MemeCore (M) Keeps Pumping by Double Digits, Bitcoin (BTC) Struggles at $111K: Weekend Watch

After a gradual increase to over $113,000 yesterday, bitcoin’s price faced immediate selling pressure and was pushed south by a few grand before it settled at around $111,000.

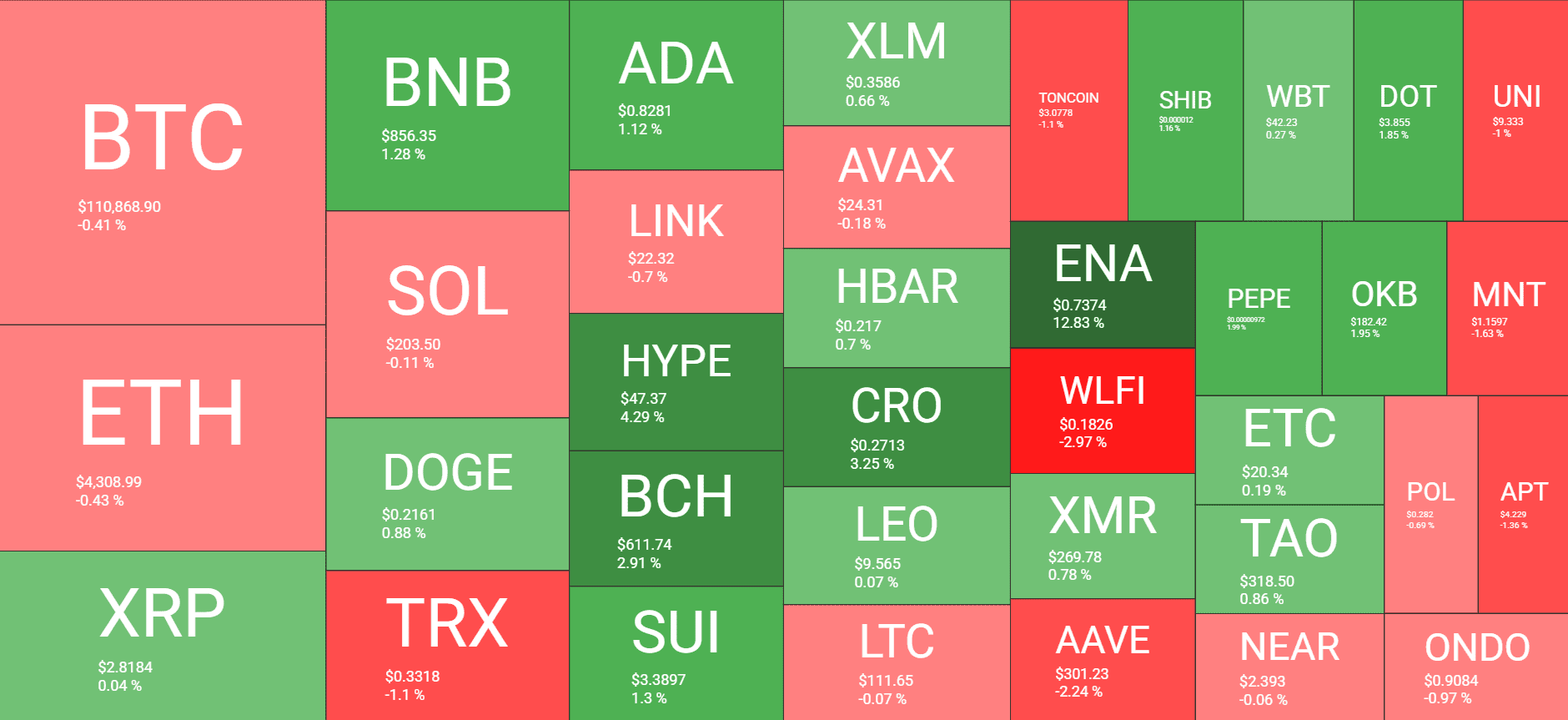

Most larger-cap alts have failed to post any significant gains, aside from HYPE, which has jumped to over $47, and ENA, which has risen by 13%.

