$1.9 Billion Pulled From Bitcoin and Ether ETFs in 4 Days as Outflow Streak Hits Hard

Bitcoin ETFs lost $312 million and ether ETFs shed $240 million on Wednesday, extending the heavy outflow streak to a fourth consecutive day. In total, crypto ETFs have now seen $1.9 billion leave over the past four trading sessions.

Bitcoin ETFs See $312 Million Exit, Ether Funds Lose $240 Million in Relentless Selloff

The selloff in crypto exchange-traded funds (ETFs) is showing no signs of slowing. For the fourth day in a row, both bitcoin and ether funds bled capital, with a combined $552 million flowing out on Wednesday, Aug. 20, alone. Investors, spooked by macro headwinds and risk-off sentiment, are now driving one of the heaviest weekly ETF outflow streaks in months.

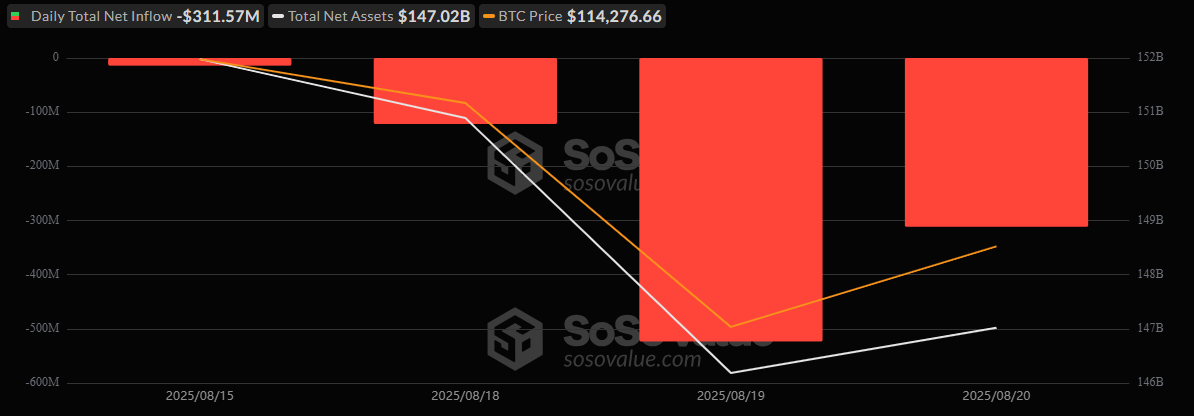

Bitcoin ETFs recorded $311.57 million in net outflows. Institutional favorite, Blackrock’s IBIT was hit hardest, losing $220 million in a single session. Ark 21Shares’ ARKB followed with a $75.74 million exit, while Grayscale’s GBTC and Fidelity’s FBTC shed $8.98 million and $7.46 million, respectively.

Only Bitwise’s BITB managed to post a marginal inflow of $619.81K, barely denting the sea of red. Trading remained active at $3.44 billion, but net assets steadied at $147.02 billion.

Source: Sosovalue

Source: Sosovalue

Ether ETFs were not spared. They logged $240.14 million in outflows, led by a massive $257.78 million loss on Blackrock’s ETHA. Some relief came from inflows into Grayscale’s Ether Mini Trust (+$9 million) and Fidelity’s FETH (+$8.64 million), but it wasn’t enough to offset the damage. Trading volumes stood at $2.65 billion, with net assets at $26.86 billion.

In just four days, the damage has piled up. Together, bitcoin and ether ETFs have seen a staggering $1.9 billion in capital outflows, underscoring a sharp shift in investor sentiment after weeks of historic inflows.

You May Also Like

XRP Ledger Unlocks Permissioned Domains With 91% Validator Backing

Music body ICMP laments “wilful” theft of artists’ work