Tether Projects $15 Billion Profit in 2025 as Stablecoin Market Hits $316 Billion

Tether, issuer of the leading stablecoin USDT USDT $1.00 24h volatility: 0.0% Market cap: $182.95 B Vol. 24h: $96.54 B and the second-largest tokenized gold XAUT, expects net profits near $15 billion in 2025. This projection reflects ongoing growth in the stablecoin sector, where high interest rates have boosted returns on reserves.

According to Bloomberg, Tether CEO Paolo Ardoino shared this outlook during an interview at the Plan B Forum in Lugano, Switzerland, on Oct. 24, 2025. He noted the rarity of such profits and highlighted the company’s focus on building partnerships to expand its reach, without naming specific investors.

The forecast follows Tether’s strong performance in prior years. In 2024, the company posted over $13 billion in net profit, more than double its $6.2 billion from 2023, according to its attestations. Equity has topped $20 billion, aided by rising Bitcoin BTC $110 505 24h volatility: 0.1% Market cap: $2.20 T Vol. 24h: $50.58 B and gold values in reserves.

Analysts point to Tether’s low costs and Treasury-backed model as key to its margins. Fintech writer Jevgenijs Kazanins echoed Ardoino’s comments on X, emphasizing the exceptional scale of these earnings.

This comes as Tether explores a funding round for up to $20 billion, implying a $500 billion valuation, according to a CoinDesk report from September. Such a deal would rank it among the top private firms globally.

Stablecoin Market Growth in 2025 and Tether’s Leadership

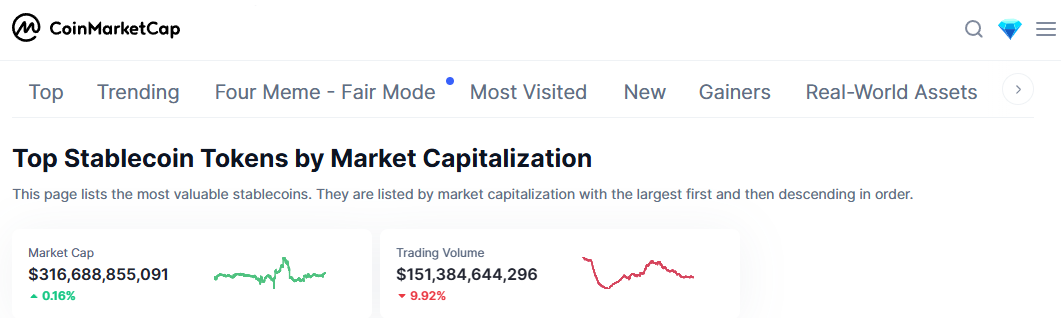

In context, the stablecoin market has expanded to around $316 billion in 2025, according to CoinMarketCap. Tether holds a dominant share, with recent milestones like reaching 500 million verified users, as Coinspeaker covered on Oct. 21.

Top Stablecoin Tokens by Market Capitalization | Source: CoinMarketCap

Earlier reports from Coinspeaker noted Tether’s record $4.9 billion profit in Q2 2025, and its pivot to gold reserves on Sept. 5 this year. The company’s growth goes beyond the dollar-pegged stablecoin USDT, seeing increased demand for the tokenized gold solution, XAUT.

Competitors like Circle have also minted billions in new tokens, with the stablecoin ratio hitting lows, as detailed in another piece by Coinspeaker. Broader crypto trends, including Bitcoin trading around $110,000, align with increased stablecoin use for payments and DeFi, fueling the crypto market.

nextThe post Tether Projects $15 Billion Profit in 2025 as Stablecoin Market Hits $316 Billion appeared first on Coinspeaker.

You May Also Like

UK Crypto Investors Could Still Face Tax Bills Despite No HMRC Warnings

Cardano Latest News, Pi Network Price Prediction and The Best Meme Coin To Buy In 2025