CZ's pet dog Broccoli ignites an on-chain PVP war, DEV and insider players make a fortune, and MEME social experiment sparks controversy

Author: Nancy, PANews

The day-long mystery of CZ’s (Binance founder) pet name was finally revealed in the early morning of today (February 14). What followed was an on-chain PVP battle with Broccoli as the theme, and BNB Chain ushered in a large-scale stress test.

A feast for DEV and insider players, the community becomes a victim of liquidity withdrawal

After TST skyrocketed after being mentioned by CZ, CZ's movements became the focus of MEME players. On the morning of February 13, CZ tweeted that he was curious about the operating mechanism of MEME coins, asking whether someone would create related tokens just by sharing the pet's name and photo, and questioned how to distinguish the "official" version. After understanding the relevant mechanism, CZ said, "It's interesting how things work. As usual with major decisions, I need to think about it for a day or so. Should I respect his privacy or make the dog's information public for everyone? Well, I might also interact with a few MEME coins on BNB Chain."

When someone suggested using a random dog photo, CZ responded by saying, "No, that would be cheating. If you're going to do it, do it right. It's just sharing a dog photo and name."

Afterwards, the entire network began to guess the name of CZ's pet dog and began to ambush related MEME coins in an attempt to "take a seat" early. The market value of a few tokens was even pushed up by thousands or even hundreds of millions of dollars. That night, CZ announced that he would release a photo of the dog in 3 hours (around 8 pm Dubai time), which whetted the appetite of MEME players. After several hours of waiting, CZ finally announced the photo of his pet dog Broccoli and the story between them in the early morning of February 14, and he also said, "I just posted a photo and name of my dog. I will not issue Meme coins myself. It depends on whether the community does this. The BNB Foundation may provide rewards for the top MEMEs on the BNB Chain, give LP support or other rewards. The details are still under discussion. More content will be released soon."

Subsequently, tens of thousands of Broccoli-named MEME coins instantly appeared on BNB Chain, and countless players rushed to join the broccoli-themed PVP battle. However, BNB Chain did not withstand this wave of stress testing, with congested networks, stuck front-ends, and clamps all over the floor...MEME players said the experience was too bad. According to the page, BscScan has currently suspended block data updates for about 12 hours.

At the same time, since CZ did not publish the CA (contract address), a large number of tokens with the same name emerged, dazzling investors. Even Bounce Brand officially renamed the pre-deployed MEME token to join the craze. The MEME experiment initiated by Broccoli also became a feast for DEV (developers)/insider players, with a large number of Pixiu and insider trading intertwined, and investors became victims of liquidity withdrawal.

