Top 10 AI & Big Data Crypto Projects Revealed — ICP, NEAR, and INJ Lead Developer Rankings

- Internet Computer (ICP) and NEAR Protocol lead the top 10 AI and Big Data cryptos with the highest development activities.

- Despite their dominance in this sector, they appear to be struggling in the market as ICP records decline across all the major trading sessions.

Recently, the Santiment team launched an Ecosystem Dev Activity Dashboard that displays the software development events created by various blockchains and their related Decentralized Applications (DApps). According to a report, the initiative has been designed to filter out low-value actions, focusing on real programming progress

ICP, NEAR, Injective, and Others Dominate in Dev Activities

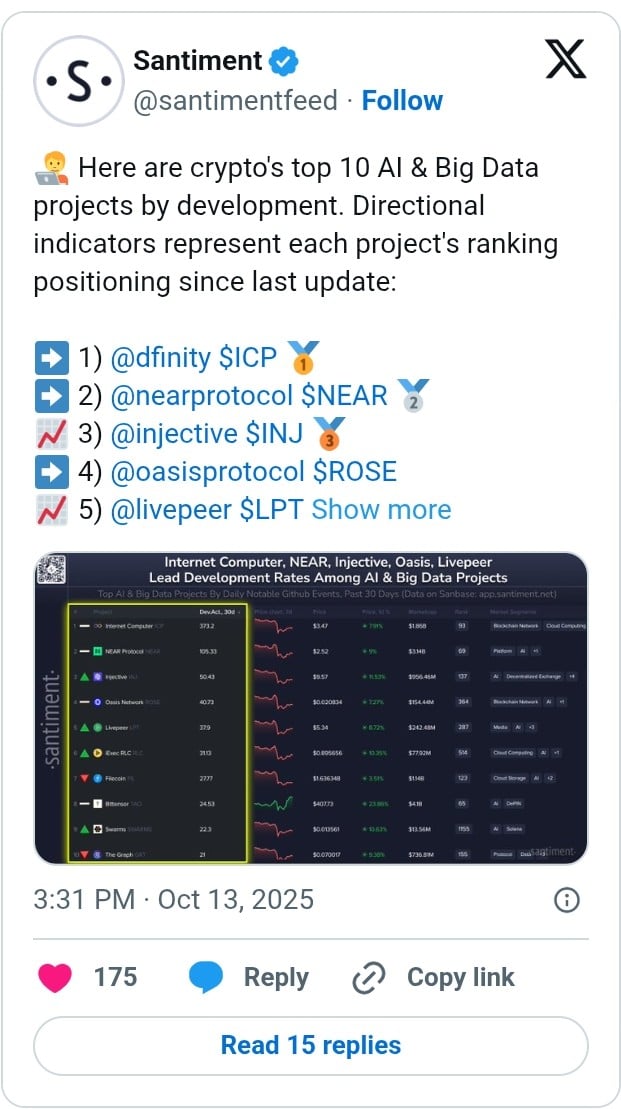

With reference to the display on the dashboard, Santiment has compiled a list of 10 Artificial Intelligence (AI) and Big Data crypto projects that are dominating based on their development events. Per the data, the first on the list is DFINITY Foundation’s Internet Computer (ICP). In the last 30 days, it has amassed a score of 373.

As noted in our earlier coverage, ICP was also leading the list of top blockchain platforms with the highest development activities last month, with a score of 423.1.

Behind ICP in the AI and Big Data sector is NEAR Protocol which has a development activity score of 105. This is also followed by Injective (50), OASIS Network (40), and Livepeer (39) completing the top five. According to Santiment, iExec RLC (31), Filecoin (27), Bittensor (24), Swarms (22), and The Graph (21) occupied the sixth to 10th position respectively.

In an accompanying Medium post, the importance of development activities was highlighted, as their numbers indicate the likelihood a project has to grow its products and be adopted by users.

In the post, Development Activities was said to be understood by many as the representation of the number of commits that a project has in its GitHub repositories. However, this could show flaws, hence the reason to introduce the new approach. This filtering approach is reported to differentiate two types of activities, namely Development Activity and GitHub Activity.

One interesting observation we came across is that most of the AI and BIG Data crypto projects dominating in the development activities are currently struggling in the market. ICP, for instance, has recorded losses across all the major trading sessions, declining by 3.2% in the last 24 hours, 24% in the last seven days, 30% in the last 30 days, and 37% in the last 90 days. Currently, the asset is trading at $3.4. As highlighted in our last analysis, ICP could bounce back to $7 when the broad market rally resumes.

NEAR, which is the second on the list of projects with the highest development activities, has also recorded losses across all the major trading sessions, declining by 19% in the last seven days.

NEAR is expected to stage a rebound as it announces several high-profile initiatives that could soon reflect in its price. As mentioned in our earlier news brief, it has introduced AI roles in blockchain governance to simplify its operations.

This does not end there. NEAR is also supporting Web3 AI with a new $20 million development fund, as explained in our previous publication.

]]>You May Also Like

Wormhole launches reserve tying protocol revenue to token

CME Group plans to roll out XRP and Solana futures options in October