MYX Finance Bull Run Continues: Best Altcoins to Buy Today

MYX Finance is having a great week. The native MYX token of this DeFi perpetuals DEX has rocketed over 1,700% since last Tuesday, posting a new all-time high of $17.95 today. And with nearly $880 million in spot trading volume since yesterday, it’s one of the most active altcoins on the market.

But what’s behind MYX’s monster run? It’s a perfect storm of hype, fundamental catalysts, and good old-fashioned short squeezes. A Trump-linked token listing, a massive token airdrop, and the upcoming V2 upgrade promising zero-slippage trading have all boosted demand.

Yet explosive runs like this rarely last. MYX’s daily and weekly charts are looking seriously overbought, and smart traders are already starting to rotate their profits elsewhere.

That trend is prompting a big question: what are the best altcoins to buy today? While MYX gets all the headlines, projects like Bitcoin Hyper, Best Wallet Token, and Ethena might be quietly setting up for their own bull runs.

1. Bitcoin Hyper (HYPER)

Bitcoin Hyper (HYPER) is getting talked up as a top altcoin pick right now, mainly because it’s pitching itself as a “true” Bitcoin Layer-2 solution. Instead of messing with Bitcoin’s core code, it anchors its security to the main blockchain while deploying an SVM-style execution layer and rollup-like batching.

In simple terms? Bitcoin Hyper aims to process thousands of transactions per second with instant finality and lower fees – all while letting developers build smart contracts and dApps that actually use BTC.

The project’s presale has already raised $14.6 million at $0.012885 per token, and whales are starting to get involved; one just invested over $13,000 in a single buy. That kind of backing tells you investors are betting on the Bitcoin Layer-2 narrative in a big way.

If Bitcoin Hyper delivers on its 2025 mainnet and exchange listing plans, it could kickstart a whole new wave of BTC-native DeFi, payments, and even Web3 games. Staking is already available via the presale at APYs of up to 75%. So, for anyone looking beyond MYX’s bull run, HYPER might be one of the cleanest bets on utility-driven growth. Visit Bitcoin Hyper Presale.

2. Best Wallet Token (BEST)

Next up is Best Wallet Token (BEST), which is interesting because it’s tied to an ecosystem that’s already thriving. Best Wallet is a non-custodial, no-KYC mobile crypto wallet app that supports 60+ blockchains – and packs in everything from token swaps and cross-chain routing to staking and portfolio tracking.

Holding the BEST token gets you real perks inside the Best Wallet app: lower trading fees, better staking yields, governance rights, and early access to vetted crypto presales. Plus, in the future, it’ll be tied to a crypto debit card offering up to 8% cashback.

That combination – a live, widely-used product plus a token with instant utility – is rare. Best Wallet has already been downloaded hundreds of thousands of times and has strong app store ratings, meaning BEST isn’t starting from zero.

The Best Wallet Token presale has already raised $15.6 million, and BEST tokens are on offer for just $0.025615 each (with an 85% APY for staking). With a clear use case in an app that people already use, this could be one of the best altcoins to buy today. Visit Best Wallet Token Presale.

3. Ethena (ENA)

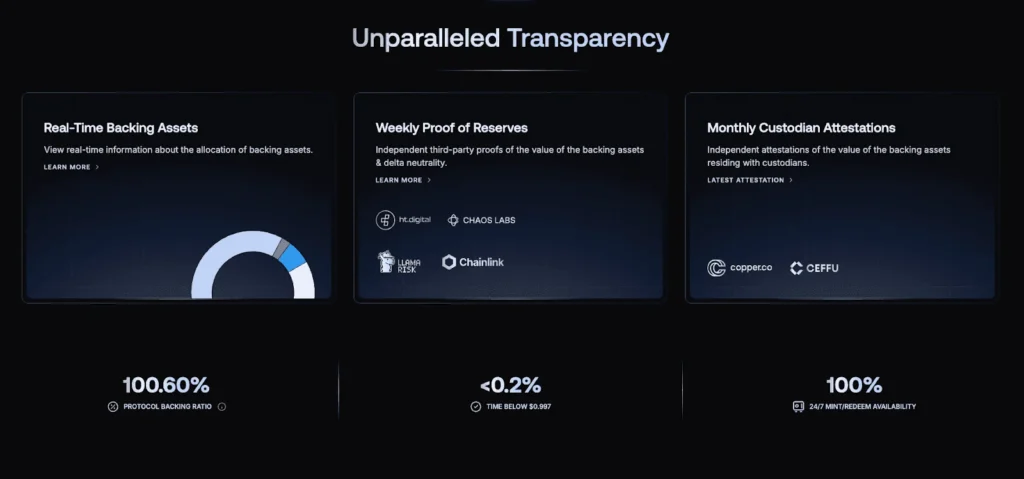

Ethena (ENA) has become one of those DeFi projects you can’t ignore, as it tackles a massive issue in crypto: the stablecoin trilemma. Its synthetic dollar, USDe, maintains its peg through a delta-neutral strategy – essentially, it uses collateral like ETH and hedges it with short derivative positions.

That setup maintains a stable price while earning holders yield from funding rates and staking rewards. And the best part? USDe doesn’t rely on traditional banks or fiat reserves, making it more censorship-resistant than rival stablecoins.

ENA is the governance token that powers Ethena’s ecosystem. Holders can vote on everything from risk parameters to new collateral types and incentives. Ultimately, if USDe usage continues to grow, being an ENA holder could become increasingly valuable.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Marathon Digital BTC Transfers Highlight Miner Stress

This U.S. politician’s suspicious stock trade just returned over 200% in weeks