Ditch KOLs: 4 Reasons to Build Communities Instead

Spoiler alert : Your KOL marketing strategy will fail. This is not a prediction, it's a fact!

Web3 marketing is evolving. If you are banking on splashing your budget on KOLs, let me inform you beforehand that it will FAIL.

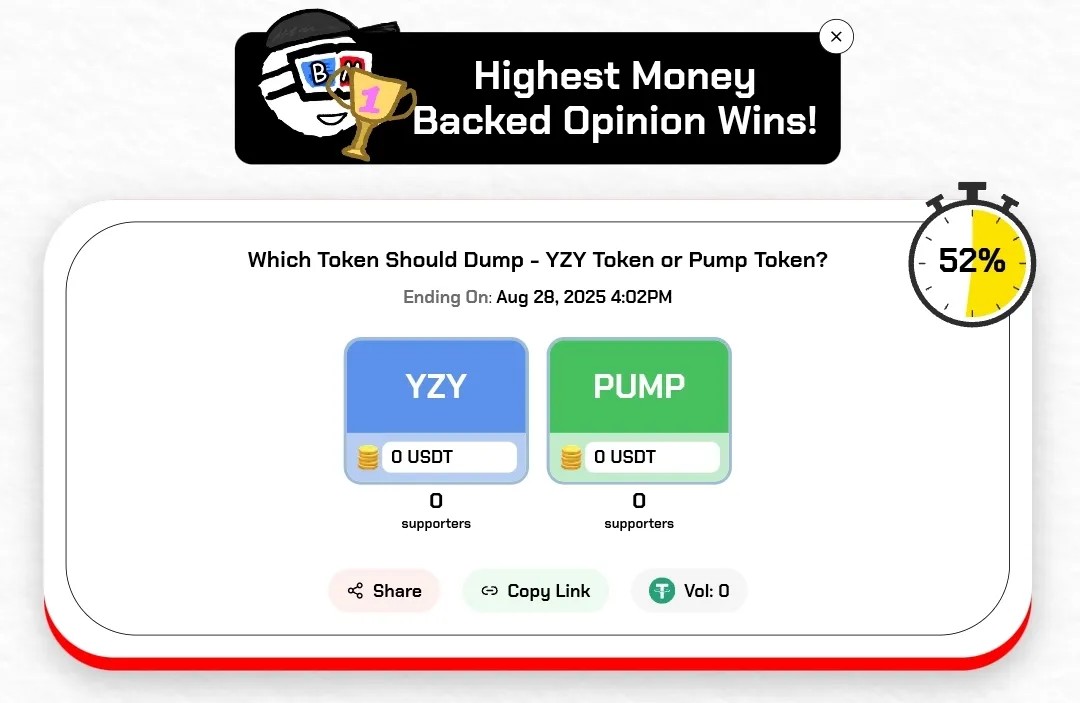

Here’s a vivid example below.

A crypto betting platform — Astrix (not the real name of the project) hired a KOL to post about a new market they had launched on their platform. The aim was to get their first 200 users for beta launch.

The result? Over 500 retweets, zero quotes, and zero stakes placed in the market.

\ You see? KOL marketing is no longer effective. Many of the crypto brands that are top of mind today own their narrative instead of renting through KOLs.

Crypto natives are now more aware. Recently, I came across a conversation on my TL that exposed influencers who had been paid to hype Chainlink over Ripple. As soon as they were exposed, some of them blocked the person who called them out. To make it worse, the comments under their posts were filled with replies like, “you were paid to post this.” There was no real engagement. Now these are notable KOLs in the space with up to 500k followers.

From my communication with the team at Astrix, I figured they are not aware of how to carry out a GTM strategy to attract the first 200 users, which is why they decided to go through the “normal route” of using KOLs.

People are tired of being sold to. They would rather spend their time where the product already works and the community is active. That's how Kaito did it.

