Reflecting on this bull market cycle: Which stage are we in now?

Author: AlΞx Wacy , Crypto Researcher

Compiled by: Felix, PANews

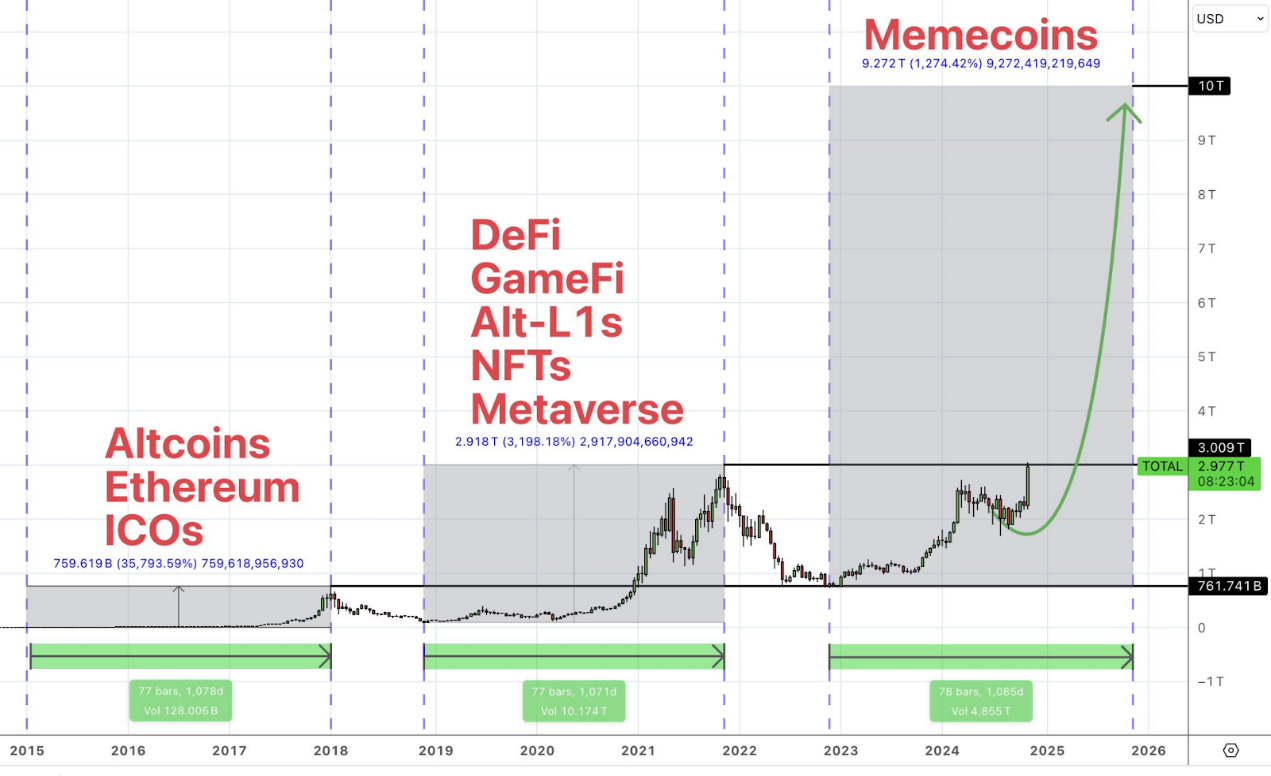

In previous bull markets, all altcoins did not surge at the same time. This does not refer to a 10-30% increase, but a 300-700% or even higher increase. These rotational surges constitute the entire bull market cycle.

Money is constantly flowing between different tokens, which is why alt seasons don’t last just a week, but months. Here’s how money used to flow:

BTC > ETH > High Market Cap Tokens > Low Market Cap Tokens > BTC…

But today this model is outdated and the current money flow cycle is more nuanced. Each phase is discussed in detail below.

