August Sees 92% Jump in Stablecoin Transaction Volume, Reaching $3 Trillion

While crypto markets were quite volatile in August and bitcoin lost 6.49% during the month, the stablecoin economy grew by more than $17 billion.

Stablecoins Soar by $17B in August Despite Crypto Market Chaos

As of Sept. 2, 2025, defillama.com data shows the fiat-pegged, U.S. dollar-driven crypto economy holds a value of $284.558 billion. On Aug. 1, it measured $267.091 billion, reflecting growth of $17.467 billion since then. About $3.2 billion of that increase came from tether ( USDT), which carries a market cap near $167.97 billion, representing 59.03% of the stablecoin market’s total worth.

Stablecoin economy stats according to defillama.com on Sept. 2, 2025.

Stablecoin economy stats according to defillama.com on Sept. 2, 2025.

Around $7.98 billion of the increase came from Circle’s USDC, which now commands a market cap of roughly $71.85 billion. Ethena’s USDe gained notable momentum over the past month, with its supply climbing more than 41% to $12.403 billion. USDe recorded inflows of roughly $3.65 billion, according to defillama.com’s stablecoin metrics.

Interestingly, Sky’s DAI grew by $880 million in August, marking a rise of just over 20%. Sky’s USDS declined by roughly $300 million, leaving its market cap at $4.511 billion. Meanwhile, World Liberty Financial’s USD1 climbed by $349 million in August, a gain of 16%. Blackrock’s BUIDL dipped 0.6% in August, with $14 million in outflows pulling its market cap down to $2.384 billion.

Rounding out the top ten, Ethena’s USDtb rose by $72 million, Falcon Finance’s USDf added $146 million, and Paypal’s PYUSD climbed $162 million since the start of August. USDtb now holds a market cap of about $1.509 billion, USDf is valued at roughly $1.234 billion, and PYUSD sits at $1.175 billion.

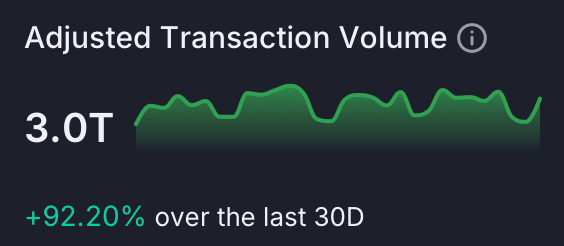

Paypal’s stablecoin crossed the $1 billion mark in mid-August, and its overall market cap now stands at an all-time high. Over the last 30 days, Artemis Terminal stablecoin data shows adjusted transaction volume jumped over 92% to hit $3 trillion.

Stablecoin stats according to Artemis Terminal on Sept. 2, 2025.

Stablecoin stats according to Artemis Terminal on Sept. 2, 2025.

The number of transactions also climbed 16.9% to 1.2 billion, showing that activity is heating up across multiple chains. Meanwhile, unique stablecoin addresses grew by almost a quarter, reaching 41.7 million. Longer-term data shows how Ethereum and Tron have cemented themselves as the backbone of stablecoin liquidity.

Since late 2023, supply has surged to all-time highs, with Ethereum leading by a wide margin and Tron holding steady as the second-largest base for stablecoins. Emerging players like Arbitrum, Base, Aptos, and TON are gradually carving out slices of the pie, but the market remains overwhelmingly concentrated on Ethereum and Tron, which together anchor a great deal of the $280 billion-plus ecosystem.

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

ETF Expert Says Spot XRP ETF Launching This Week Will Test Investors, Here’s How