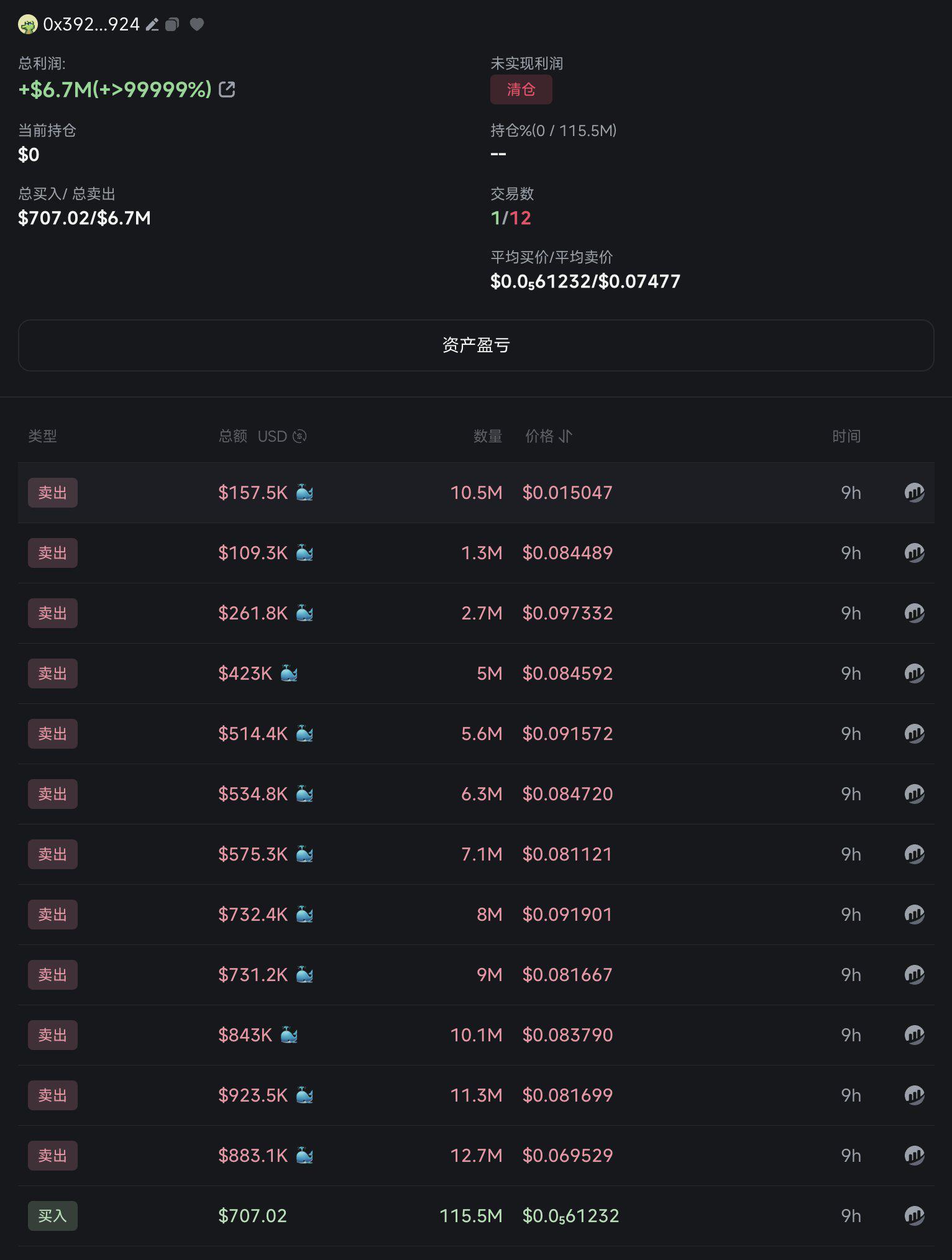

"Rug pulls are happening everywhere. They pushed the market value of a token to $400 million - enough to make people believe that this is "the real project" and falsified all the data: holders, trading volume, and even created a huge liquidity pool. Then, once retail investors chased the rise due to FOMO...they started selling, and some tokens even collapsed from $400 million to $30 million in a few minutes, while insiders left with more than $43 million, leaving investors with worthless tokens." Web3 researcher Pi pointed out. According to the monitoring of on-chain data analyst Ember, a Broccoli creator on BNBChain spent only 1 BNB to make a profit of $6.72 million, creating a 9,517-fold profit in 24 minutes.

