DOGE Forecasts 15x Gains, Yet Ozak AI Prediction Could Deliver True 100x ROI

The post DOGE Forecasts 15x Gains, Yet Ozak AI Prediction Could Deliver True 100x ROI appeared first on Coinpedia Fintech News

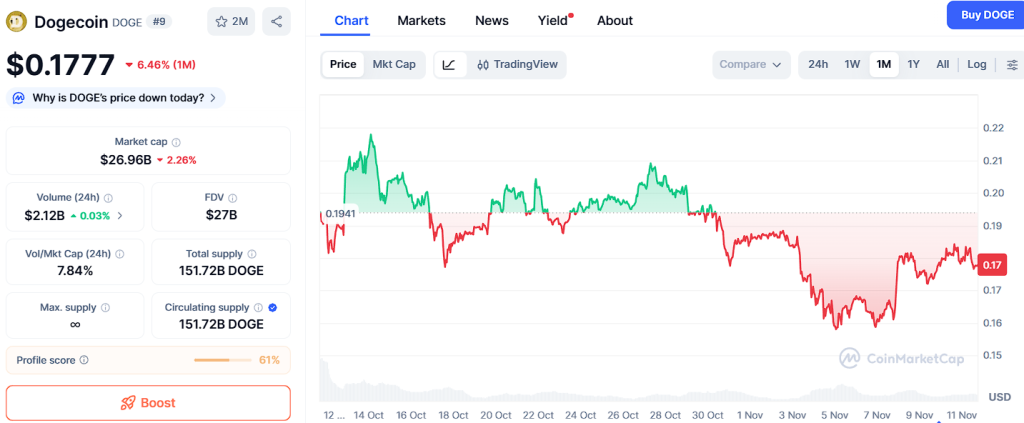

Crypto sentiment is heating up again, and Dogecoin (DOGE) is once more leading the meme coin movement. With the token trading near $0.1777, traders are eyeing potential 15x returns if retail hype continues into 2025.

Yet while DOGE’s community-driven charm and cultural momentum remain undeniable, analysts believe the next major wealth-creation opportunity won’t come from a meme coin—it’ll come from Ozak AI (OZ). Built at the intersection of artificial intelligence and blockchain, Ozak AI is redefining how decentralized ecosystems learn, predict, and evolve. With forecasts suggesting a potential 100x ROI, Ozak AI isn’t just another presale—it’s the foundation of crypto’s intelligent future.

Dogecoin (DOGE) Overview

Dogecoin (DOGE) has been a symbol of crypto’s unpredictable power since its inception. Trading at $0.1777, DOGE continues to benefit from its deep community roots and recurring social media buzz. Technical indicators show resistance at $0.194, $0.215, and $0.242, with support levels at $0.162, $0.145, and $0.129—a structure that suggests strong consolidation before a potential breakout.

Youtube embed:

Ozak AI ($OZ) Project Review | A Look at Its AI-Driven Financial Platform

The token’s primary catalyst remains its association with Elon Musk and the possibility of integration within X (formerly Twitter) as a payment token. Even without official confirmation, Musk’s continued support for DOGE keeps it relevant in public discourse, fueling speculation and driving trading volume.

Analysts predict DOGE could reach $2–$3 during the next bull cycle—a roughly 15x return from previous cycle lows. However, despite its sentimental and speculative appeal, Dogecoin still lacks significant utility beyond its community status. For traders seeking sustainable, innovation-driven upside, the focus is shifting toward projects like Ozak AI (OZ) that combine advanced technology with early-stage potential.

Ozak AI (OZ) Overview

Ozak AI (OZ) is quickly establishing itself as one of the most forward-thinking crypto projects of 2025. Its mission is simple yet revolutionary: to infuse artificial intelligence into blockchain systems, enabling networks that can analyze data, forecast outcomes, and make autonomous decisions. By merging AI, predictive analytics, and decentralized automation, Ozak AI is turning static blockchain systems into self-learning ecosystems capable of real-time optimization.

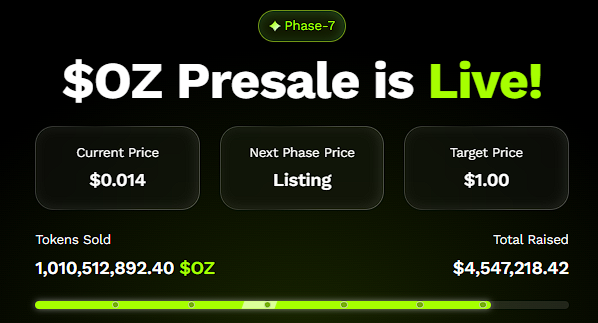

Currently in its 7th OZ presale stage, Ozak AI has already raised over $4.5 million and sold more than 1 billion OZ tokens, reflecting overwhelming investor interest. The project’s AI-powered infrastructure is driven by AI prediction agents—autonomous entities that scan blockchain and real-world data, detect opportunities, and automate intelligent decisions across decentralized environments.

Key partnerships have solidified Ozak AI’s credibility and scalability:

- Perceptron Network: Provides over 700,000 active AI nodes for large-scale computation.

- HIVE: Offers 30 ms predictive market signals for ultra-fast AI data processing.

- SINT: Integrates cross-chain AI agents and voice automation systems, enhancing interactivity and interoperability.

Audited by CertiK and Sherlock, and already listed on CoinMarketCap and CoinGecko, Ozak AI has demonstrated transparency, legitimacy, and technical maturity. Analysts expect the project to reach a $1 price target—equating to a 100x ROI from its current presale price of $0.012.

Why Ozak AI Outshines Dogecoin’s 15x Forecast

Dogecoin has history, hype, and heart—but Ozak AI has innovation, intelligence, and scalability. The key difference lies in utility versus sentiment. DOGE’s upside depends on market emotion, whereas Ozak AI’s growth potential is grounded in real technology—a fusion of blockchain and AI that has the potential to disrupt multiple industries.

As artificial intelligence becomes the defining technological force of the decade, projects like Ozak AI that merge decentralized data with autonomous analytics are being hailed as the next generation of Web3 leaders. Its potential applications in DeFi, trading, logistics, and data automation make it far more than just a speculative investment—it’s the foundation for intelligent crypto infrastructure.

For investors seeking transformative ROI, the math is simple: DOGE could 15x, but Ozak AI could 100x. The difference between excitement and evolution is what separates short-term profits from long-term fortunes.

Smarter Rotation for 2025

Every crypto cycle tells the same story—early movers win. In 2021, Dogecoin made millionaires out of meme believers. In 2025, Ozak AI could make millionaires out of early innovators. As capital flows from hype-driven assets toward utility-driven ecosystems, Ozak AI’s presale presents one of the rare opportunities to enter before the market catches up.

With a credible roadmap, deep partnerships, and a clear vision to merge AI and blockchain, Ozak AI isn’t chasing trends—it’s defining them. For investors who understand that intelligence is the next frontier of crypto evolution, flipping even a small position into Ozak AI could be the smartest 100x decision of the cycle.

About Ozak AI

Ozak AI is a blockchain-based crypto venture that offers a technology platform that focuses on predictive AI and advanced records analytics for monetary markets. Through machine learning algorithms and decentralized network technologies, Ozak AI permits real-time, correct, and actionable insights to help crypto fanatics and companies make the precise choices.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

You May Also Like

Cash App Sets 2026 Rollout for Major Crypto Upgrade With Stablecoin and Bitcoin Payment Features

Fed Decides On Interest Rates Today—Here’s What To Watch For