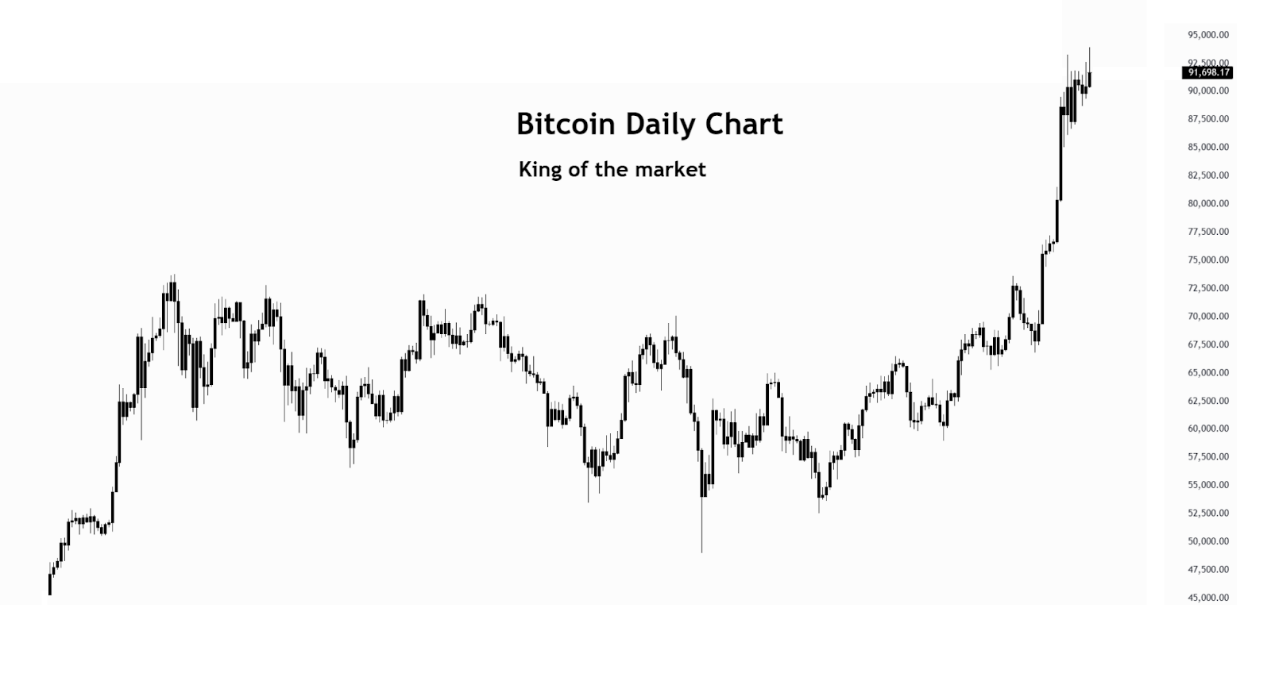

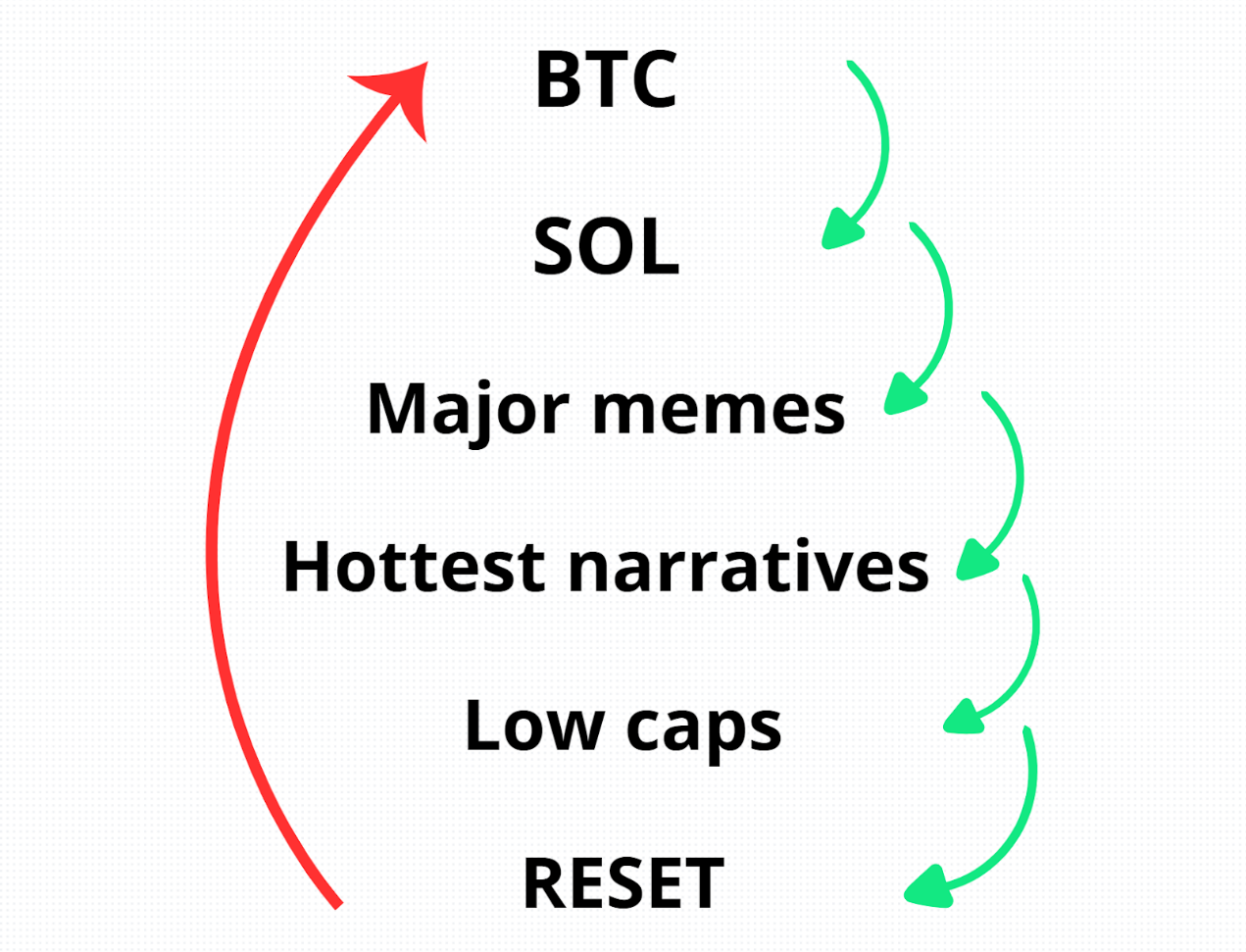

Phase 1

BTC is leading the way as always. Market giants lead the crypto trend, but once BTC stops rising (or its rise slows down), other tokens will take over.

Phase II

SOL, as the leader among altcoins in this cycle, is starting to rise. Some other major altcoins may follow, but their performance is weaker (it is currently at this stage).