The recent messy uncovering of KOLs being paid up to $60k to shill a coin shows how much bad pr KOL marketing has, especially since many projects go after accounts with inflated followers and botted activity. On the other hand, tools like Kaito and Cookie make it possible to spot influencers with smart, high-quality followers. Many agencies lower the bar with KOL marketing because most of the projects they promote are short-term and built only on hype. Tools like Kaito have also made KOL marketing more expensive, especially when quality is involved.

4 reasons why you shouldn't rely on KOL marketing:

- KOL marketing now has bad PR. You are indirectly communicating how you want to be perceived if you rely on KOLs to build your brand.

- More often, KOLs bring in low-quality users, driven more by hype than by utility.

- The ROI is not commensurate with the amount spent.

- You are thinking of blitz marketing if your aim is just to bring in hype through KOLs. The longer and most assured route is owning your community.

How Astrix can get users without KOLs

Astrix is a fandom betting platform; different from a prediction market where you place stakes on the possibility of a future event happening and then cash out if your stake is correct. Astrix is simply a marketplace where the larger fanbase wins. It’s like betting on Messi vs Ronaldo, and the side with the larger stake shares the deposits. Currently, it's not as popular as prediction markets. Here's how Astrix can stand out:

\

- Own a category

In Web3, many people want to build the same thing, especially after one project has a breakthrough. Over time, we see that the first movers become category leaders in their space and capture the user base. For instance: Hyperliquid - decentralized perps trading, Kaito - InfoFi, and Abstract - consumer blockchain.

Astrix can decide to own the FanFi category - a decentralized source of truth for fans. If anyone wants to find out who has a stronger fanbase between Messi and Ronaldo, they should be able to boldly quote Astrix.

Here are never seen features Astrix can add to step up the platform :

-

Permissionless market creation: Anyone can create fandom battles, not just the platform.

-

Squad governance: Squads vote on strategies, rewards, and rivalries to keep it decentralized.

-

All stakes, AI decisions, withdrawals, and outcomes are visible on-chain.

-

Community-owned pools: Liquidity for fandom markets is shared and governed by fans.

-

AI as oracle to:

-

Check if a market is clear and fair before it goes live.

-

Pull data from trusted sources to decide outcomes.

-

Block low-quality or vague markets.

-

Suggest results, and the community can confirm.

\

-

Users can form squads and pool stakes together to represent their fandom against rival squads.

-

In app chat room for squads.

-

Evergreen markets to keep rivalries like Messi vs Ronaldo open forever with incentives for early stakers.

-

Fans can withdraw anytime or hold stakes long term as proof of loyalty.

-

Sharable assets to help users quote Astrix outside the platform.

-

NFT badges used within the platform to level up.

-

Leaderboard to rank fans by wins, streaks and influence.

-

Simple dashboard showing markets all-time dominance and short-term momentum.

-

Fans can wager on short term sentiments like “Will Kanye West tweet in the next 24 hours?

You see, that's how you make an ordinary product EXTRAORDINARY!

\

\

- Choose an ecosystem

Building a fandom betting product demands speed. Astrix could choose an ecosystem where gambling already thrives, such as Solana or Base. The brand colors should blend with the ecosystem’s palette. For example, if they intend to use Base and their brand’s main color is orange, it may be difficult for the Base community to adapt to the brand.

\

- Create markets for the community

Start by building markets that appeal to the ecosystem community Astrix is based on. Create clans like Sol vs Base, shill early access, and share the roadmap. Give users a clear promise - genuine users always want to know where the project is headed.

\

-

Use team accounts and founder funnel.

People want to buy from people. Having a strong founder personality and team member accounts on X will help amplify the reach and bring in quality users.

\

- Community flywheel

A decentralized community should grow to the point where the community manager is not seen as a hero but shares responsibility with community members.

To do this, Astrix can run in-app contests to spot consistent activity and highlight community members who naturally talk about the platform. Recruit them as internal KOLs. I’ve seen this to be more effective than forcing endorsements from people who care more about the pay check than the platform. A typical example of a project that recruited community members as mods and KOLs is Hyperliquid.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk