Talking about Ethena: USDe Token Economics and ENA Valuation

Author: DMD , Crypto KOL

Compiled by: Felix, PANews

Since the rise of DeFi, it has become clear to crypto market participants that a decentralized, censorship-resistant stablecoin is needed. So far, MakerDAO’s DAI has been in the lead, only temporarily surpassed by UST in terms of market capitalization in 2022.

However, DAI’s overcollateralized model is capital inefficient, and the fees generated by the MakerDAO protocol only go to the DAO, not to stablecoin holders. Ethena Labs’ USDe is an excellent product in many ways, especially considering that USDe investors can earn lucrative returns by productizing futures basis + financing transactions through Ethena.

This article aims to analyze why we believe Ethena’s USDe is destined to surpass DAI as the leading decentralized stablecoin, and examine the current stablecoin landscape, USDe’s token economics, and a valuation and scenario analysis of ENA.

Current Stablecoin Landscape

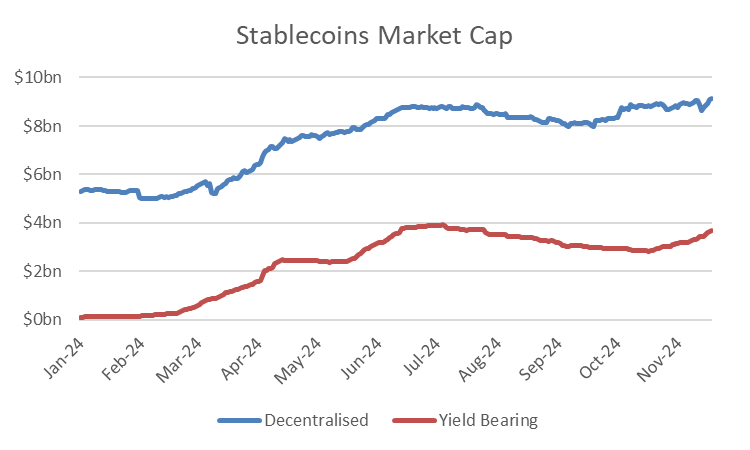

There are a number of important trends happening in the stablecoin space:

- The market share of decentralized stablecoins is increasing: from 4.1% at the beginning of the year to 5% in November

- The market share of yield-generating stablecoins is increasing: from 0.1% at the beginning of the year to 2.1% in November

- These two changes may seem small, but they represent important growth as stablecoins as a whole have grown by more than 40% so far this year to $183 billion.

Ethena's USDe is both a decentralized stablecoin and a yield-based stablecoin. USDe has grown from $85 million at the beginning of the year to $4 billion now.

It is not unreasonable to expect stablecoins to grow to a market cap of $1 trillion by the end of the decade, especially with Trump’s victory and stablecoin regulations expected to be passed as soon as this year. Therefore, Ethena’s growth opportunities are huge.

USDe Token Economics

USDe token economics consists of two parts:

