Shiba Inu Price Prediction: No All Time High In Sight – Whales Are Buying This New Crypto Instead

Shiba Inu’s once explosive rise in 2021 made headlines across the world, but 2025 has brought a harsh reality check. According to recent market data, the popular meme coin has struggled to reclaim even a fraction of its former highs, leaving investors asking whether a new all-time high is even possible. With trading volumes thinning and whales exiting positions, the Shiba Inu price prediction for this cycle looks increasingly uncertain.

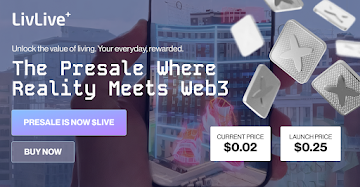

However, not all major investors are retreating from crypto. Many are redirecting their funds into new, utility-driven presales — and LivLive ($LIVE) is at the center of this migration. As Shiba Inu continues to stagnate, LivLive’s presale has crossed $2 million, attracting attention for its mix of real-world engagement, AR technology, and massive bonus token rewards that could turn small investments into life-changing returns.

LivLive Turns Real-World Actions Into Tokenized Rewards

LivLive is emerging as one of the most talked-about crypto presales of 2025. Built as an AR-powered, blockchain-enabled loyalty ecosystem, it transforms real-world activities into digital rewards through its native token, $LIVE. Every physical action — from scanning locations to verifying presence through its wearable wristband — earns users tokenized value, creating a true bridge between the digital and physical world.

One of the platform’s biggest advantages lies in how it connects brands and consumers. Through on-chain verification, brands can ensure that every engagement is authentic — a feature that guarantees real ROI on marketing campaigns. For investors, this creates long-term stability since adoption isn’t driven by hype, but by real-world utility that scales across cities, retail locations, and communities.

LivLive’s $LIVE Token: Where Utility Meets Massive ROI Potential

At the time of writing, the LivLive presale is priced at just $0.02, with a launch price of $0.25 already confirmed. Analysts forecast $LIVE could reach $1 post-launch, offering early participants an ROI of 4,900% from launch and up to 49× from the presale price. This has triggered growing FOMO across the crypto community, particularly as whales diversify away from meme coins like Shiba Inu in search of projects with genuine adoption potential.

To celebrate Halloween, LivLive has introduced a special SPOOKY40 bonus code, giving buyers +40% extra $LIVE tokens during the presale. This limited-time deal closes officially on November 1, but the community expects the allocation to sell out before then. For instance, an investor buying $1,000 worth of $LIVE at $0.02 secures 50,000 tokens, but with the SPOOKY40 code, that becomes 70,000 tokens. If $LIVE hits $1, those tokens would be worth $70,000 — and at $5, a staggering $350,000.

With whales shifting capital and influencer buzz building rapidly, LivLive is now being viewed as one of the best crypto presales for those seeking the next big ROI opportunity before 2026.

Shiba Inu Struggles to Maintain Momentum

Despite loyal community support, the Shiba Inu price prediction for 2025 remains underwhelming. Analysts note that the token’s burn mechanics and ecosystem updates have failed to significantly impact price performance. SHIB currently trades far below its previous highs, with on-chain data showing declining whale participation and a reduction in large transactions.

The memecoin sector has seen declining dominance as investors move toward projects with measurable utility. Shiba Inu’s roadmap focuses on incremental improvements, but without a breakthrough catalyst, analysts warn that an all-time high may remain out of reach this cycle. The shift in sentiment is clear — whales are no longer betting on nostalgia-driven tokens but on innovation-driven ecosystems like LivLive.

Why Smart Money Is Moving Toward Presales

Whales have always chased asymmetric returns, and this cycle is no different. The focus has shifted from hype-based coins toward new cryptos with 100x potential, where early entry provides exponential upside. LivLive fits perfectly into that narrative — it merges real-world interaction with blockchain tokenomics, offering investors both engagement and profitability.

Meanwhile, the Shiba Inu price prediction keeps fading into a waiting game for retail holders. LivLive’s model of verifiable engagement and real-world integration gives it a utility edge that meme coins simply can’t replicate, explaining why high-net-worth investors are stacking $LIVE tokens while retail traders remain stuck in SHIB’s sideways trend.

Final Take: LivLive Leads the Next Wave of ROI Opportunities

Based on the latest research and investor sentiment, LivLive stands out as the best crypto presale in the market right now. With a low entry price, scalable real-world use cases, and a massive community-driven token supply, it offers something few new cryptos can — utility-backed growth with huge upside.

While the Shiba Inu price prediction shows limited movement, the momentum behind LivLive continues to accelerate. Investors using the SPOOKY40 code before November 1 gain a decisive advantage, securing 40% more tokens ahead of the next price rise. For those looking to join the next major wave before the crowd, LivLive might just be the top crypto to buy this week — before it’s too late.

Find Out More Information Here

Website: www.livlive.com

X: https://x.com/livliveapp

Telegram Chat: https://t.me/livliveapp

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Shiba Inu Price Prediction: No All Time High In Sight – Whales Are Buying This New Crypto Instead appeared first on Live Bitcoin News.

You May Also Like

Mastercard Goes All Into Web3 Via Acquisition of Zerohash for Nearly $2B

Crucial Delay: How Lack of Data Could Impact Fed Policy Adjustments