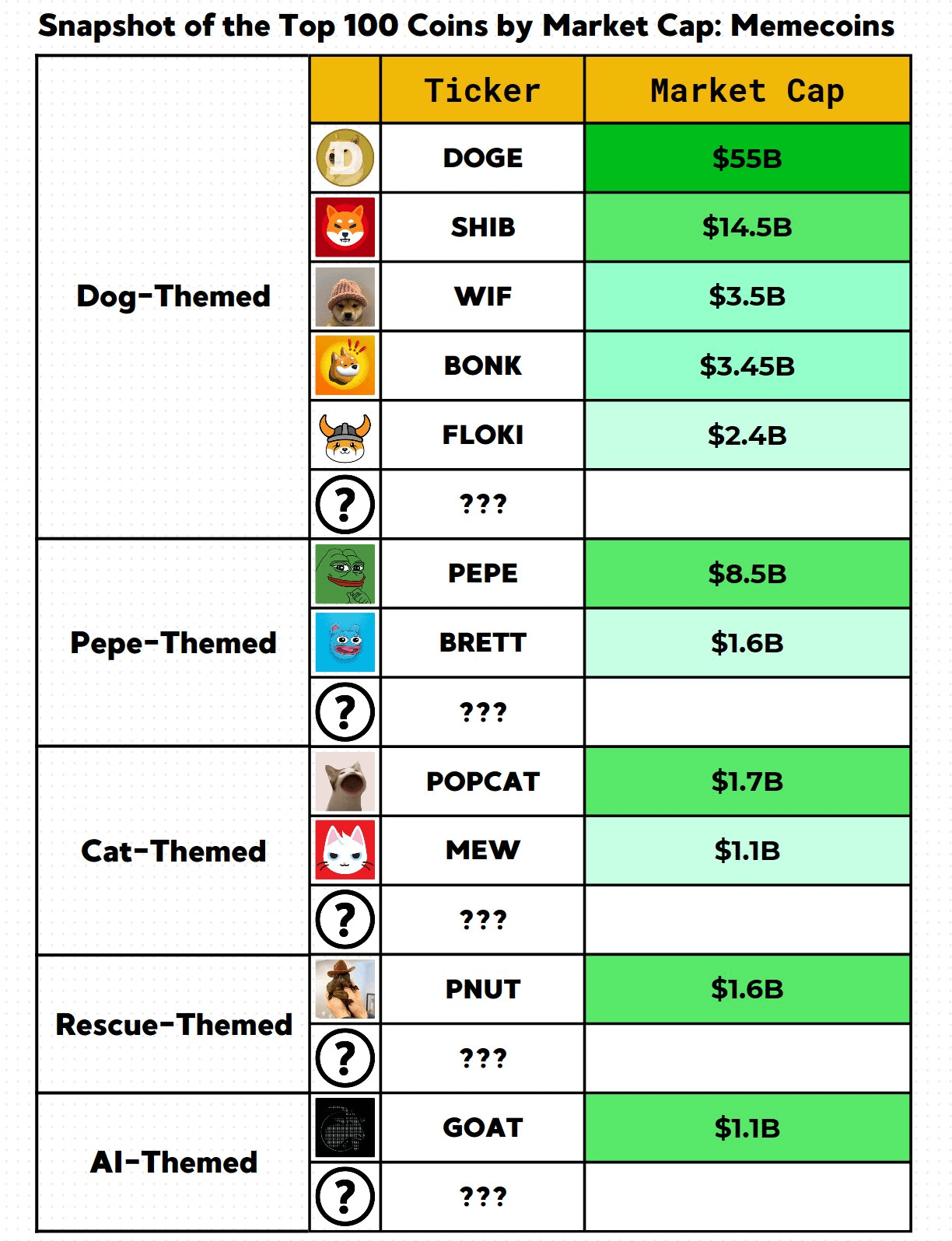

Phase 3

The following tokens may “take over” the rise of SOL:

- Mainstream memecoins: DOGE, SHIB, PEPE, WIF, BONK, POPCAT

- Mainstream altcoins: RENDER, SUI, APT, LTC, etc.

Some coins may underperform or break out late.

Stage 4

This phase was dominated by the hottest narratives: Memecoins, AI, RWA, and some combinations of these narratives, such as AI memes and AI x DePIN.

Some narratives will be skipped and players will be stuck. So choose wisely.

Stage 5

During this phase, low market cap coins start to rise rapidly, even every hour. This phase is the best time to trade robust memecoins and projects with good fundamentals. Choose the best performing coins, as there are often market surges and crashes.

Stage 6

Money is flowing back into BTC. These cycles are becoming increasingly unpredictable as the market matures. Don’t waste this bull run, you still have time to make life-changing money in the next 5-9 months.

But remember one important thing, you can build wealth in two ways:

- Long-term holding of tokens that can increase in value

- Trade with faster-rising coins

Historically, less than 1% of people who try the second approach achieve long-term success.

Therefore, most of your funds should still be held in long-term positions, and if you want to seize every opportunity of a surge, you should use idle funds (small positions).

Related reading: Why did Memecoin take the lead in this bull market? A brief discussion on the new logic of asset sector rotation

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Trump foe devises plan to starve him of what he 'craves' most