Kimchi Premium: Key Characteristics and Reasons of the Korean Crypto Market

Author: Jay Jo & Yoon Lee

Compiled by: Felix, PANews

Key points:

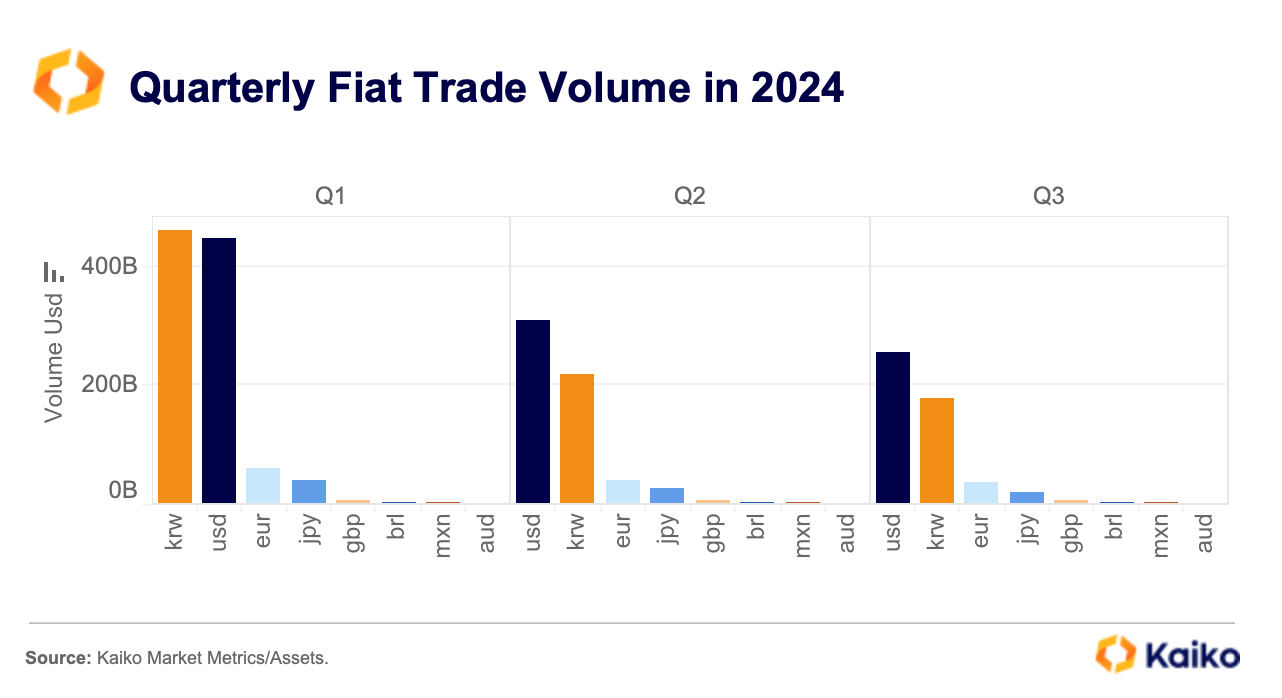

- South Korea's crypto market has attracted global attention due to its high trading volume and wide participation. In the first quarter of this year, the Korean won exceeded the US dollar in global cryptocurrency trading volume.

- This has created a phenomenon known as the “Kimchi premium,” which represents the price difference between global and Korean exchanges and manifests itself in various forms.

- The kimchi premium is the result of aggressive buying by domestic investors in a limited market environment. It is a meaningful indicator for understanding the Korean market.

1. Introduction

The Korean crypto market has attracted much attention due to active investor participation and high trading volume, with about 7.78 million users on Korean exchanges (about 15% of the total population of South Korea). This enthusiasm extends to the global market. In the first quarter of 2024, the global trading volume of the Korean won (KRW) exceeded that of the US dollar (USD) and continued to outperform other fiat currencies in the following quarters.

