Ethereum’s Tokenization Boom Sparks $5,000 Speculation—Is an ETH Price Breakout Incoming?

The post Ethereum’s Tokenization Boom Sparks $5,000 Speculation—Is an ETH Price Breakout Incoming? appeared first on Coinpedia Fintech News

Ethereum may not be making daily headlines, but its long-term story is getting stronger. While short-term price swings continue to test investor patience, the broader foundation beneath ETH appears to be quietly improving.

Beyond speculation and hype cycles, Ethereum is increasingly becoming the infrastructure layer for tokenized finance. At the same time, the weekly chart shows the ETH price retesting a major macro support zone, a level that has historically acted as a launchpad for strong upside moves.

With fundamentals strengthening and technical structure holding, could Ethereum price be setting up for a larger breakout toward $5,000?

Ethereum’s Growing Role in Tokenized Finance

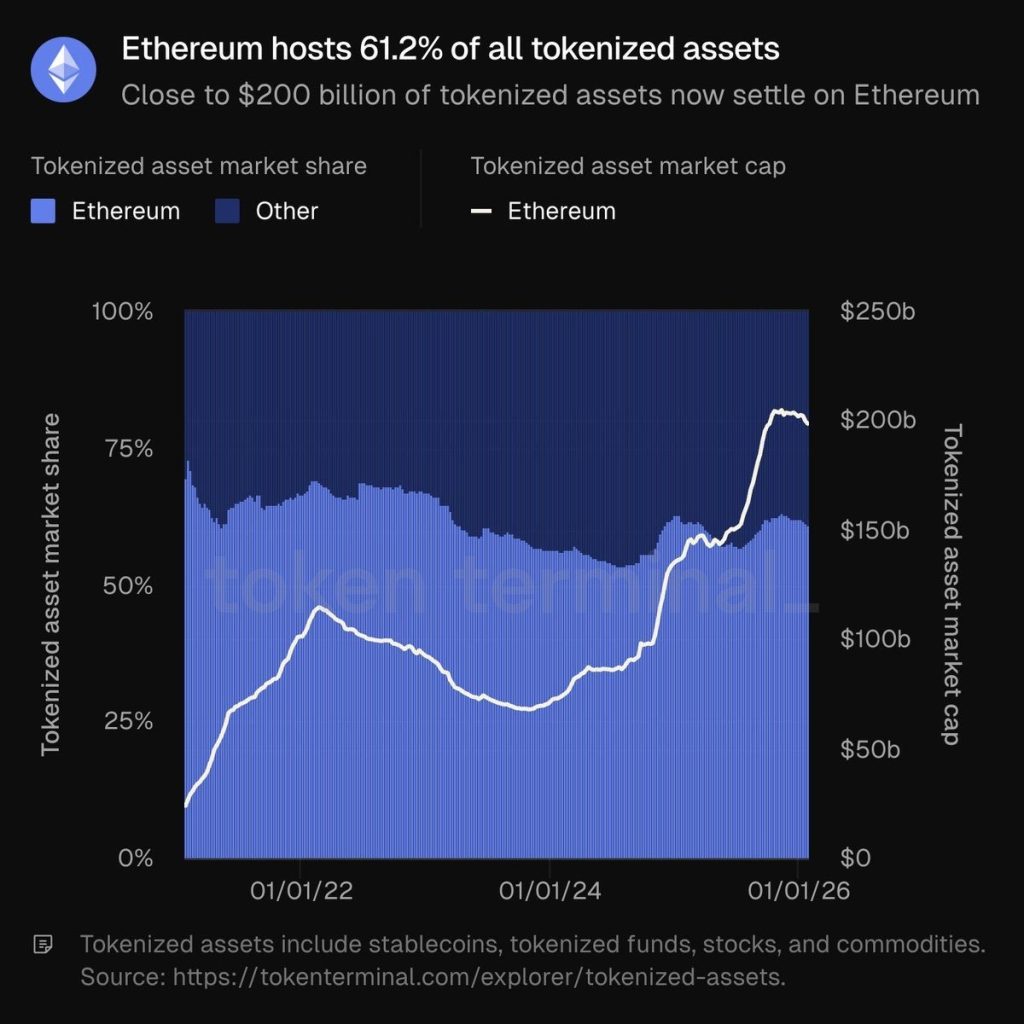

Ethereum now hosts more than 60% of all tokenized assets, with nearly $200 billion already settled on the network. That’s not just a DeFi statistic—it reflects real capital moving on-chain.

When institutions explore tokenizing real-world assets such as funds, bonds, or structured products, Ethereum continues to be the preferred base layer. Its established infrastructure, liquidity, and security track record give institutions confidence.

Source: X

Source: X

As tokenisation gains global traction, Ethereum stands to benefit from increased settlement activity and sustained on-chain demand. Instead of being viewed purely as a speculative asset, ETH is increasingly tied to real financial infrastructure.

ETH Weekly Chart Points to a Possible $7,000 Target

On the technical side, Ethereum price is currently retesting the lower boundary of a multi-year ascending channel on the weekly chart. In previous cycles, similar pullbacks toward this trendline formed higher lows, followed by significant rallies. The structure remains intact for now, suggesting that the broader uptrend has not been broken.

If ETH holds this macro support and begins climbing back toward the upper boundary of the channel, a breakout could open the door toward the $7,000 region. This target is derived from the projected move of the channel structure. This bullish setup depends on defending the current support. A confirmed breakdown below the channel base would weaken the macro outlook and delay any breakout scenario.

Conclusion

Ethereum’s leadership in tokenized assets strengthens its long-term narrative, especially as institutions increasingly settle value on-chain. At the same time, the weekly chart shows ETH sitting at a critical structural level within its broader uptrend.

If buyers step in and push the price higher from this zone, the path toward $7,000 becomes technically realistic. But for now, Ethereum must first prove that this macro support can hold. The next move could define whether ETH is simply consolidating or preparing for its next major expansion phase.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Undeniable Synergy: How Guest Posting Fuels SEO, & Backlinks Power