driven late entrants become trapped at elevated levels. This pattern doesn’t guarantee a negative outcome for SIREN, but it does warrant defensive position sizing and strict risk management protocols.

Furthermore, the timing of this surge—occurring during a period when broader crypto markets have shown mixed signals—raises questions about catalyst sustainability. Without clear fundamental drivers such as major protocol upgrades, institutional partnerships, or significant TVL (Total Value Locked) increases, price movements of this magnitude often prove ephemeral.

Actionable Takeaways and Risk Management

For investors considering SIREN exposure, we recommend several evidence-based approaches. First, implement strict position sizing—allocating no more than 1-3% of portfolio value to mid-cap tokens exhibiting parabolic characteristics minimizes catastrophic loss potential while maintaining upside exposure.

Second, establish clear exit criteria before entering positions. A trailing stop-loss at 20-25% below entry price can protect against sudden reversals while allowing profitable positions to run. Given SIREN’s demonstrated intraday volatility, wider stops may be necessary to avoid premature exits from normal price fluctuations.

Third, monitor volume trends closely. Sustained volume above $30 million daily would suggest continued interest, while declining volume on subsequent up-days typically signals momentum exhaustion. Additionally, tracking the token’s correlation with major crypto assets (BTC, ETH) can reveal whether SIREN is moving independently or simply amplifying broader market trends.

Finally, investors should demand greater transparency regarding SIREN’s fundamental value proposition, tokenomics roadmap, and development milestones before committing significant capital. The absence of readily available protocol metrics in current market data represents an information asymmetry that favors insiders over retail participants—a dynamic that rarely ends favorably for late-stage momentum buyers.

In conclusion, while Siren’s 52.3% surge presents compelling technical momentum, the elevated volume-to-market-cap ratio, proximity to recent all-time highs, and lack of detailed fundamental catalysts suggest a cautious approach. We maintain that this represents a trader’s market rather than an investor’s opportunity, with risk management paramount for anyone considering exposure at current levels.

You May Also Like

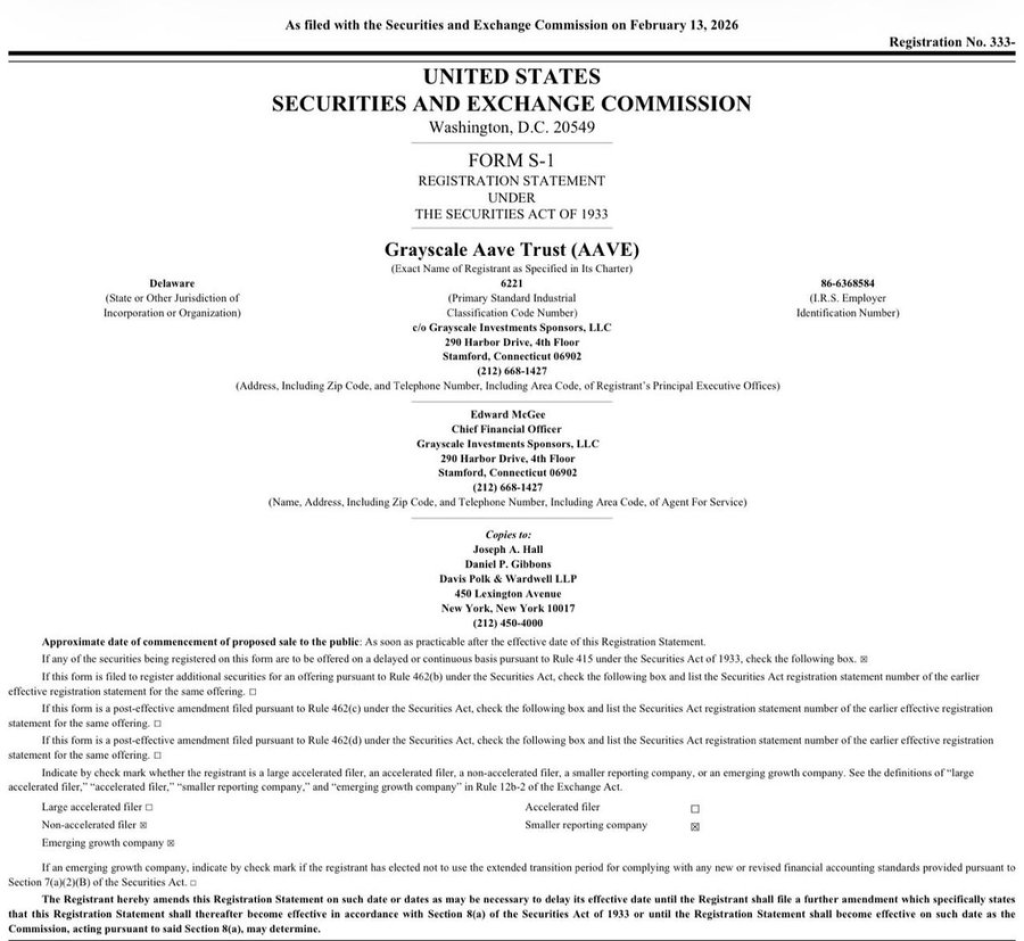

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More