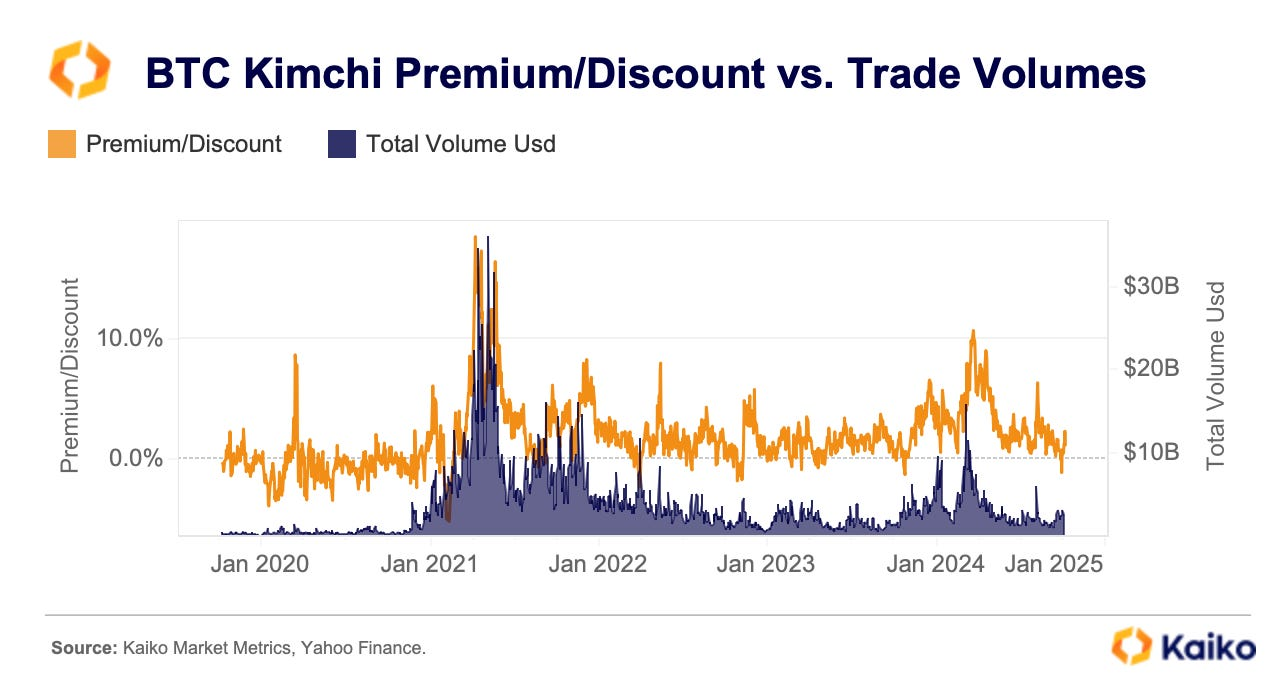

The Korean market’s enthusiasm for cryptocurrencies is reflected in a unique phenomenon: the “Kimchi Premium”. This is a unique feature of the Korean market that reflects the price difference between domestic exchanges and international exchanges. The premium is often highly volatile and changes with market conditions. This report explores the causes and forms of the Kimchi Premium to reveal the unique dynamics of the Korean crypto market.

2. Reasons for the kimchi premium

There are two main reasons for the existence of the kimchi premium: the high participation of Korean investors in the crypto market and the restricted market environment leading to market inefficiencies.

2.1. Korean investors’ enthusiasm for cryptocurrencies

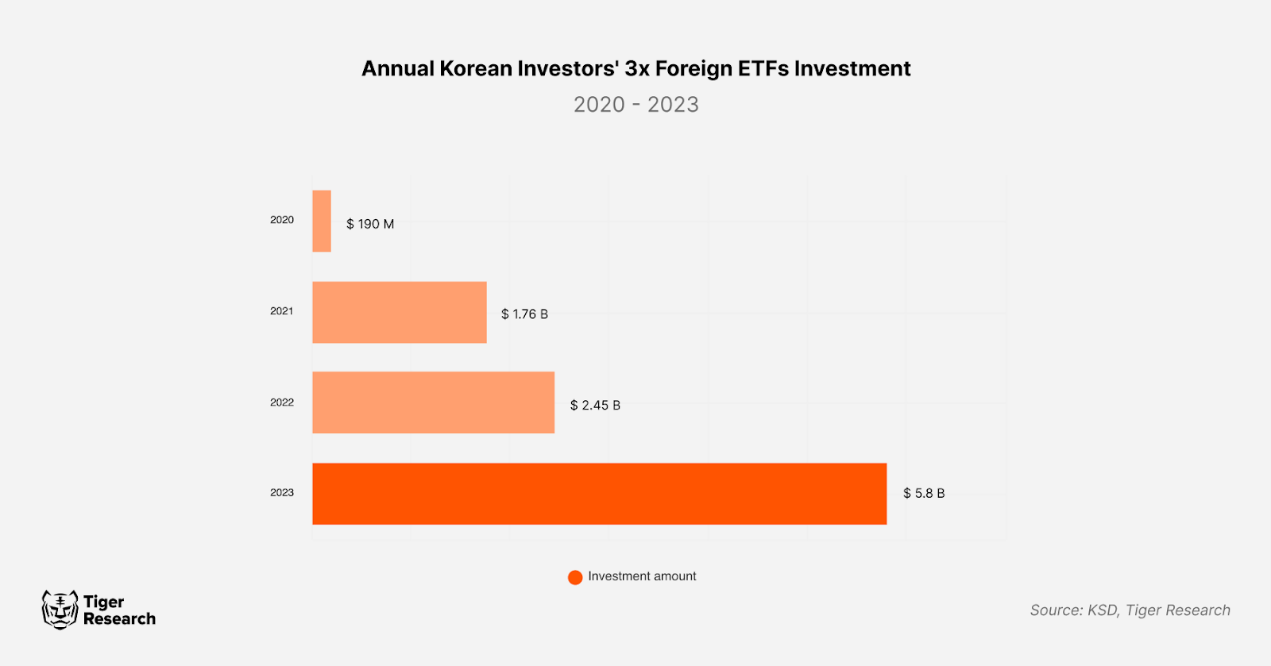

A key factor behind the kimchi premium is the aggressive risk-taking behavior of Korean investors. They have shown a strong appetite for high-risk investments, even in traditional markets. Investment in leveraged ETFs with a volatility of 3x has jumped from $190 million in 2020 to $5.8 billion in 2023. This aggressive tendency has also affected the Korean crypto market.

