Over $321M in Token Unlocks Set for ZRO, ARB, SOL, and DOGE This Week

- This week’s biggest cliff unlocks will be by Kanye West’s YZY token which will release 17% of its supply, while Kaito releases 10%.

- The largest linear unlock will be by RIVER at 6.4%, but RAIN’s 9.46 billion token unlock will have the highest dollar value at $93.46 million.

It’s yet another week when over $300 million will hit the market in new tokens released via cliff and linear token unlocks. As CNF reported, the first week of February saw $400 million worth of tokens unlocked, with HYPE’s $304 million topping the charts. The second week welcomed $278 million, with Avalanche and Aptos as the main culprits.

This week, around $320 million will hit the market in both linear and cliff unlocks, adding supply pressure to a struggling market. The sector has lost over $100 billion in the past 24 hours for a $2.34 trillion market cap, with some like XRP, Dogecoin and Monero losing over 10% of their value.

According to the Tokenomist, cliff unlocks will amount to $109.8 million this week. LayerZero’s ZRO will add the highest dollar value to the market this week, releasing 12.7% of its circulating supply, currently valued at $43.2 million.

The unlock comes at a time when the token has been getting battered. In the past 24 hours, it has shed 11% of its value to trade at $1.66 at press time for a $497 million market cap. It’s currently trading 78% below its all-time high, which it hit at the end of 2024, at $7.52.

Its current circulating supply is 298 million, but its maximum supply is set at one billion tokens; the 26 million tokens entering the market this week are one of many scheduled unlocks as the project aims to have the 700 million locked tokens finally released.

YZY, ARB, KAITO Unlocks

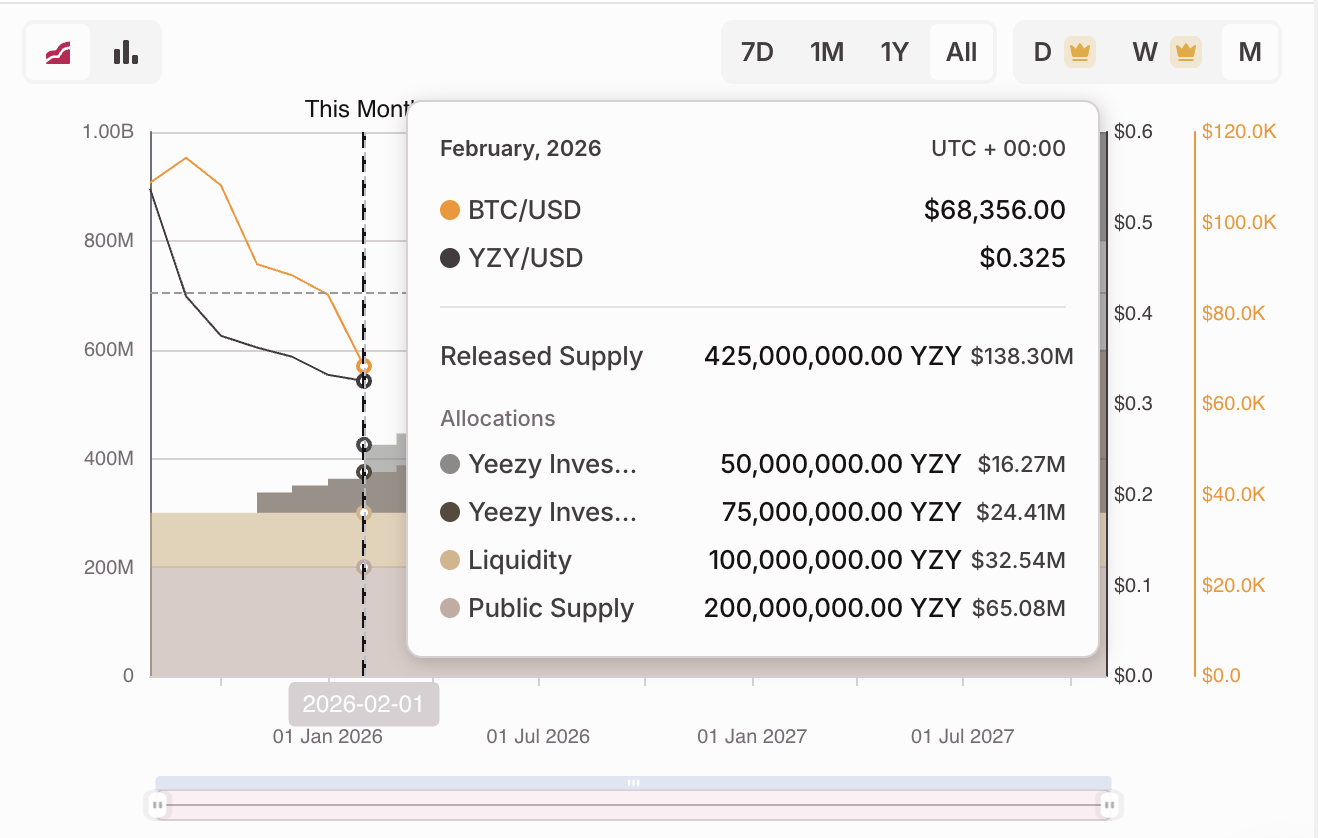

YZY, the Solana-based token tied to Ye, formerly known as Kanye West, has the second-largest unlock by dollar value, releasing $20.34 million into the market. However, it tops the charts for tokens released compared to circulating supply at 17%. YZY’s 62.5 million released tokens will bring the circulating supply to 362.5 million tokens, with the hard cap set at one billion tokens.

Image courtesy of Tokenomist.

Image courtesy of Tokenomist.

YZY trades at $0.3258, dipping slightly in the past day. Since its spike to $0.83 at launch, it has been steadily losing its value. At launch, the token was accused by one blockchain analytics firm of rug-pulling investors, with 11 wallets making all the money as retail lost millions of dollars.

Arbitrum and Kaito are the other notable linear unlocks this week. ARB worth $10.52 million, or 1.6% of its circulating supply, will enter the market, while $10.08 million in KAITO, amounting to 13.5% of the supply will be released.

On the linear side, BTC continues to dominate, with miners earning new tokens worth $35 million today alone. RAIN’s $13.2 million and SOL’s $5.78 million are the other big releases today.

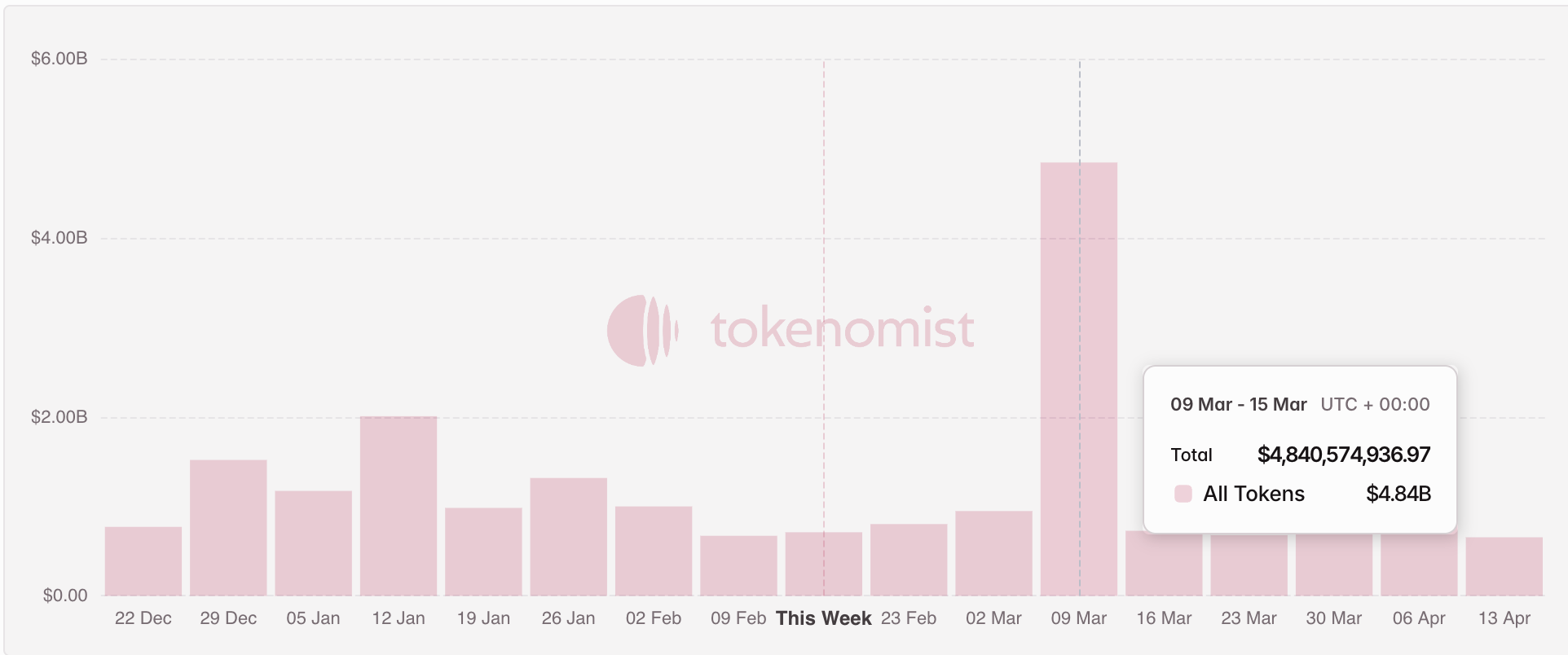

Cumulatively, $711 million will enter the market this week from both linear and cliff unlocks. This will be the lowest amount in unlocks for the next four weeks. The headline maker is the week of March 9, where $4.84 billion will hit the market.

Image courtesy of Tokenomist. ]]>

Image courtesy of Tokenomist. ]]>You May Also Like

Trump adviser demands Fed economists be 'disciplined' for arguing with presidential tactic

Trump admin appeals after judge orders slavery exhibit returned to Philadelphia museum