Solana News: VanEck Taps SOL Strategies to Stake Its Solana ETF

VanEck selects SOL Strategies as the staking provider for its new Solana ETF (VSOL), highlighting SOL Strategies’ certified infrastructure.

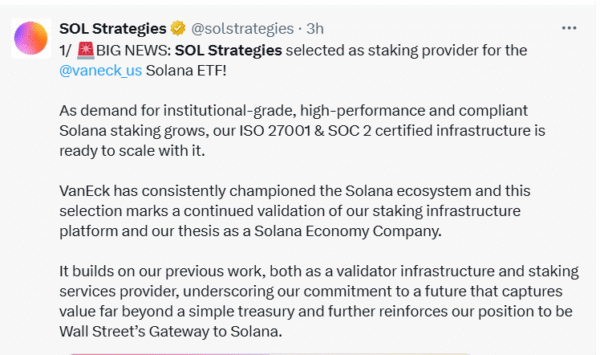

SOL Strategies has been selected as the staking provider for the VanEck Solana ETF. This partnership comes in the face of rising demand for institutional-grade, high-performance, and compliant Solana staking. SOL Strategies’ infrastructure of ISO 27001 & SOC 2 certified infrastructure is poised to scale with this demand.

SOL Strategies: Wall Street’s Gateway to Solana Staking

VanEck has always been an advocate of the Solana ecosystem. This selection represents a continuation of the validation of the staking infrastructure platform of SOL Strategies. It also reinforces their thesis as a Solana Economy Company.

This is a continuation of the previous work of SOL Strategies. This includes both the validator infrastructure and the staking services. It emphasizes their dedication to a value-creating future. This value is much more than a mere treasury. It further strengthens their position as “Wall Street’s Gateway to Solana.”

Related Reading: Crypto News: Hong Kong Approves Asia’s First Solana ETF as Analysts Target $400 | Live Bitcoin News

SOL Strategies has been chosen as the staking service provider for VanEck’s newly debuted Solana ETF (VSOL). SOL Strategies is a Canadian investment company. It specializes in the Solana ecosystem. It also has a revenue-generating validator business.

More details about the partnership have been announced. SOL Strategies announced its selection on November 17, 2025. Their business model is to operate ISO 27001 and SOC 2 certified validators. They also provide strategic investments and infrastructure solutions. These are all in the Solana ecosystem.

Source: X

Source: X

A fee waiver is also part of the launch. VanEck is foregoing the sponsor fee for VSOL at launch. This is for the first $1 billion in assets under management (AUM). This waiver is to be extended to February 17, 2026. During this period, SOL Strategies will also waive their fee for their staking services. This provides an incentive to adopt early and reap the maximum return for initial investors.

Institutional-Grade Services and Ecosystem Validation

SOL Strategies offers institutional-grade services. Their institutional client base consists of partnerships with premier custodians. These custodians include Bitgo and Crypto.com. The company has also passed SOC 1, SOC 2 and ISO 27001 audits. These are applicable to its staking platform. This strict compliance shows their focus on security and reliability.

This partnership is a major development for the Solana ecosystem. It brings a new level of institutional sanction. The launch of a Solana ETF by a major player in the financial world such as VanEck, highlights the growing importance of Solana. The choice of SOL Strategies further demonstrates the need for secure and compliant staking solutions.

This important partnership is highly expected to attract a new breed of traditional investors towards the Solana blockchain, thereby gradually leading to more growth, adoption and innovation in the thriving ecosystem. It is a key moment in the continued convergence of traditional finance and decentralized digital assets. It will also create additional growth and adoption of its ecosystem.

The post Solana News: VanEck Taps SOL Strategies to Stake Its Solana ETF appeared first on Live Bitcoin News.

You May Also Like

UAE’s nieuwe cryptowet zorgt voor ‘Bitcoin-ban’-angst na zware straffen

BitMine (BMNR) Buys 54K ETH as Tom Lee Names Reason for Crypto Weakness