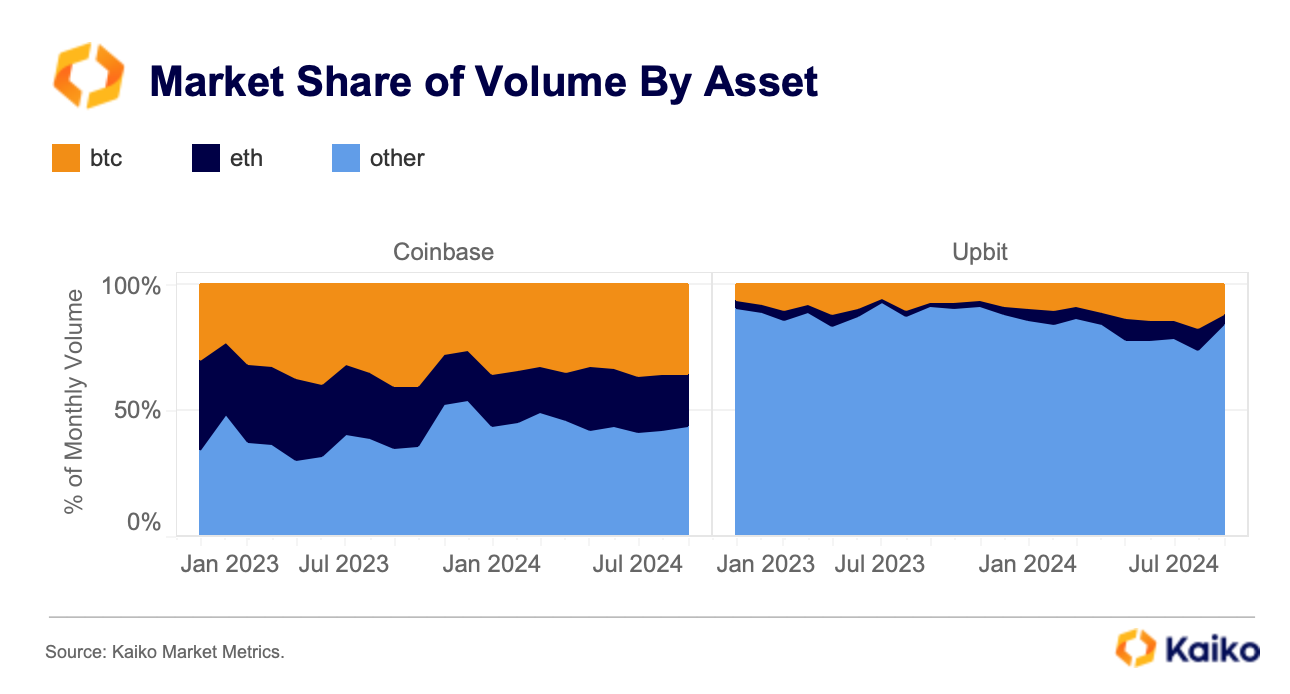

The aggressive investment tendency of Korean investors is more obvious in the crypto market. Compared with KOSPI (Korea Composite Stock Price Index) and KOSDAQ (Kosdaq, Korea's startup market), cryptocurrencies are more volatile, creating more profit opportunities. In the first half of 2024, the average MDD (maximum drawdown) of cryptocurrency assets was about 70%, while the MDD of KOSPI and KOSDAQ was around 10%. From the trading volume data of Coinbase and Upbit, it can be seen that Korean investors clearly prefer small-cap, high-volatility altcoins.

2.2. Market efficiency is low due to limited market environment

Another reason for the kimchi premium is that the Korean crypto market is limited and structurally inefficient. This inefficiency manifests itself in three main aspects:

First, domestic crypto exchanges in South Korea adopt a decentralized structure. Each exchange has its own liquidity pool, unlike centralized systems such as Nasdaq or S&P. This setup disperses liquidity and reduces the efficiency of individual exchanges. To improve this situation, some exchanges connect their liquidity pools with other liquidity pools to create a better trading environment.

The second reason is the limited access to domestic exchanges in South Korea. Only citizens who meet certain criteria can use these platforms: they must 1) live in South Korea, 2) have a local mobile phone, and 3) hold a verified bank account with real name.

Finally, regulatory restrictions are also affecting the market. Although cryptocurrencies are not defined in the Foreign Exchange Act, large transactions using kimchi premiums have faced prosecution. Regulators plan to define crypto assets and operators in the Foreign Exchange Act, which will further restrict the transfer of crypto assets between local and international exchanges.

These liquidity, access, and regulatory constraints reduce arbitrage opportunities and exacerbate structural inefficiencies.

3. Various forms of kimchi premium

The above two factors are the key reasons for the kimchi premium, but they do not fully reflect its uniqueness. The kimchi premium is the result of the combined effect of multiple factors. The market structure, regulatory environment and investment culture have different impacts on the market at different times.

This article mainly studies three types of kimchi premiums. The first is the kimchi discount, which is lower than the global exchange. The second is the individual kimchi premium, which is caused by abnormal price fluctuations of specific cryptocurrencies. The third is based on Gaduri Pumping, which is a unique phenomenon in the market.

3.1. Kimchi discount

Due to the active participation of investors, domestic crypto exchanges in South Korea often show high premiums, but this is not always the case. As crypto assets can still flow between global and local exchanges, the premium will gradually disappear. Changes in domestic investor sentiment may also turn premiums into discounts.

