Snorter Token Presale Ends in 48 Hours – Biggest Crypto Launch of 2025?

After a brief market downturn, the cryptocurrency market has bounced back to a valuation of $3.8 trillion, gaining 1% in the past 24 hours. Bitcoin is back above $111,000, and Ethereum is inching toward the key $4,000 level.

Notably, Solana leads the top ten cryptocurrencies by market cap with a solid 3% daily gain. This renewed strength in the Solana ecosystem is drawing attention to promising new projects built on the network.

Amid this ecosystem resurgence, a new project is set to debut that experts believe could be one of the biggest launches of the year: Snorter Token (SNORT).

Snorter Token is developing a powerful Solana-native meme coin trading bot designed to take advantage of the network’s high-speed volatility.

The team is wrapping up its presale, with just 48 hours left and around $5.5 million already raised, making Snorter Token one of the best Solana meme coins to buy right now.

Source – Cryptonews YouTube Channel

Snorter Bot Could Be the Fastest Trading Tool on Solana – Here’s Why

The Solana meme coin market has surged with the broader crypto recovery, climbing 6% in the past 24 hours to reach $7.86 billion. Riding this wave, a new project called Snorter Token (SNORT) is stepping in to transform meme coin trading with an innovative approach.

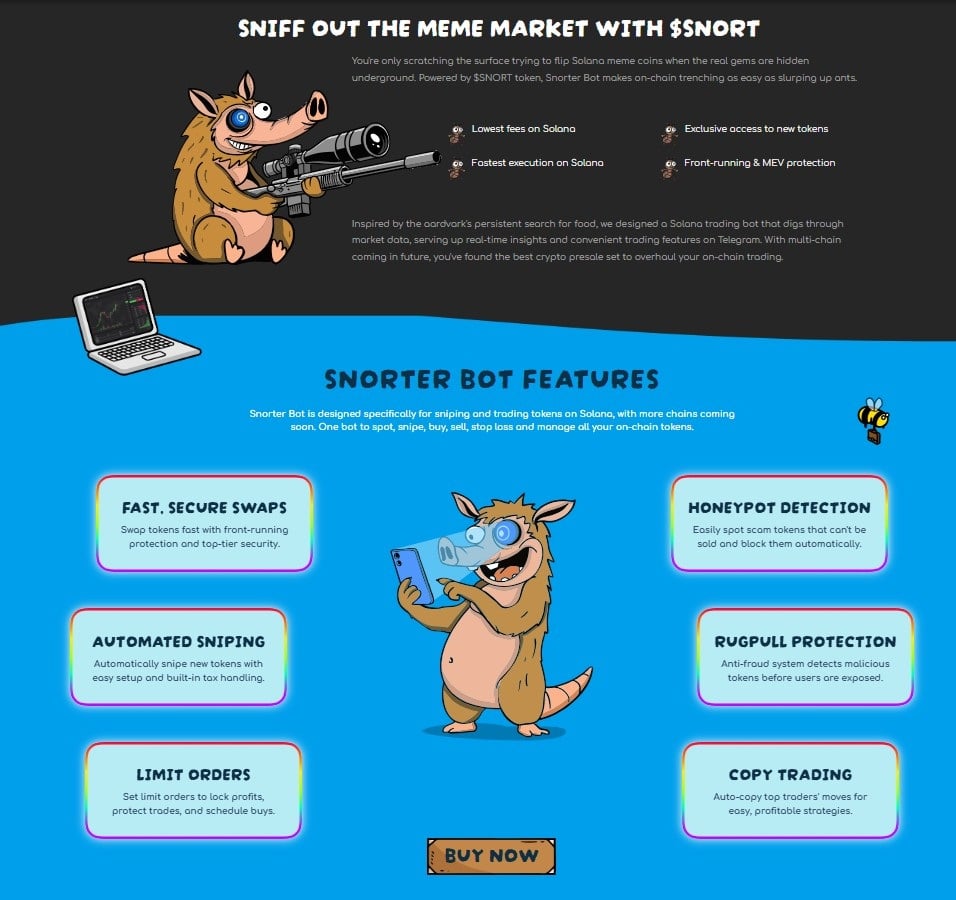

Snorter Token powers the Snorter bot, a precision-trained Aardvark built to hunt the hottest tokens on Solana.

Designed to solve the common frustrations of meme coin trading, Snorter delivers a fast, affordable, and user-friendly solution to high fees, slow execution, and complicated interfaces.

Instead of paying steep rates, traders who hold a minimum balance of $SNORT tokens enjoy reduced fees of just 0.85% per transaction, compared to the 1% charged by leading bots like BONKbot, Banana Gun, and Trojan.

This makes Snorter bot the most cost-effective option at launch. The bot also solves the problem of clunky trading setups by operating directly within a Telegram chat. Users no longer need multiple wallets or browser extensions, as everything happens in one intuitive interface.

Beyond convenience, Snorter bot delivers exceptional speed and precision. Its Solana routing engine enables sub-second execution, minimal latency, and built-in front-running protection, outperforming even top-tier platforms like Raydium, Jupiter, and Pump Fun.

In a market where milliseconds make the difference, this edge gives traders a serious advantage. Security is another core strength. The Snorter bot detects potential honeypots and rug pulls before they strike, keeping user funds safe.

This is especially valuable for new traders still learning the ropes. For those unsure about their trading strategy, Snorter’s Copy Trading feature allows them to follow successful traders until they gain confidence.

Launching on Solana, the world’s second-fastest blockchain by transactions per second, Snorter bot plans to expand to Ethereum, BNB Chain, and other EVM networks soon.

Snorter Token Presale Ends Soon – Last Chance to Join the Next Solana Trading Bot

Snorter Token’s presale has already raised around $5.5 million, showing that investors trust the project. With only 48 hours left and the token priced at $0.1083, this is the last chance to buy before launch.

Investors can buy $SNORT directly from the official presale website using ETH, USDT, USDC, BNB, or even a bank card. It is also available through the Best Wallet app on both iOS and Android.

Snorter Token’s advanced trading bot and successful presale have caught the attention of retail traders and popular analysts like Crypto Gains.

The YouTuber, who has around 150,000 subscribers, called $SNORT one of the best new presales of the year because it is a trending meme coin that offers real value to holders.

Analyst Austin Hilton also supports $SNORT for its unique staking system that lets holders earn passive income even when the price stays flat.

By staking $SNORT, users can earn up to 101% APY. So far, nearly 25 million tokens are already locked in the staking pool, showing strong interest from the community.

This system also helps stabilize the project by lowering the circulating supply and rewarding long-term supporters.

https://twitter.com/SnorterToken/status/1981732824945168452Ahead of launch, the developers burned 250 million tokens, which is half of the total supply. This major burn could give $SNORT the push it needs for a strong post-launch rally.

With the crypto market heating up again, Snorter Token stands out as one of the best Solana meme coins, offering real use cases and strong growth potential for investors before the claim date.

Visit Snorter Token

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Unprecedented Surge: Gold Price Hits Astounding New Record High

Little Pepe Token News as DeepSnitch AI Raises $463K in Record-Breaking Time