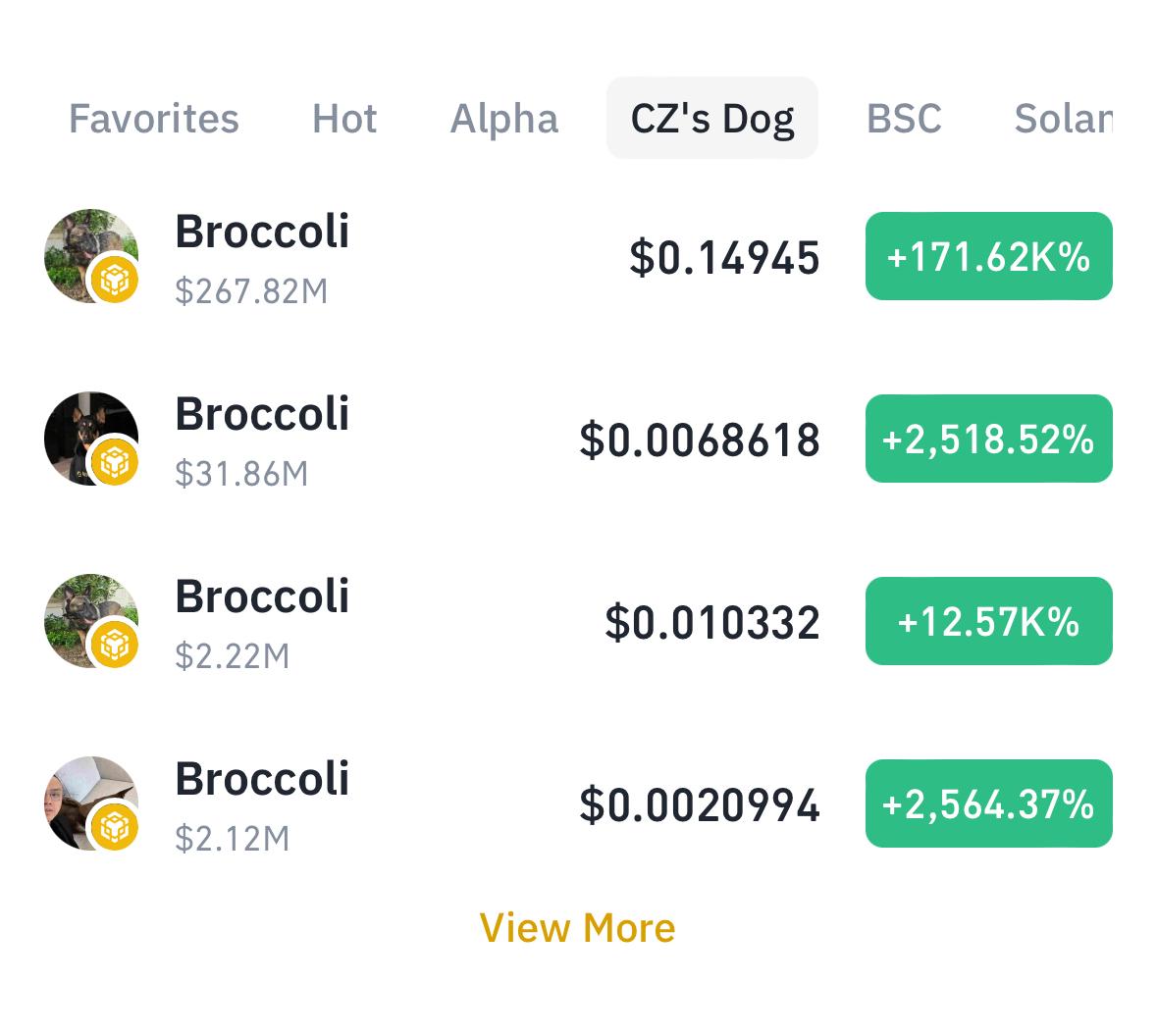

However, the "CZ's Dog" section in Binance Web3 Wallet shows that as of the time of writing, the market value of the most Broccoli coins is only just over 100 million US dollars. Despite the high market participation and the influx of hundreds of millions of US dollars, these funds are still relatively scattered and no leading project with a high degree of consensus has yet to be formed.

MEME social experiment sparked controversy, CZ responded that he will continue to learn and build

While Broccoli gained market attention, CZ's MEME social experiment also sparked market controversy.

“This aggression will not last,” Solana co-founder Toly tweeted

Sonic Labs co-founder Andre Cronje suggested that if CZ really decides to participate in such a project, it would be better to directly launch an official smart contract and share it, rather than letting the community create it themselves, otherwise it may lead to many people publishing dozens or even hundreds of contracts, thereby defrauding community members. In order to avoid indirectly causing losses to the community, it is better for him to launch a fair version himself.

Crypto researcher CM pointed out that it is not impossible to not issue a CA and the community drive is not impossible, but the problem is that social experiments must be established in a relatively fair environment, or at least let most people have some gaming experience. BNB Chain lacks the environment like Solana in the early days where everyone worked together to make the cake bigger, but to quickly share the cake that was hard to pull. This kind of change requires some leadership and organization, and it is difficult to achieve it by community initiative alone. I personally prefer to build applications, but I do not reject the MEME path. What I hate is the reduced cost of doing evil and the lack of a sense of security brought by a sustainable environment.

"There is an interesting term in psychology called 'Plausible deniability', which describes CZ's state tonight. I tried to put CZ's thoughts into his mind. He might be thinking: I just posted a few pictures of my pet dog. Like hundreds of millions of dog lovers in the world, I have done nothing wrong. I am even helping my chain and doing an interesting social experiment. I am dedicated and avant-garde. But he selectively downplayed the fact that his identity has a huge impact on the community. He is fully capable of deducing everything that will happen tonight. Letting thousands of dogs compete is not even a zero-sum game, but a negative-sum game. Countless Pixiu, clamps, insiders and small conspiracy groups have made huge profits, while most people have negative returns. Although, for ordinary people who post a picture of a pet dog on WeChat Moments, there is no problem. However, for a CEO of a crypto exchange, this should never be considered as 'without fault'." said 0xTodd, partner of Nothing Research.

CZ also responded to the community controversy, saying, "MEME is not completely community-driven? I don't want to participate in the issuance/operation of a MEME coin because I don't have any experience. I didn't expect this to be a stress test. However, it is interesting to see the breadth stress test (a large number of new MEME coins were created) and the depth stress test (a large number of transaction activities on a contract address). I think everyone was prepared for the latter. There is still a long way to go in scalability. Progress is never smooth. We keep learning and keep building.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Ranking the “XRP Killers”: Why Digitap ($TAP) Takes the #1 Spot for 2025