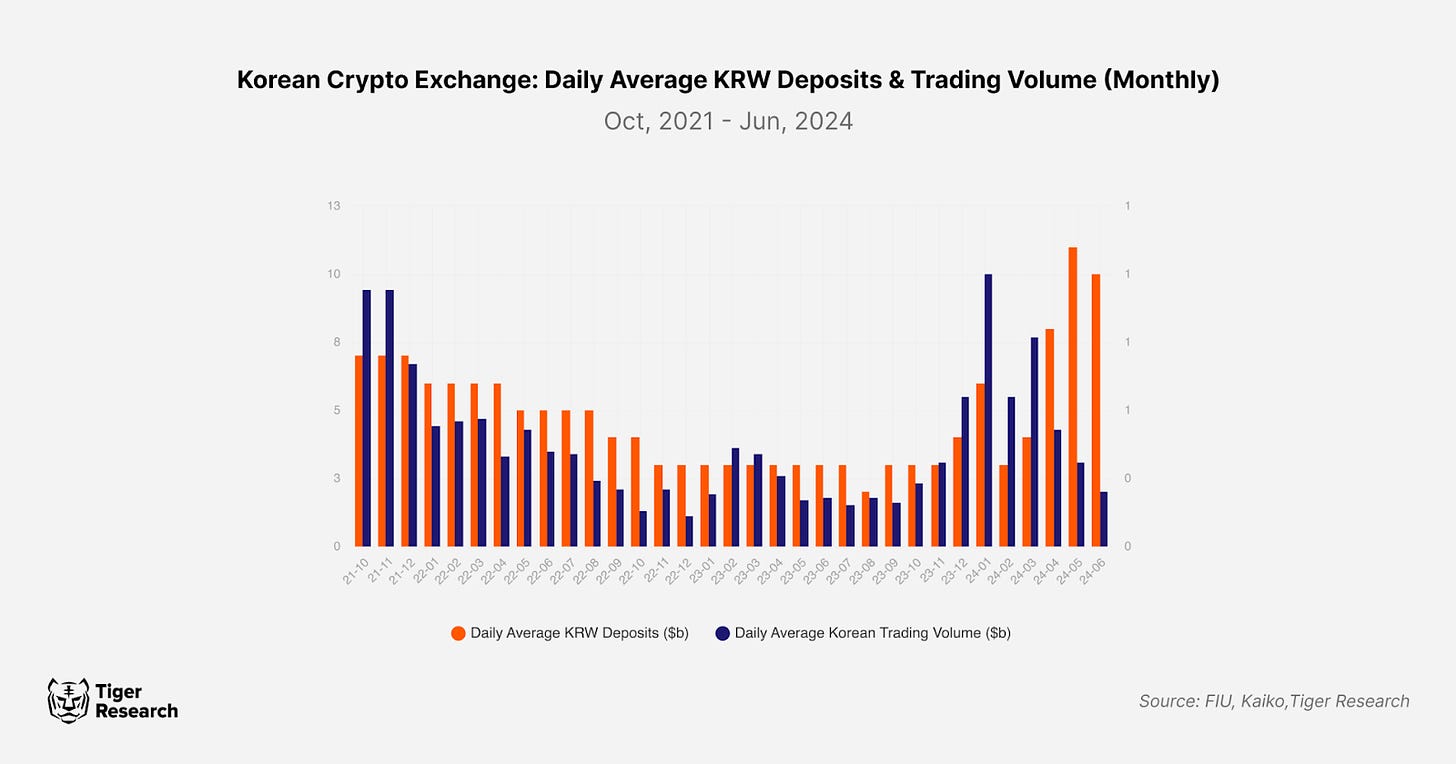

There are three main reasons for the recent changes in the kimchi premium. First, the long-term slump in cryptocurrency prices has led to a large-scale sell-off by investors and a decrease in buying interest. Domestic exchange data in South Korea reflects this trend, with an increase in Korean won deposits and a decrease in average daily trading volume.

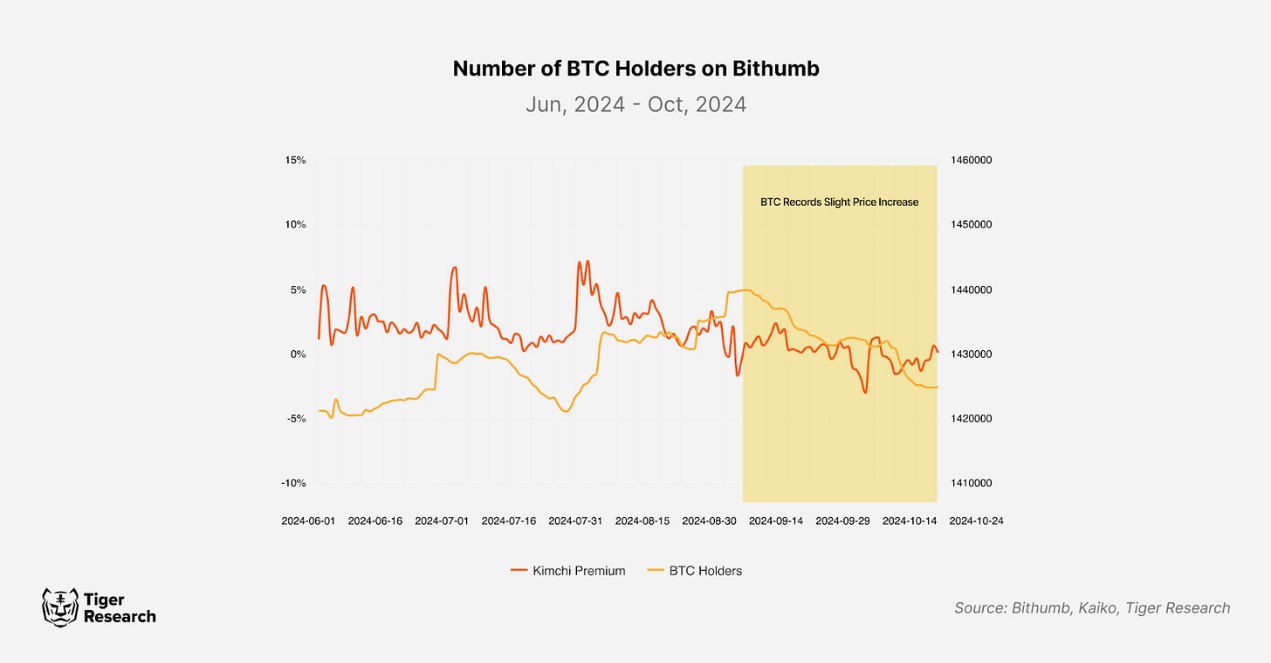

The second factor is that cryptocurrency prices have recently risen slightly after a long period of decline, which may lead to more profit-taking. As the number of Bitcoin, Ethereum and major altcoin holders on Bithumb decreases, the premium has turned into a discount. Finally, some analysts believe that domestic market sentiment in South Korea has cooled due to the implementation of the Virtual Asset User Protection Act.