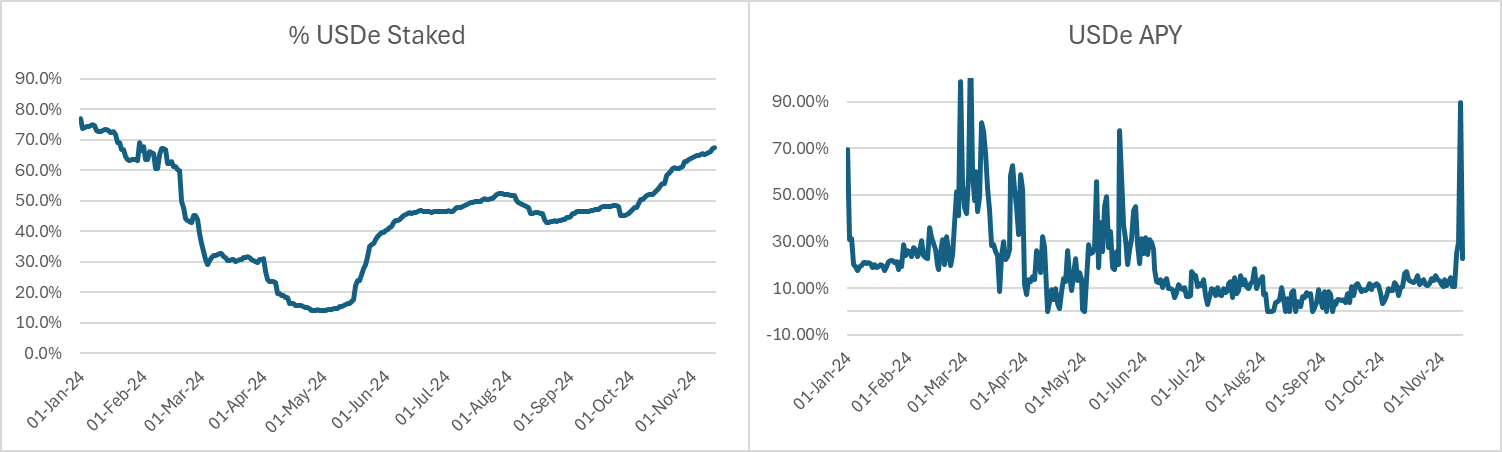

- The income paid to USDe stakers: Based on the total supply of USDe, the pledge ratio, and the income obtained by the Ethena protocol. Data shows that the average income of USDe stakers so far this year is 19.4%, of which about 45% of USDe is pledged.

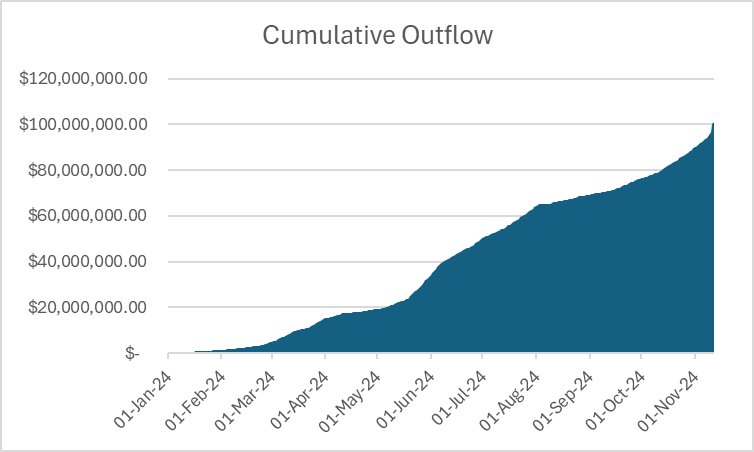

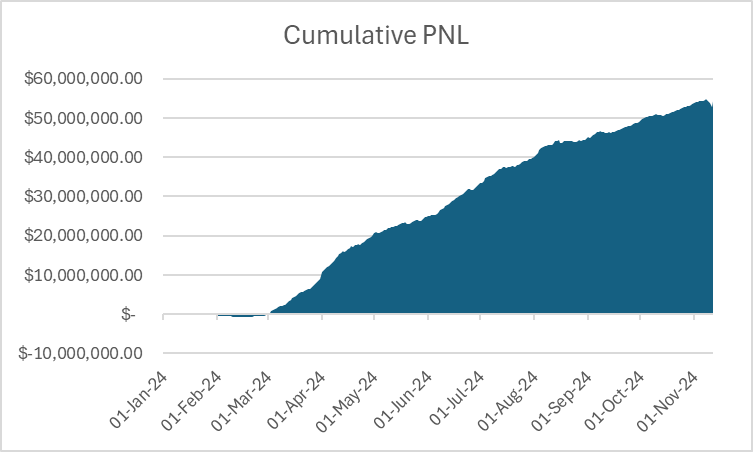

The chart below shows that just over $100 million in yields were paid out to USDe stakers:

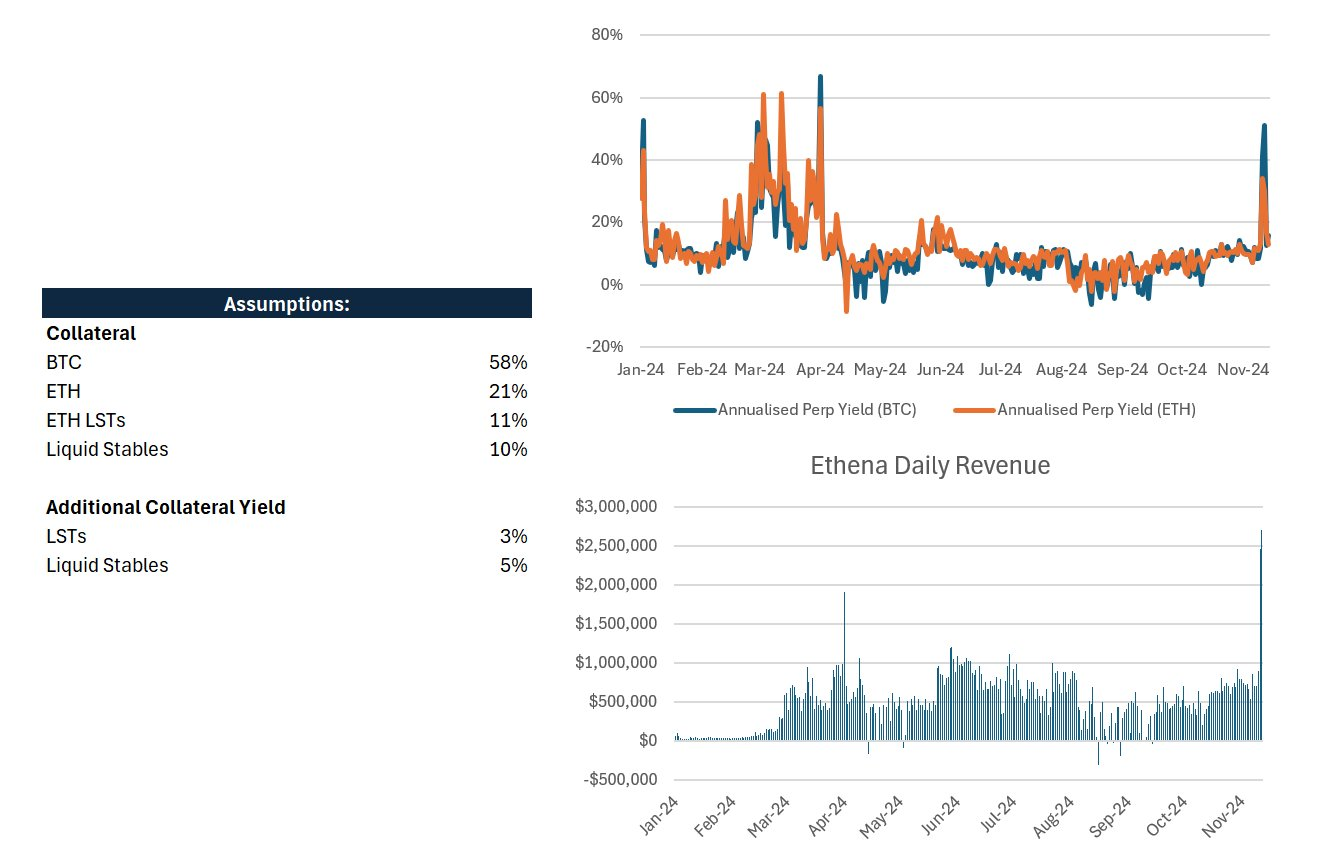

- Collateral yield: When users mint USDe, they deposit one of a variety of other stablecoins. Ethena converts these stablecoins into one of several collaterals and then shorts these collaterals with futures. Therefore, it maintains collateral delta neutrality and earns basis and funding rates at the same time.

Assuming a specific collateral split (see below), and taking the yield on that collateral from Ethena’s dashboard ( https://app.ethena.fi/dashboards/hedging/BTC ), we can deduce the yield the protocol is earning:

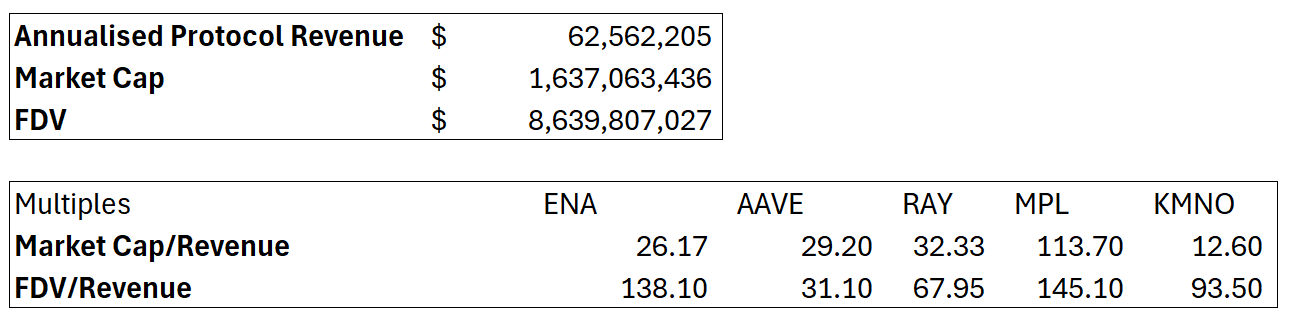

Combining these two points, we can derive the total profit and loss (PNL) of the Ethena protocol: an estimated annualized profit and loss of $62 million:

This makes ENA's MC/revenue multiple 26 times, which is more attractive than some other top DeFi projects (of course not based on FDV, token unlocking is an important obstacle for the project).

ENA Valuation: Scenario Analysis

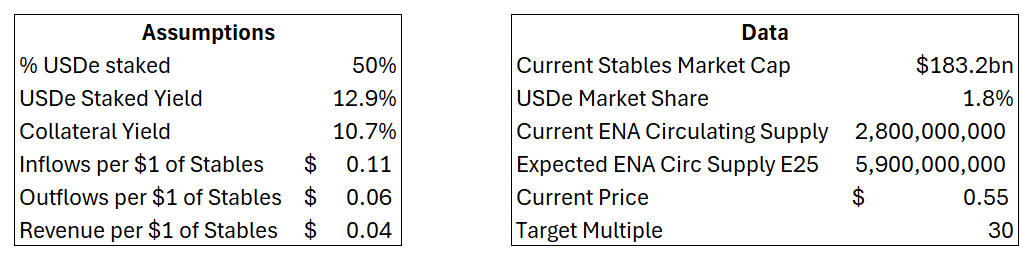

The above leads to some assumptions that can be used to estimate ENA's valuation by the end of next year. These assumptions are important for the analysis that follows.

One thing to note here is that Ethena’s business model relies on a certain percentage of USDe not being staked. This allows them to pay USDe investors more than they earn on collateral while still maintaining an operating income margin of $0.04 per $1 USDe market cap.

Note: The collateral yield is based on the collateral split shown previously and applied to the full year. Actual numbers may therefore differ slightly.

Ethena’s growth is based on two numbers:

- Growth in the total market value of stablecoins

- USDe’s Market Share

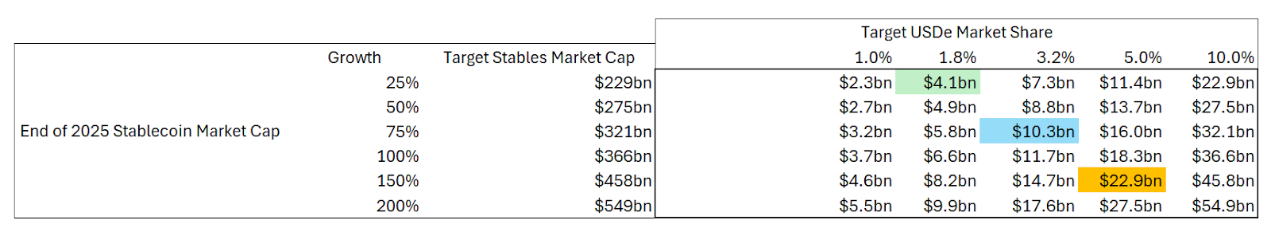

The base case is highlighted in blue: USDe doubles its market share and stablecoins grow 75% over the next year. This estimate is considered quite conservative by the author, and the bullish case (orange) is also very reasonable: USDe grows to 5% market share and total stablecoins grow 150%, bringing USDe's market value to nearly $23 billion. Green represents the bearish case, where USDe's market share does not grow, while the total stablecoin market value grows slightly by 25%.

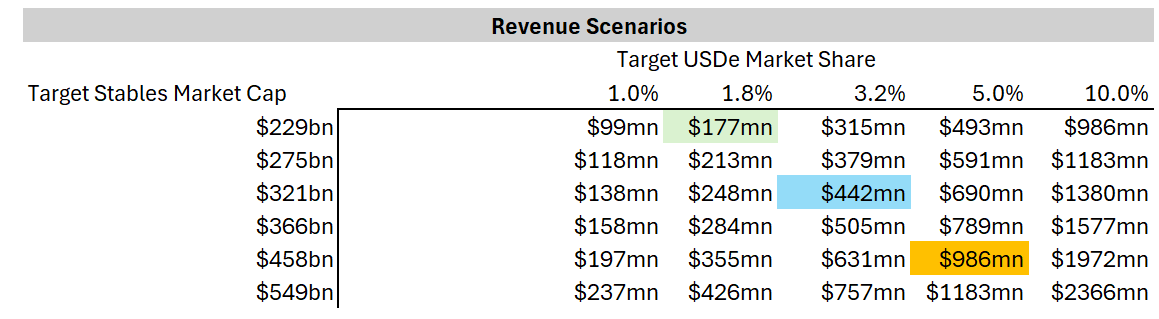

Based on the above assumed revenue margin of $0.04, ENA's revenue for next year would be as follows:

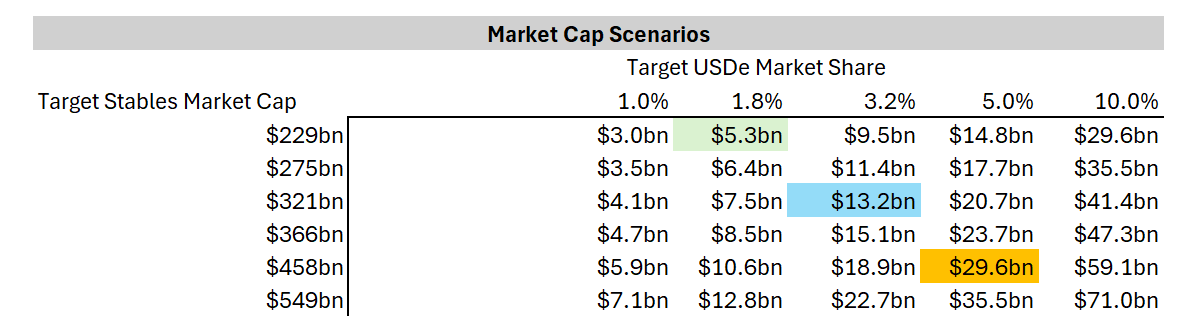

Based on an assumed 30x revenue multiple, we arrive at ENA's market cap in the table below. Note that the author expects 2025 to be a very strong year for crypto assets, with valuations outpacing fundamentals. 30x is only slightly higher than ENA's current multiple of 26x, so the potential upside for the following scenario analysis is much higher:

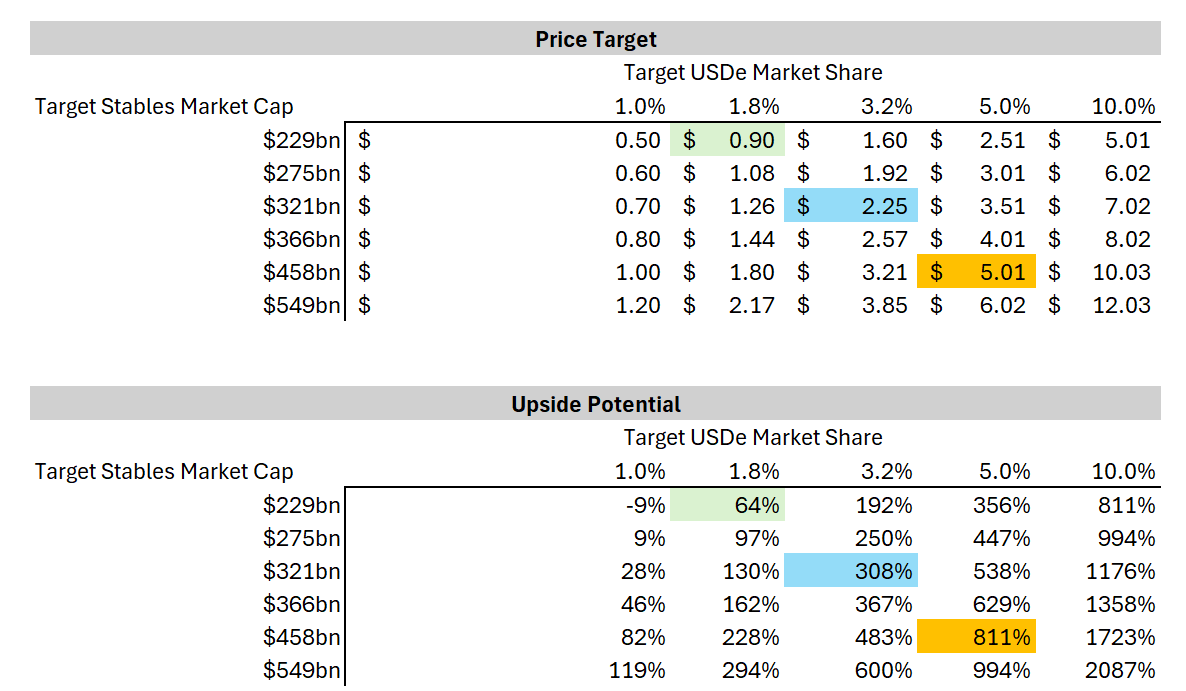

Finally, we can derive price targets and upside potential based on the market cap table and the expected circulating supply of ENA (which will almost double by the end of 2025) (see the previous data table).

in conclusion

The author's base case forecast is that ENA will have a target price of $2.25 by the end of next year, representing a 300% appreciation. The author's optimistic forecast is a target price of $5, representing an over 800% return. The author emphasizes that the 30x price multiple is conservative, and the actual return may be higher.

Ethena is experiencing multiple catalysts that make the author confident about the above scenario:

USDe is added as margin collateral on Deribit:

https://x.com/DeribitExchange/status/1859905540912288192

USDe was added as collateral on Aave, and sUSDe is coming soon:

https://x.com/ethena_labs/status/1857232687326802306

Recent governance proposal, whereby Ethena Labs protocol revenue will be used to benefit the protocol and ENA holders, with more details to be announced by the end of the month:

https://x.com/EthenaFndtn/status/1857470376655385070

Of course, ENA also has some risks, namely protocol-related risks (smart contracts, financing gaps, liquidation risks), but the author believes that the team has considered these issues extensively and will continue to take steps to address them. Finally, while token unlocking is certainly a problem, the author believes that the growth opportunities for Ethena outlined in this article far outweigh the seller pressure of token unlocking.

Expect USDe to surpass DAI, and once that happens, Ethena will continue to grow into one of the most important DeFi protocols in crypto, alongside the likes of Aave, Uniswap, Lido, and Raydium. Both USDe and ENA token holders can benefit from this growth.

Related reading: Business analysis of Ethena: After a 80% drop and rebound, is ENA worth buying?

You May Also Like

Born Again’ Season 3 Way Before Season 2

Pi Network Rolls Out Palm Print Authentication Ahead of Massive Unlock