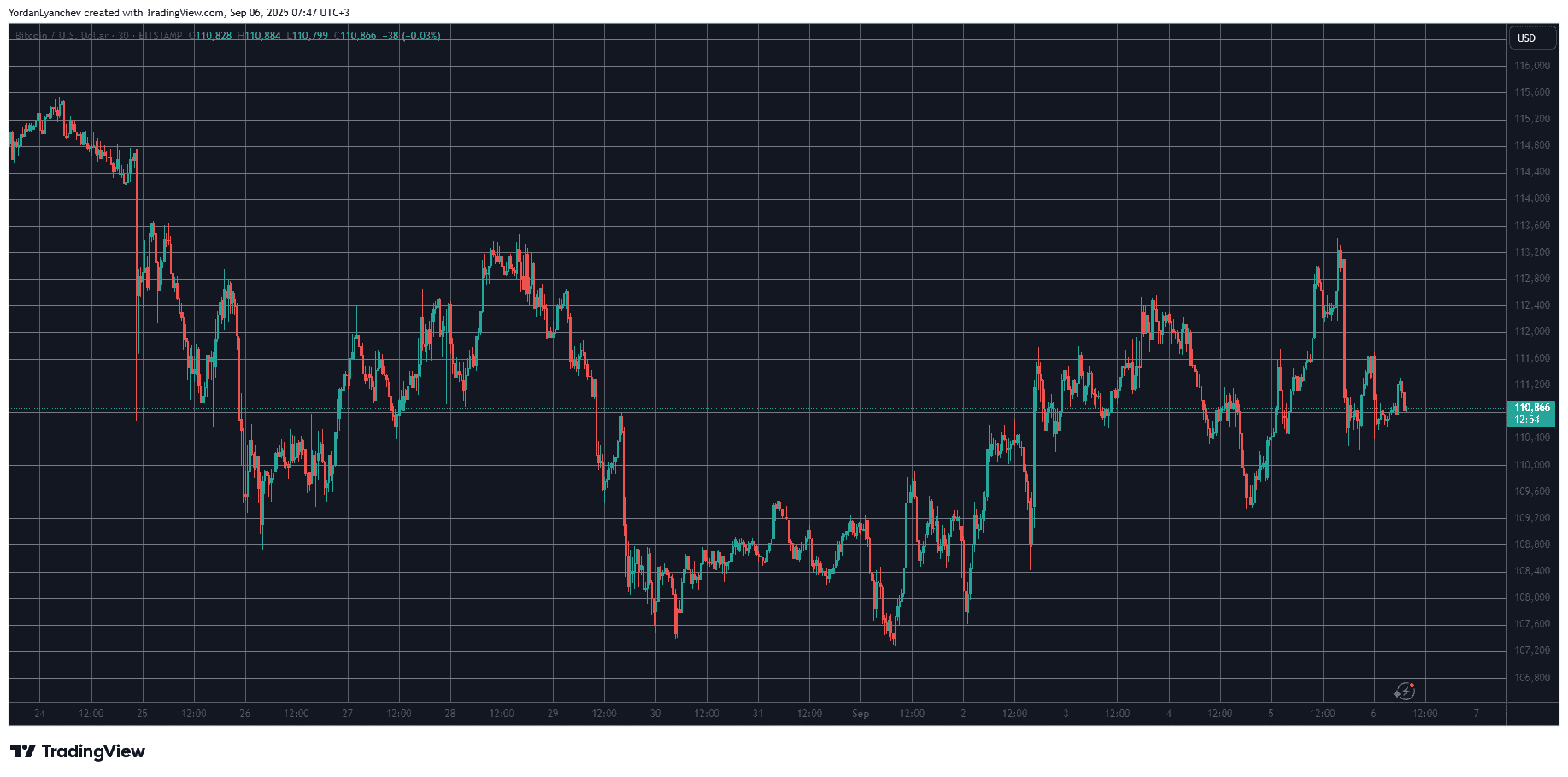

BTC Stopped at $113.5K

The primary cryptocurrency tried to break out at the end of the previous business week, but the bears were quick to intercept the move and halt it in its tracks. As such, the asset fell from $113,500 to under $107,500 within a day or so.

The following 48 hours were painful as well, as bitcoin failed to recover any of the losses and marked a new multi-week low of $107,100 on September 1. The bulls finally tried to step up at this point, and after some shaky performance, drove BTC out of this local bottom to over $111,500 by Tuesday.

Another rejection followed suit, but this time it was less painful, and bitcoin slipped to $109,000. The asset went on the offensive once again on Friday, surging toward $113,500 after a weak jobs report in the US. That was another short-lived rally, though, as BTC lost almost all gains immediately in a drop to $110,400, which left over $300 million in liquidations.

It has calmed at around $111,000 ever since, with its market cap at just over $2.2 trillion on CG, and its dominance over the alts at 56.5%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

M Keeps Pumping

The undisputed altcoin in terms of weekly (and daily) gains is once again MemeCore, which entered the top 100 digital assets just several days ago. M has skyrocketed by 14% in the past day alone, and 200% since this time last Saturday, and now trades at $1.57 with a market cap of well over $2.6 billion.

ENA follows suit, with a 13% surge that has taken it to $0.73. PUMP and HYPE are next, with 10% and 4.5%, respectively. CRO and BCH are also slightly in the green, while the rest of the larger-cap alts have remained essentially at the same levels as yesterday.

The total crypto market cap has stalled at $3.910 trillion on CG.

Cryptocurrency Market Overview. Source: QuantifyCrypto

Cryptocurrency Market Overview. Source: QuantifyCrypto

The post MemeCore (M) Keeps Pumping by Double Digits, Bitcoin (BTC) Struggles at $111K: Weekend Watch appeared first on CryptoPotato.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Kalshi debuts ecosystem hub with Solana and Base