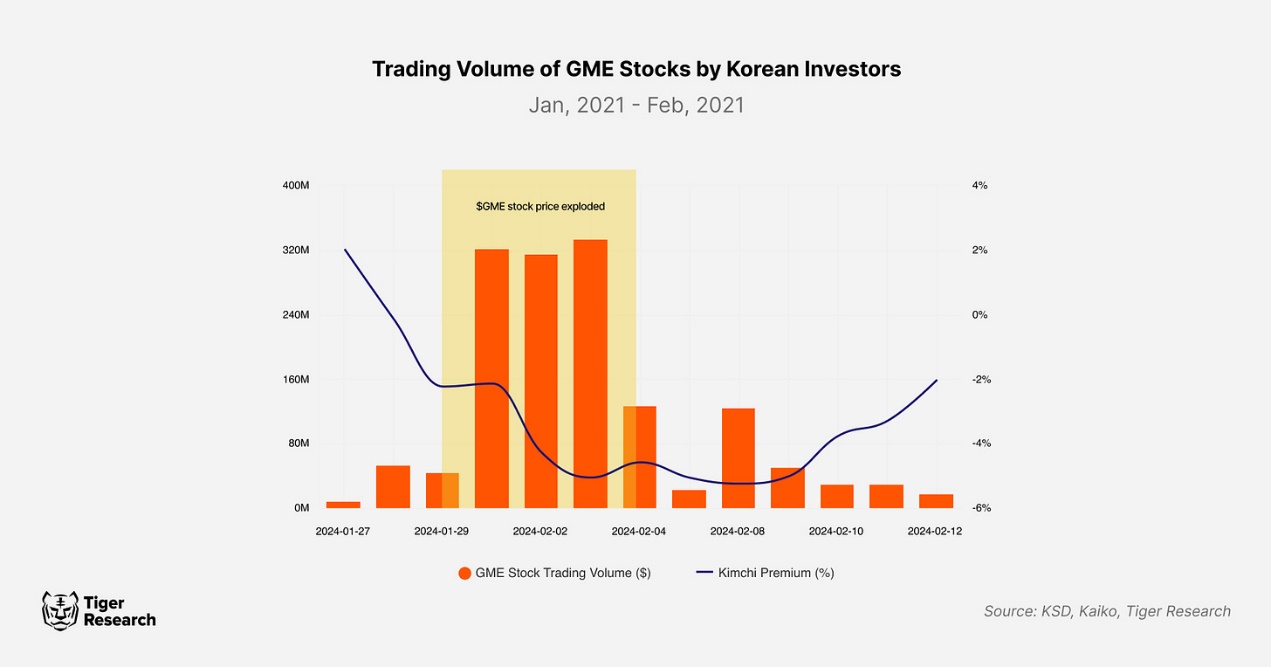

External factors also played a role. In late January 2021, as domestic investors turned their attention to GameStop (GME) stocks, Bitcoin's kimchi discount reached about 5%. In that week, Korean investors traded $1.58 billion in GameStop shares. This shows how the kimchi premium is affected by the "attention economy" and fluctuations are driven by investor interest.

3.2. Individual Kimchi Premium

The Kimchi premium represents the price difference between global and local exchanges for major cryptocurrencies like Bitcoin and Ethereum. The premium for most cryptocurrencies remains within a certain benchmark range. However, certain conditions can drive some cryptocurrencies higher, driven by a surge in buying interest. A common example is the initial price surge during an exchange listing, often referred to as the "listing beam." This initial surge also occurs on global exchanges such as Binance, but tends to be more extreme and volatile in South Korea.

