Solana Price Under Pressure: Extreme Fear Meets Early Signs of Exhaustion

Market conditions are fragile as Solana price trades in a late-stage downtrend with extreme fear, stretched sentiment, and growing scope for sharp countertrend squeezes.

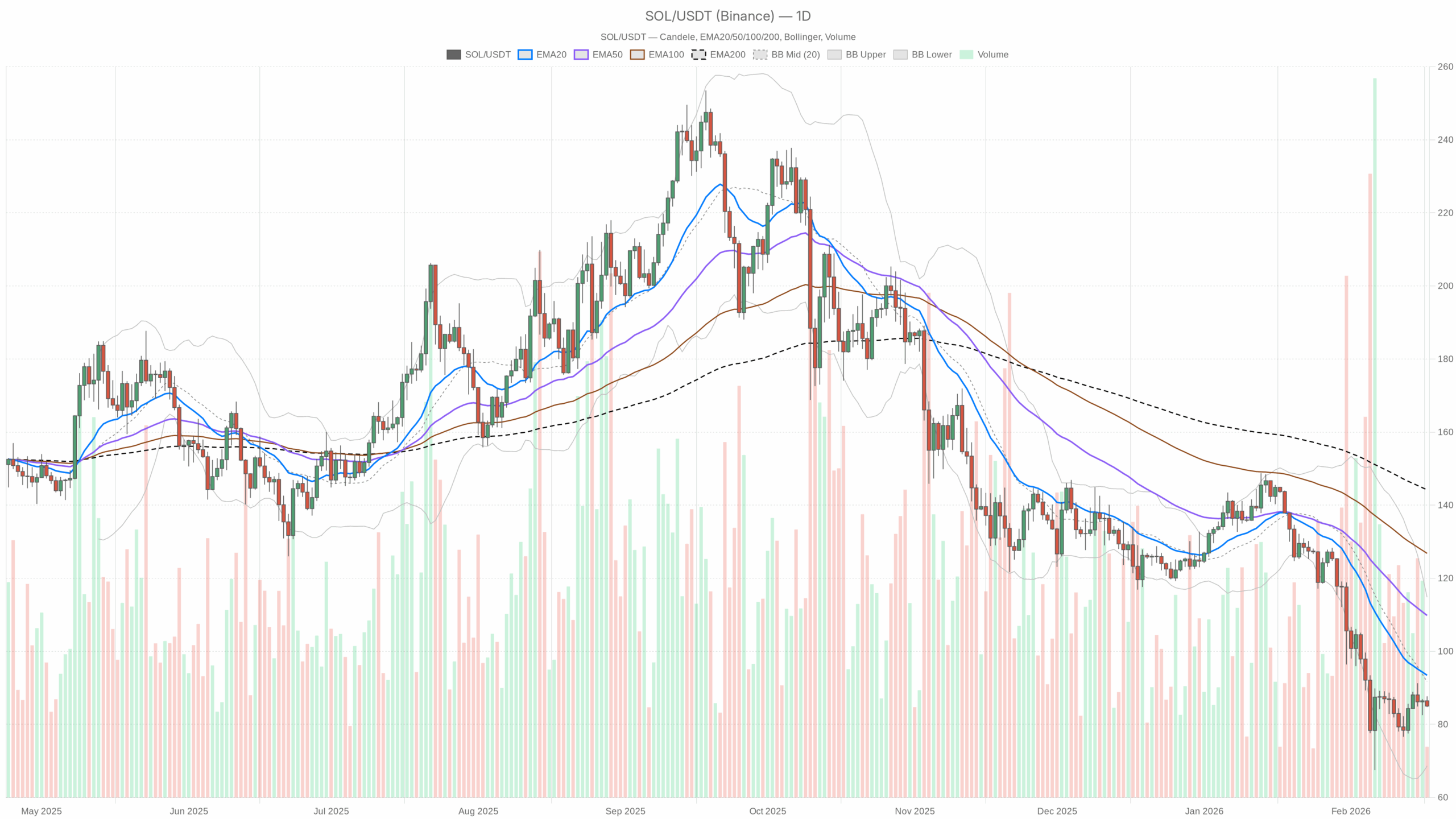

SOL/USDT daily chart with EMA20, EMA50 and volume”

SOL/USDT daily chart with EMA20, EMA50 and volume”

loading=”lazy” />SOL/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

Main Scenario from the Daily Chart: Bearish Bias

The daily timeframe (D1) sets the tone, and here the message is straightforward: the primary regime is bearish.

- Daily close: $85.01

- Regime flag: bearish

- Market backdrop: BTC dominance ~56%, total market cap down ~0.8% 24h, volumes down more than 12%, and sentiment at Extreme Fear.

In plain terms: capital is clustering in Bitcoin, risk appetite is thin, and altcoins like Solana are still in the “sell rallies, not buy dips” bucket on the higher timeframe. Until SOL can reclaim and hold above its key daily moving averages, the path of least resistance remains down or sideways-to-down.

Daily Timeframe (D1): Structure, Momentum, and Volatility

Exponential Moving Averages (EMA) – Trend Still Firmly Down

- EMA 20: $93.44

- EMA 50: $109.81

- EMA 200: $144.20

- Price: $85.01

Price is trading well below the 20, 50, and 200-day EMAs, with a clean bearish stack (price < EMA20 < EMA50 < EMA200). This defines a mature downtrend. Every rally towards the 20-day EMA around the low-90s is, by default, a potential selling zone until that structure is broken.

In human terms: the big money is still positioned on the short and defensive side on the daily. Solana is in “bounce inside a downtrend” territory, not yet in “bottomed and reversing” territory.

RSI (14) – Weak, But Not Yet Washed Out

- RSI 14 (D1): 35.48

Daily RSI is sitting in the low-to-mid 30s, below neutral but not deeply oversold. That tells us momentum is still bearish, but the most aggressive phase of selling may be easing.

Translation: there is room for one more leg down before you hit true capitulation readings, but we are already in a zone where fresh shorts have to be more careful. The downside energy is there, but it is no longer limitless.

MACD – Bearish Phase, Early Signs of Stabilisation

- MACD line: -9.82

- Signal line: -10.94

- Histogram: +1.13

Both MACD line and signal are negative, which is consistent with a downtrend. However, the MACD line is now slightly above the signal line (positive histogram). That usually points to losing downside momentum inside a broader bearish structure.

In other words: the trend is still down, but the selloff is not accelerating anymore. Conditions are ripe for either a consolidation phase or a corrective bounce, not necessarily an immediate trend reversal.

Bollinger Bands – Trading in the Lower Half

- Middle band (20-day basis): $91.71

- Upper band: $114.81

- Lower band: $68.61

- Price: $85.01

Solana is trading below the mid-band and comfortably above the lower band. Prior touches of the lower band (around the high 60s) look like a volatility extreme, and we are now rebounding inside the lower half of the band structure.

Practically: the market has already punished late longs, but it has not yet rewarded dip buyers in a big way. Price is in the repair zone, where you usually either grind sideways or stage a countertrend move back towards the mid-band in the low 90s.

ATR (14) – Elevated but Not Explosive Volatility

- ATR 14 (D1): $7.63

An average true range of about $7.6 against an $85 price tag implies roughly 9% daily swings are normal right now. Volatility is clearly elevated compared with quiet uptrends, but we are not in full capitulation mode.

In plain terms: traders should be prepared for wide intraday ranges and deeper wicks on both sides. Stops that worked in calmer conditions are likely too tight here.

Daily Pivot Levels – Short-Term Map Inside the Downtrend

- Pivot point (PP): $85.82

- Resistance 1 (R1): $86.88

- Support 1 (S1): $83.94

Price is currently sitting slightly below the daily pivot (around $85.8), leaning towards the support side. If SOL keeps trading under the pivot, the intraday bias leans bearish. A push through the pivot and a hold above R1 would hint at a short-term attempt to squeeze higher within the larger downtrend.

For active traders: the pivot gives a nearby line in the sand for intraday sentiment, but it does not override the overall bearish daily structure.

Hourly Timeframe (H1): Neutral Regime, Compressed Around Value

- Close: $85.00

- Regime: neutral

EMAs on H1 – Flat Cluster, No Clear Intraday Trend

- EMA 20: $85.81

- EMA 50: $85.85

- EMA 200: $85.29

On the 1-hour chart, all three EMAs are tightly clustered around the mid-85s, with price only a bit below them. This is classic range behaviour, not a strong intraday trend.

In practice: the market has stopped trending hard down on the hourly and is instead oscillating around a short-term fair value area. It is a digestion phase after the prior drop, and it often precedes a larger move in either direction.

RSI and MACD on H1 – Mildly Weak, Not Broken

- RSI 14 (H1): 42.56

- MACD line: -0.02, Signal: 0.08, Histogram: -0.09

Hourly RSI is slightly below neutral, hinting at a mild bearish lean but nothing extreme. MACD is hovering near zero with a slightly negative histogram, again showing a modest downward bias inside a mostly sideways environment.

Human translation: bears still have the edge on the hourly, but they are not pressing it. It is more of a slow drift lower than an active liquidation wave.

Bollinger Bands and ATR on H1 – Tightish Range

- Bollinger mid: $85.76, upper: $87.48, lower: $84.05

- ATR 14 (H1): $0.90

The bands are not extremely narrow, but they are also not flaring aggressively. Combined with a roughly $0.90 hourly ATR, we are dealing with contained intraday volatility around the mid-80s.

For intraday traders, this is a fade-the-edges environment more than a chase-breakouts one, at least until we see a clear expansion in volatility or a decisive break out of this band structure.

Hourly Pivot – Micro Bias Gauge

- Pivot point (PP): $85.02

- R1: $85.30

- S1: $84.73

Price is sitting almost exactly on the hourly pivot around $85. That reinforces the idea of a neutral, balanced intraday tape. A sustained move below S1 would tilt the short-term flow back to the downside, while reclaiming R1 and holding above it would give bulls some tactical room to push towards the high-80s.

15-Minute Timeframe (M15): Short-Term Weakness for Execution Timing

- Close: $85.00

- Regime: bearish

EMAs on M15 – Micro Downtrend Against a Flat Hourly

- EMA 20: $85.65

- EMA 50: $85.89

- EMA 200: $86.07

On the 15-minute chart, price is clearly below the short, medium, and long intraday EMAs, all sloping down. That is a micro downtrend nested inside a neutral hourly range and a bearish daily trend.

Execution-wise: this favours short entries on bounces into the M15 EMAs if you are trading with the broader daily bias, but it does so within an environment where the hourly is not in strong trend mode. That raises whipsaw risk for overly aggressive intraday traders.

RSI and MACD on M15 – Near-Term Oversold Lean

- RSI 14 (M15): 30.9

- MACD line: -0.34, Signal: -0.24, Histogram: -0.10

RSI on 15 minutes is hovering just above the oversold threshold, and MACD is negative with a negative histogram. Short-term momentum is clearly pointing down.

In simple terms: the very short-term window is weak and stretched. Chasing new shorts at these levels on a 15-minute basis is late; the better entry is usually after a bounce back towards the intraday moving averages.

Bollinger Bands and ATR on M15 – Micro Volatility Pockets

- Bollinger mid: $85.81, upper: $86.88, lower: $84.74

- ATR 14 (M15): $0.35

Price is trading closer to the lower band, in line with the short-term oversold reading. With a modest $0.35 ATR, the market is allowing for small but frequent flicks within the tighter band. Expect quick intraday reversions rather than smooth trends on this timeframe.

15-Minute Pivot – Very Tight Intraday Levels

- Pivot point (PP): $85.04

- R1: $85.10

- S1: $84.95

Price is sitting just under the 15-minute pivot, and the R1 and S1 range is extremely tight. This reflects a short-term battle at the margin. For execution, these levels are more noise than structure, but they can matter for very short-term scalps.

Macro and On-Chain Context for Solana

Solana’s share of total crypto market cap is around 2.0%, with SOL-related DeFi venues like Raydium, Orca, Meteora, and BisonFi all showing pullbacks in fee generation over the last 7–30 days, with a couple of exceptions on BisonFi and Orca on a 30-day basis. Fee compression on major Solana DeFi protocols usually lines up with lower on-chain activity and less speculative leverage, consistent with the current risk-off sentiment.

In combination with Extreme Fear readings, this tells you participation is low and traders are defensive. That is exactly the kind of backdrop where big moves can emerge from relatively small flows, both to the downside, if liquidity thins out, and to the upside, if short positioning is crowded.

Solana Price Scenarios

Bullish Scenario for SOLUSDT

The bullish case is a countertrend rally inside a broader downtrend, not a full-blown reversal, at least not yet.

For bulls to gain traction:

- Hold above or reclaim the daily pivot around $85.8 and avoid a clean break of S1 at $83.9.

- Hourly EMAs flip to support, price needs to get back above the H1 20, 50, and 200 cluster around $85.8–$86 and stay there.

- Push towards the daily Bollinger mid-band at about $91.7, ideally turning that into a consolidation zone rather than immediate rejection.

- RSI on the daily climbs back above the 45–50 zone, showing momentum is shifting from weak downtrend to more balanced conditions.

In this scenario, Solana price could stage a squeeze towards the low-to-mid 90s first, and if the broader market stabilises, potentially extend towards the psychological $100 area where the declining 50-day EMA, near $110, would be the next big test.

What invalidates the bullish scenario?

A decisive daily close below $84 that is followed by continued weakness into the low 80s would undercut the idea of an immediate relief rally. A rollover of the hourly chart back into a clean downtrend, with price pinned under all H1 EMAs with RSI sub-40 and expanding negative MACD, would also signal that bears have reasserted control.

Bearish Scenario for SOLUSDT

The bearish case is a continuation of the higher timeframe downtrend, with the current pause resolving lower.

For bears to stay in charge:

- Maintain price under the daily 20 EMA, near $93.4. Every push into the low 90s that gets sold is a confirmation that the longer-term trend is still down.

- Break and close below daily S1 around $83.9, converting that area into resistance on retests.

- See RSI stuck in the 30–40 band on the daily, showing persistent downside bias without a strong mean reversion.

- MACD on daily rolls back with a growing negative histogram, the current mild improvement fades and the lines diverge again.

Under this path, Solana price can revisit the lower Bollinger area in the low 70s and potentially probe towards the prior extremes near the high 60s, around the lower band at about $68.6. In an environment of extreme fear and falling volumes, slippage and air pockets lower are very possible if bids thin out.

What invalidates the bearish scenario?

A clean daily close back above $95, comfortably over the 20-day EMA, followed by continuation rather than immediate rejection would weaken the bearish narrative. If that move comes with daily RSI reclaiming 50 and MACD crossing into positive territory, the character of the trend shifts from downtrend to at least sideways, if not early accumulation.

Neutral and Indecision Scenario

There is a real risk that neither side wins quickly and Solana simply ranges between roughly $80 and $95, digesting the prior selloff.

In that case:

- The daily trend stays technically bearish, with EMAs above price, but momentum indicators remain mixed and non-committal.

- Hourly EMAs keep clustering around mid-range and act as a mean-reversion magnet.

- Bollinger Bands slowly contract, signalling volatility compression ahead of the next large move.

This is the kind of environment where swing traders often get chopped up, and where patience usually pays more than aggressive positioning.

Positioning, Risk, and Uncertainty

Right now, Solana is caught between structural bearishness on the daily and early signs of selling fatigue on the lower timeframes. The tape is not screaming capitulation bottom, but it is far from a clean, orderly downtrend as well.

For participants thinking in terms of risk:

- Volatility is elevated, with daily ATR around $7.6, so position sizing has to account for wide swings.

- Sentiment is extreme, and fear at these levels can fuel both panic flushes and violent short squeezes.

- Timeframe conflict matters: daily says respect the downtrend, hourly says we are consolidating, and 15-minute data says near-term stretched. Entries and exits that ignore this hierarchy are more exposed to whipsaws.

In short, Solana price is still in a downtrend, but that downtrend is aging. Bears remain in control on the higher timeframe, yet they are no longer unchallenged. Traders need to decide whether they are playing the macro trend, fading rallies, or the micro exhaustion, fading extremes within the range, and then size their risk accordingly in a market that is fearful, thin, and volatile.

You May Also Like

The DDC Group and MindMap Digital Announce Strategic Partnership

Bitcoin 8% Gains Already Make September 2025 Its Second Best