Missed the Ethereum Pump? 3 Tokens Under $1 That Could Skyrocket With Huge Gains in 2025

Historical data reveal that the real money is made by buying the tokens for under $1 before the crowds arrive. Cheap entry points with good fundamentals and expanding acceptance can turn a $500 investment into life-changing gains. Here are three tokens under $1 that could be among the biggest winners in 2025, led by Little Pepe (LILPEPE), one of the fastest-rising presale projects of the year.

Little Pepe (LILPEPE): The Meme Coin That Could Redefine 2025

Little Pepe has quickly emerged as one of the best under-$1 tokens to buy, thanks to its mix of meme power and serious infrastructure. Priced under $0.003 in its presale, LILPEPE has already raised $24.5 million and sold over 15.3 billion tokens, proving massive demand before it even hits exchanges. The project is building its own Layer 2 network dedicated to meme coins, ensuring lightning-fast, low-cost transactions. This isn’t just another meme coin chasing hype; it’s a meme coin that provides the infrastructure for the entire meme economy.

Its unique features also set it apart:

- Zero taxes on trades.

- Fair launchpad with sniper-bot resistance.

- A CertiK audit score above 95%, assuring investors of the safety of its ecosystem for transactions.

The $777,000 giveaway, with ten winners set to receive $77,000 each, has generated viral buzz across Twitter and Telegram. This community-driven hype made Dogecoin and Shiba Inu explode, but LILPEPE has far more utility. Analysts believe LILPEPE could reach $1 within a year of launch, replicating Dogecoin’s historic run in a fraction of the time. This could be one of the biggest ROI opportunities for early investors in 2025.

TRON (TRX): Institutional Accumulation Signals Big Upside

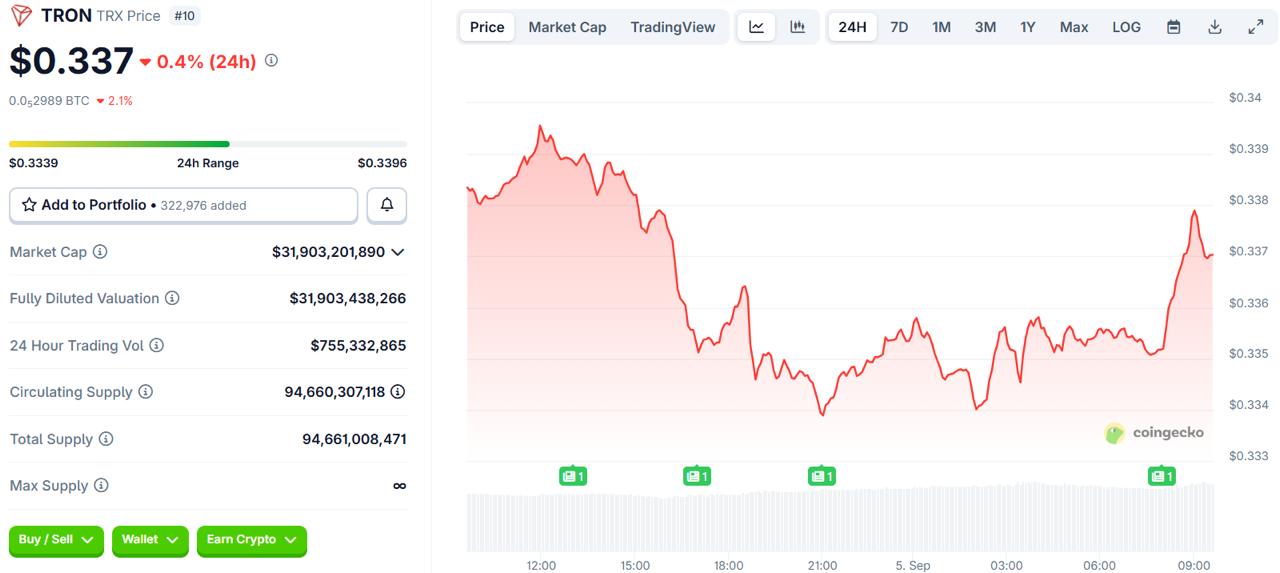

Tron (TRX) has established itself as a top blockchain by transaction volume, with over 2.4 million daily active addresses and a DeFi TVL above $6 billion. Institutional demand is also heating up. Nasdaq-listed Tron Inc. recently doubled its holdings by adding $110 million worth of TRX. This treasury-backed accumulation provides stability and signals a long-term commitment to the project. From a technical standpoint, TRX has broken out of a multi-year range and is now consolidating around $0.33. Analysts expect upside targets to range between $0.50 and $0.75 by year-end.

Tron Price Chart | Source: CoinGecko

With strong on-chain usage, growing DeFi activity, and significant accumulation of big money, TRON is one of the best cryptos under $1 to buy in 2025.

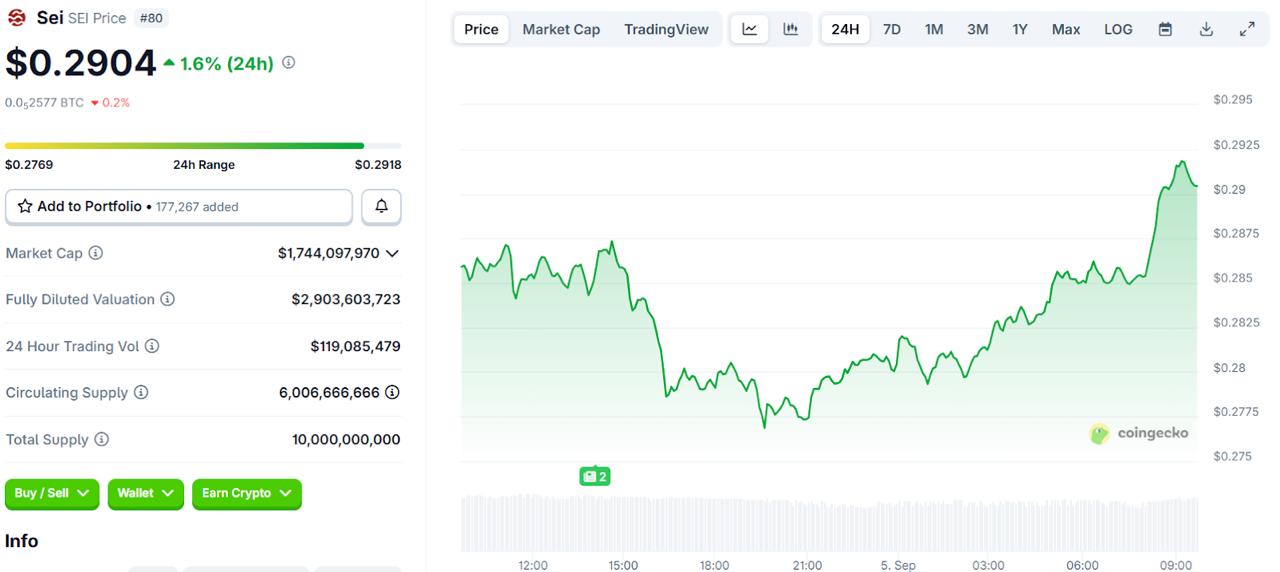

Sei (SEI): Fast Transactions and Developer Momentum

Sei (SEI) is emerging as a serious contender in the EVM space after the launch of Seiscan, a dedicated block explorer powered by Etherscan. This integration gives developers and traders the same reliable tools across Ethereum, making Sei more accessible and transparent. SEI is already gaining attention for its sub-second transaction speeds and focus on institutional-level finance. The addition of Seiscan boosts credibility and could accelerate ecosystem growth by attracting more DeFi protocols. Sei is also in contention for spot ETFs approval later in the year.

Sei Price Chart | Source: CoinGecko

Trading around $0.29, analysts predict that SEI could reach $3 by the end of 2025, supported by growing developer adoption and rising institutional interest. This makes it one of the best cryptos under $1 to buy for those seeking strong infrastructure plays.

Final Thoughts

If you missed the Ethereum pump, don’t worry; opportunities are everywhere in the best under $1 tokens to buy. Projects like Little Pepe, Tron, and Sei each offer compelling growth stories backed by institutional interest, partnerships, and cutting-edge infrastructure. But the standout is clearly Little Pepe. With a sold-out presale approaching, a groundbreaking meme launchpad, and viral-level community hype, it combines all the ingredients for exponential growth in 2025. For those seeking the next big meme-to-mainstream success story, LILPEPE is hard to ignore.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Missed the Ethereum Pump? 3 Tokens Under $1 That Could Skyrocket With Huge Gains in 2025 appeared first on Coindoo.

You May Also Like

nLIGHT to Announce Fourth Quarter and Full Year 2025 Financial Results on February 26th

When silver became a meme stock, retail investors ultimately caught the falling knife.