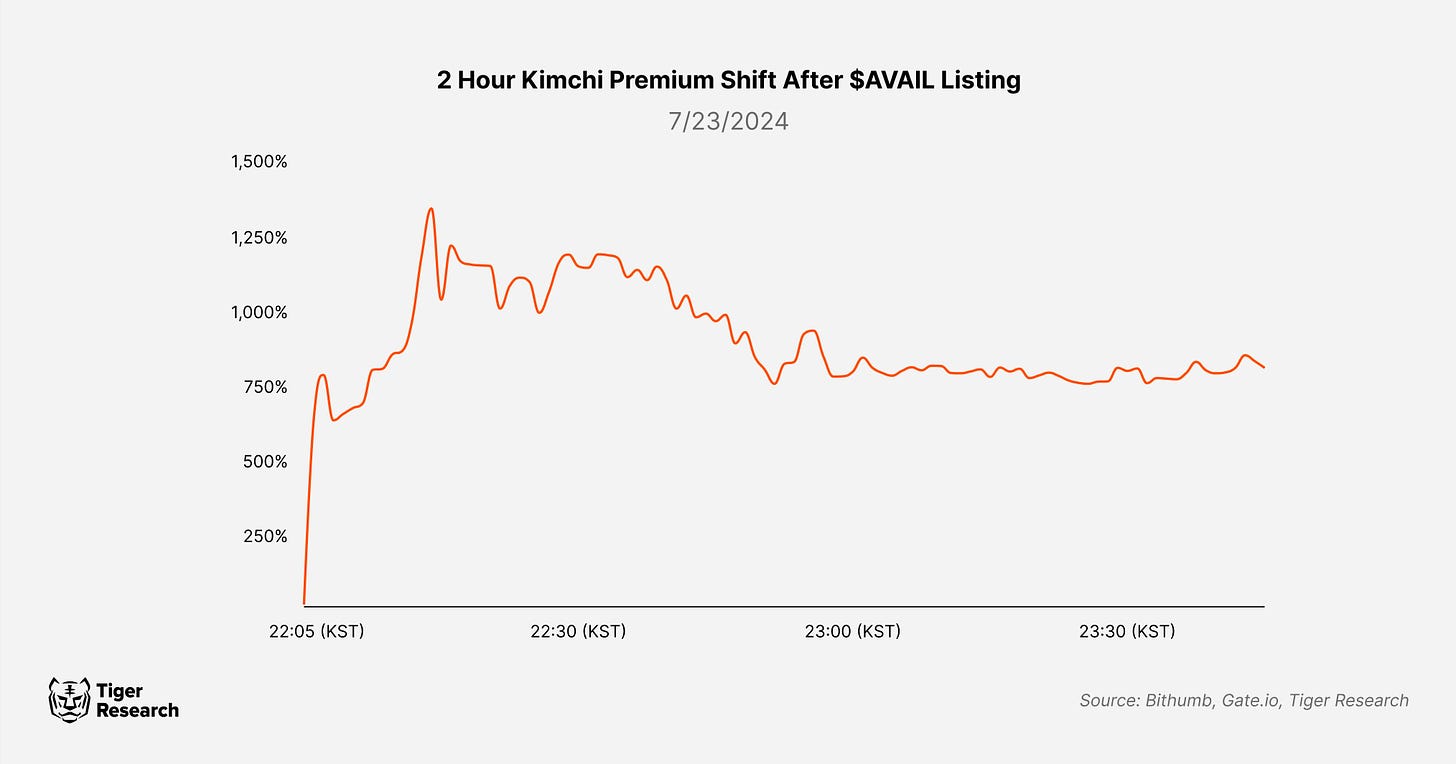

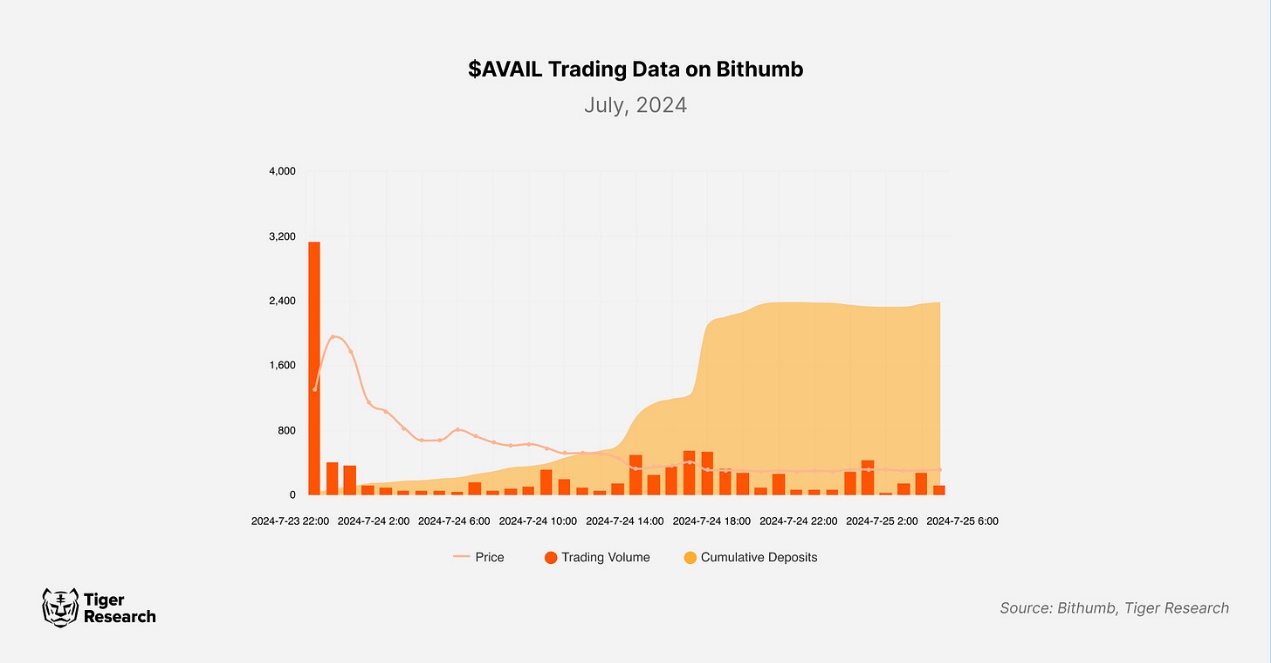

A typical example is AVAIL, which was listed on Bithumb in July 2024. Soon after its listing, Avail attracted a lot of attention and its kimchi premium soared to about 1,255%.

However, as trading volume stabilized, the premium returned to a typical level of around 3%. This example illustrates how the peak in early trading slows down as supply increases.

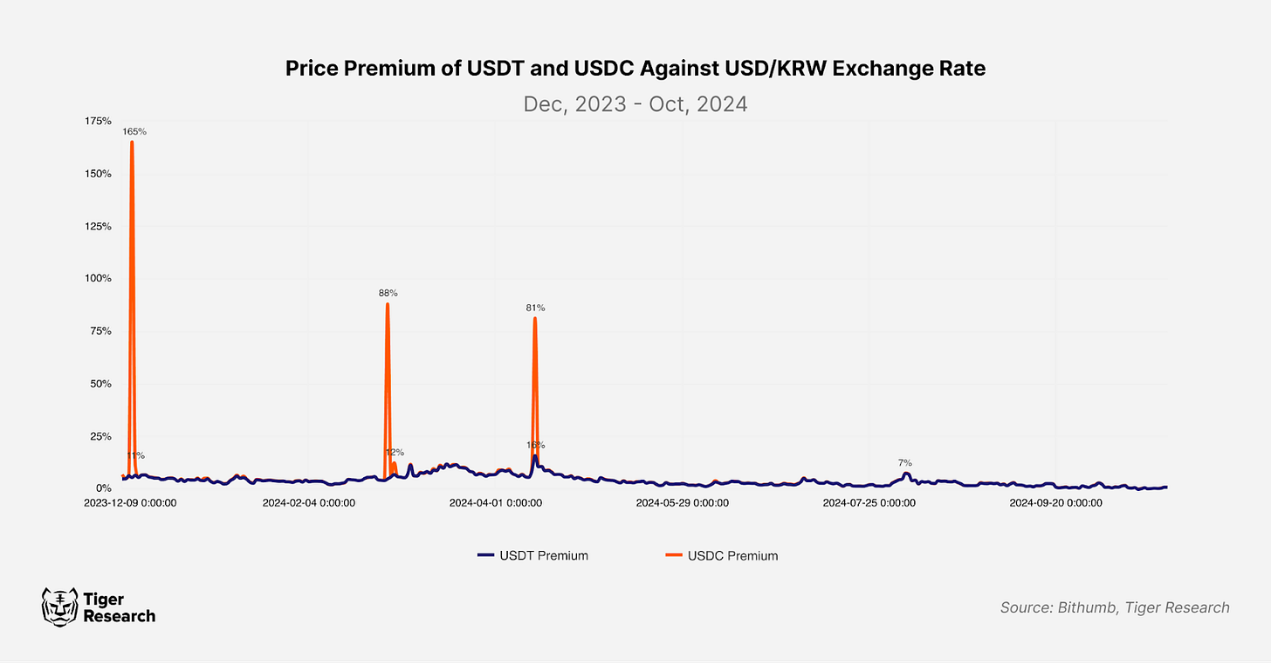

The Kimchi premium also appears on fiat-backed stablecoins such as USDT and USDC. When USDC was first listed on Bithumb, it traded at a 165% premium to the won-to-dollar exchange rate due to strong initial buying interest. While this premium fluctuates, it is usually higher than the won-to-dollar exchange rate, with occasional spikes. These price differences can be caused by automated trading and retail investor misunderstandings, which create a temporary premium.

3.3. Gaduri Pumping Premium

The Gaduri Pumping premium occurs when an exchange suspends deposits and withdrawals of cryptocurrencies. This restriction allows certain players to take advantage of reduced liquidity by artificially pushing up prices. Some retail investors also see this as an investment opportunity, further driving the premium up rapidly.

