Why is the Crypto Market Up Today? BTC, ETH, XRP, SOL is Up as Inflation Cools

The post Why is the Crypto Market Up Today? BTC, ETH, XRP, SOL is Up as Inflation Cools appeared first on Coinpedia Fintech News

The cryptocurrency market is flashing bright green today ahead of Valentine’s Day on Friday, February 13th, as a wave of bullish sentiment sweeps through the digital asset ecosystem. Total market capitalization has surged as investors react to favorable macroeconomic data and a massive squeeze of short positions.

Here is a breakdown of why the crypto market is rallying today:

US CPI Data Comes in Cooler Than Expected

The primary catalyst for today’s rally is the latest Consumer Price Index (CPI) report from the US Bureau of Labor Statistics (BLS). Annual inflation in the US declined to 2.4% in January, down from 2.7% in December.

Crucially, this figure came in below the market expectation of 2.5%. This “cool” inflation print has fueled hopes that the Federal Reserve may lean toward more dovish monetary policies or potential rate cuts later this year.

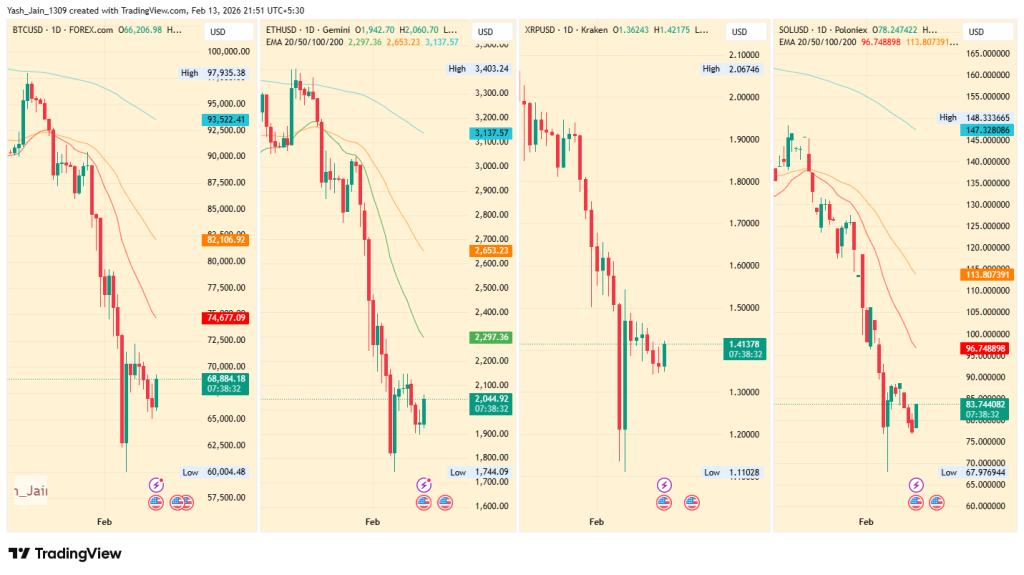

Bitcoin Leads the Charge, Altcoins Follow

In response to the CPI news, Bitcoin (BTC) surged by 4% today, breaking through key resistance levels and stabilizing the broader market. This upward momentum immediately spilled over into the altcoin sector:

Ethereum (ETH) outperformed the leader with a 6% jump.

Solana (SOL) remains a top performer, rising 6.50%.

XRP showed strong recovery, posting a 5% gain.

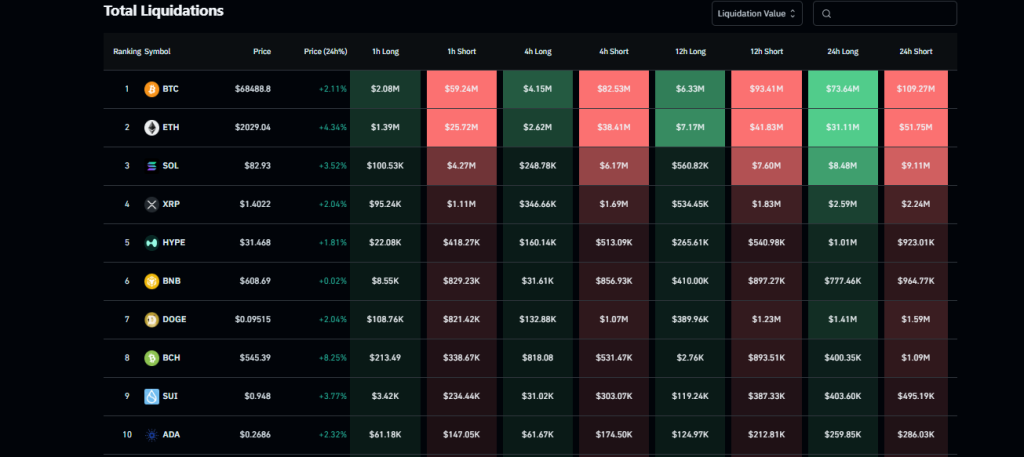

Short Sellers Get “Rekt”: $365 Million in Liquidations

The rapid price spike caught many bearish traders off guard. According to data from Coinglass, the total 24-hour liquidations across the crypto market reached a staggering $365.81 million.

The rally was largely fueled by a “short squeeze,” as traders betting on a price drop were forced to buy back their positions. Of the total liquidations, $202.30 million were short positions.

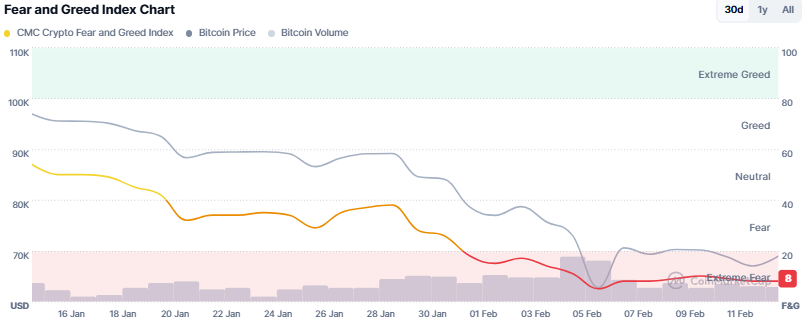

Market Sentiment Hasn’t Shifted to “Greed” Yet

With the inflation bogeyman appearing to recede and institutional inflows continuing to steady the ship, the Crypto Fear & Greed Index could take a breath of relief sooner. However, for now, it’s still at 8 into the deeper fear zone, but rising demand in the short term could show a bounce towards the neutral area, because the “Greed” territory is far from reach until a long-term confirmation is received. Heavy liquidations by short sellers have cleared the path for further upside today, as there is now less immediate sell pressure from over-leveraged bears.

What’s Next?

As we head into the weekend, analysts are watching to see if Bitcoin can flip its current local high into a permanent support floor. If the macro environment remains stable and the “cooling inflation” narrative persists, the crypto market may be looking at a sustained bullish trend for the remainder of February.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Undeniable Synergy: How Guest Posting Fuels SEO, & Backlinks Power