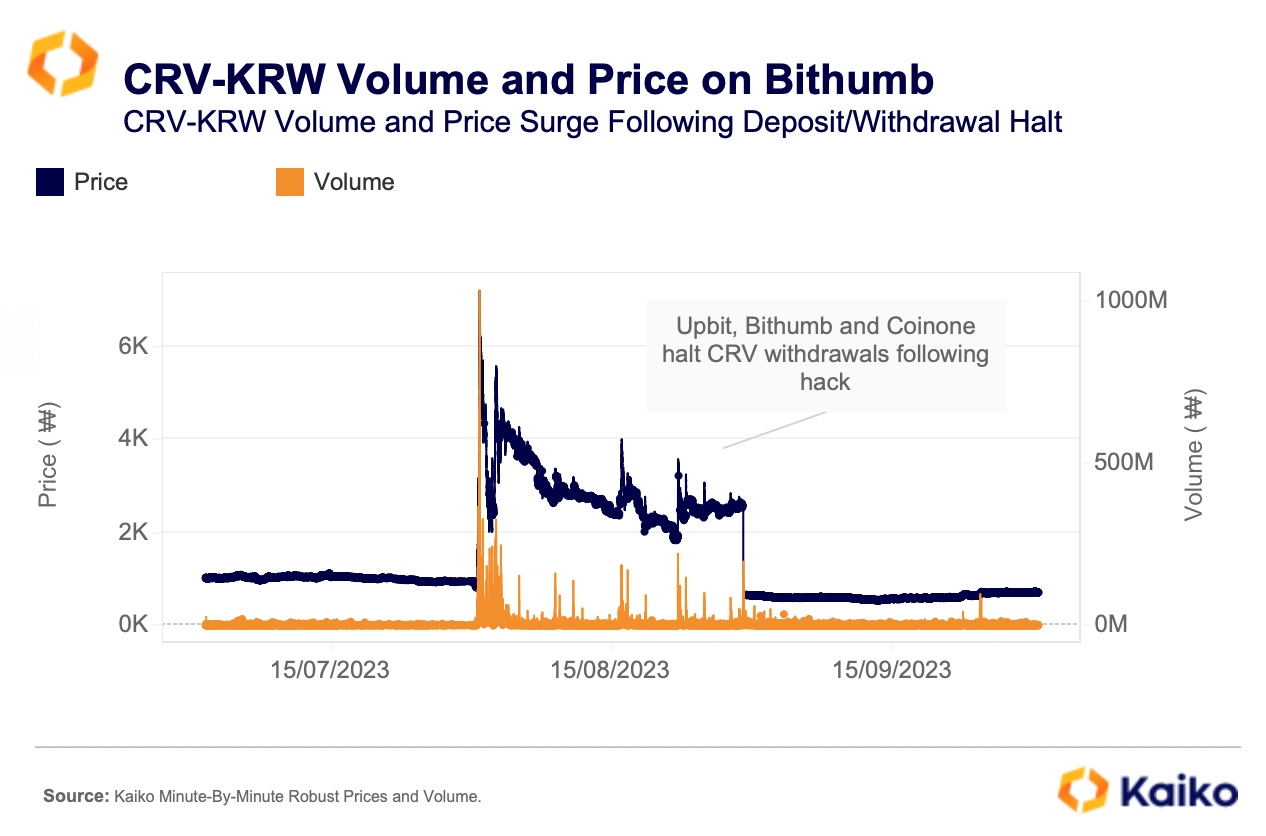

Gaduri Pumping premiums are not limited to deposit and withdrawal suspensions during network upgrades, but can also occur in bearish situations. CurvedAoToken ($CRV) in August 2023, when a security vulnerability caused deposits and withdrawals to be suspended, saw a 700% price premium on local exchanges. This pattern is often repeated during hacks or other major disruptions.

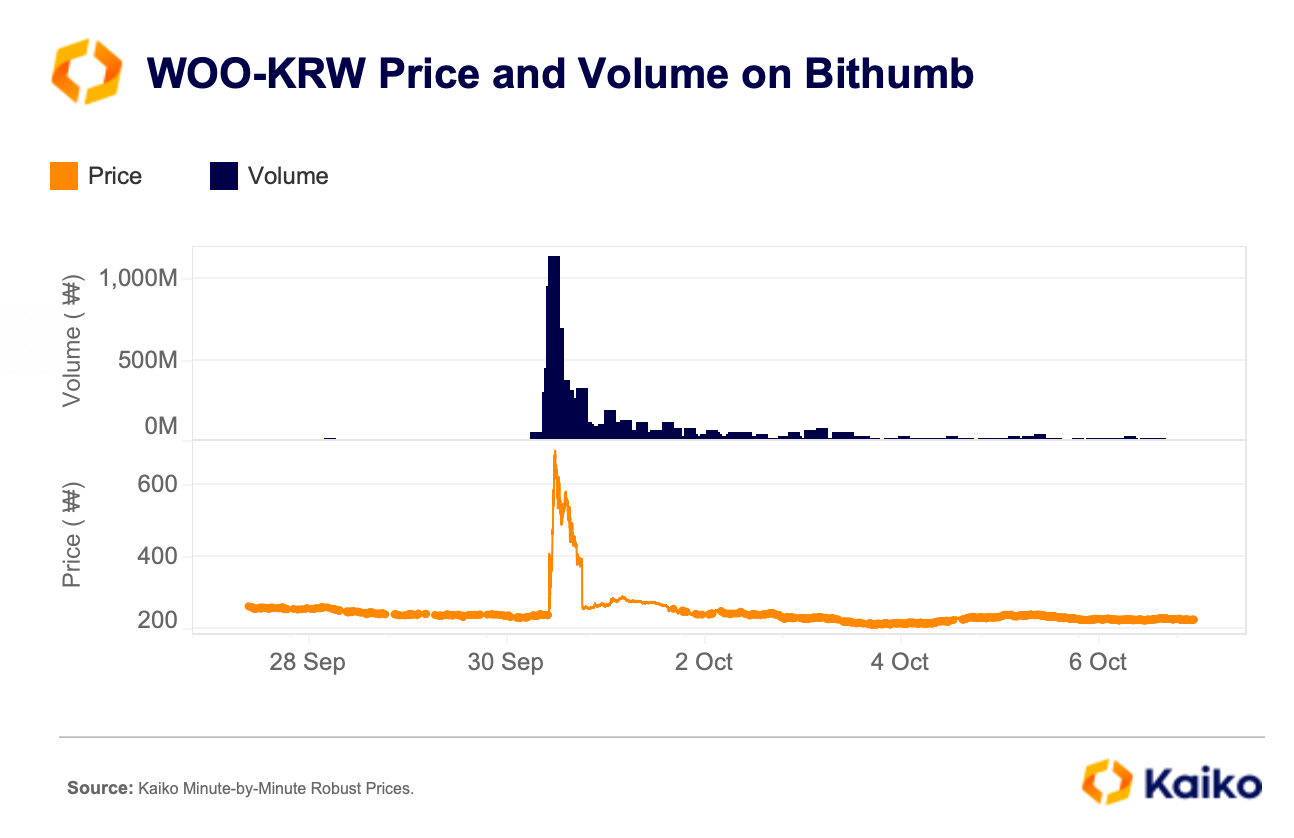

Some believe that certain entities use APIs to enable circular trading and street pumping through alias accounts. The evidence continues to accumulate. The Financial Intelligence Unit (FIU) has found many cases of elderly users conducting automated trading from the same overseas IP address. This activity continues despite the Virtual Asset User Protection Act. Recently, similar patterns have emerged in cryptocurrencies such as WoNetwork (WOO), LumiWave (LWA), and Radiant Capital (RNDT).

4. Thoughts on the kimchi premium

The Kimchi premium is a unique aspect of the Korean crypto market that is driven by a variety of factors. It represents more than just a price difference. Market structure, investor sentiment, and a restricted trading environment all contribute to this phenomenon. While this article highlights the main factors, others also play a role. Fully explaining the Kimchi premium remains challenging because no single rule or pattern applies.

For example, the relatively stable and low kimchi premium in the second half of 2024 may be due to the increase in the rate of Korean investors using overseas exchanges. The number of days with a kimchi premium above 5% in the first half of 2024 was about 5.6 times that in the second half of 2023. This trend suggests that many investors are moving their assets overseas to profit from potential price differences. Outbound remittances of more than 1 million won to overseas operators under the Travel Regulations reached about 52 trillion won, more than double that in the second half of 2023.

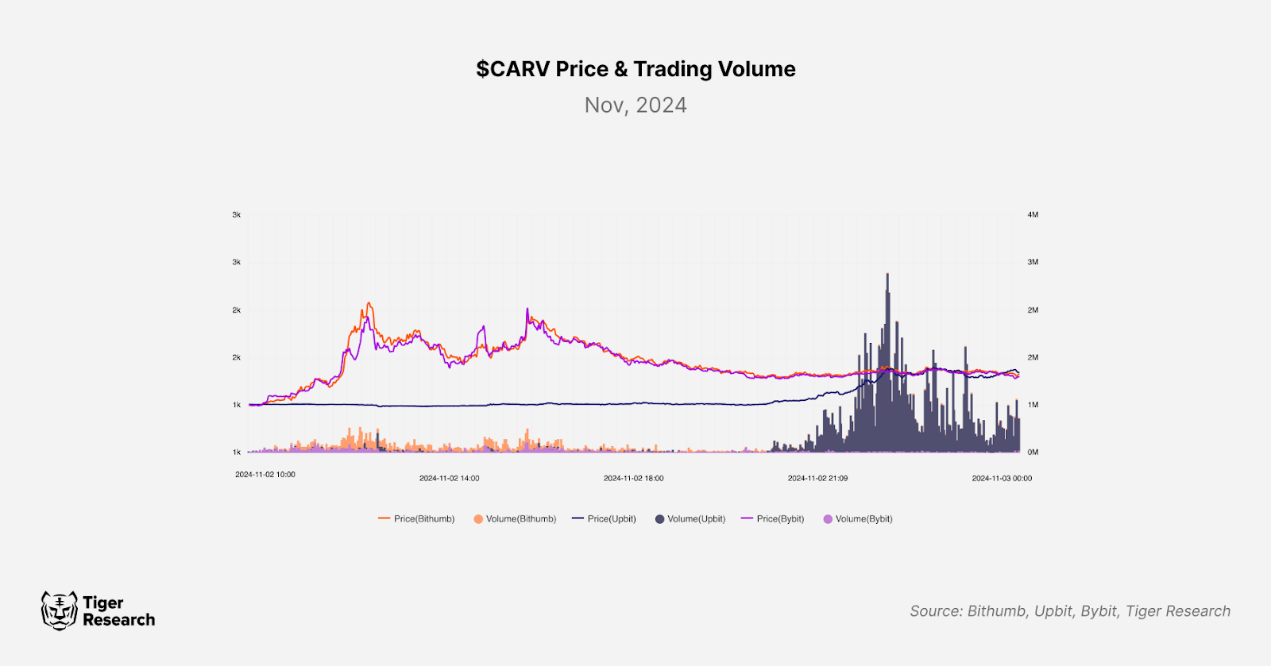

However, these individual factors cannot fully explain the kimchi premium. As described by economist Keynes, “animal spirits” arise from various uncertainties and irrational behaviors of market participants. A recent example illustrates this complexity: the price of CARV tokens on Upbit is lower than other exchanges such as Bithumb and Bybit.

So how should we view the unique phenomenon of the Kimchi premium? Rather than viewing it as an anomaly, it is better to view it as a valuable market indicator. Price premiums in the crypto market are not unique to South Korea. In other countries, premiums occur for different reasons depending on local market conditions. For example, Coinbase in the United States has a premium due to interest from institutional investors. In Turkey, premiums also appear as the currency depreciates and people turn to alternative assets. Similar patterns have been observed in Japan, Europe, and elsewhere.

Thus, the Kimchi premium can serve as an indicator of the unique market environment in each region. South Korea is particularly interesting due to its restricted trading environment and strong retail investor sentiment. The premium reflects the level of retail interest and capital inflows into the market. It provides valuable insights into the characteristics of the Korean market and may help predict trends in cryptocurrencies. However, speculative trading can sometimes lead to a Kimchi premium, resulting in price distortions that may not reflect true market interest.

Related reading: Viewpoint: Three major changes that will occur in the virtual asset market after the South Korean parliamentary elections

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm