Monero Price Whipsaws After Channel Break: Breakout Failure or Strategic Liquidity Sweep?

The post Monero Price Whipsaws After Channel Break: Breakout Failure or Strategic Liquidity Sweep? appeared first on Coinpedia Fintech News

Monero price has delivered one of the sharpest technical whipsaws in the market this week. After breaking out of a rising channel and triggering bullish momentum, XMR quickly reversed, wiping out breakout buyers before stabilizing with a 5% rebound today. The broader crypto market remains fragile, yet Monero’s structure now sits at a critical decision point. The question traders are asking is simple: Was that breakdown a trap, or the beginning of a deeper correction?

Monero Price Breakout Fades Into Liquidity Rotation: What’s Next?

For several weeks, Monero price respected a rising parallel channel, steadily printing higher highs and higher lows. The breakout above channel resistance initially signaled bullish continuation, with upside targets projected toward the $380–$400 region based on measured move logic. However, follow-through buying never expanded meaningfully. Instead, price stalled above resistance, then sharply broke back inside the channel before slicing below short-term support. That sequence of breakout, rejection, breakdown fits the classic liquidity sweep pattern. Momentum traders entered on breakout confirmation, only to see the move reverse as leveraged positions were forced out.

The decline pushed XMR toward the $340–$350 demand zone, where previous consolidation had occurred. Long lower wicks on recent candles indicate dip absorption rather than panic distribution. Structurally, price remains above the broader ascending trendline from late last year, meaning the higher-timeframe trend is stressed but not invalidated. Immediate resistance now sits around $360–$365. A decisive reclaim of that level would re-establish short-term bullish structure, while failure could keep Monero trapped in a volatility compression phase.

XMR’s Market Positioning Realigns After the Breakdown

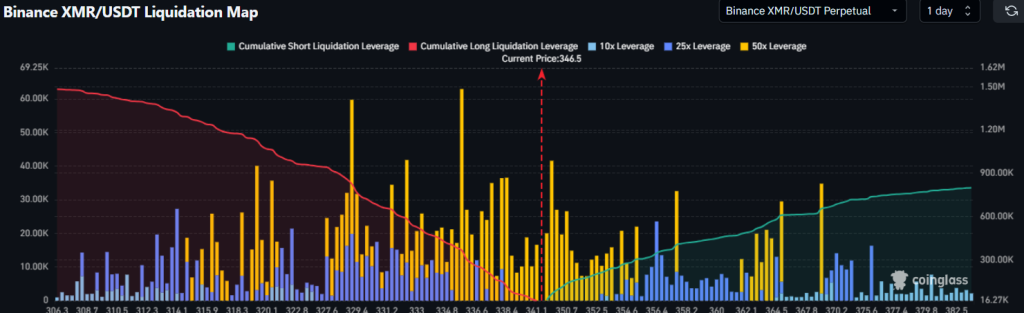

Derivative positioning data reinforces the idea that this move was leverage-driven. The Binance XMR/USDT liquidation map shows dense liquidation clusters between $340 and $355, where cumulative long liquidations spiked sharply. The heavy concentration of 25x and 50x leveraged positions in that region suggests the drop was engineered through forced unwinds rather than organic spot selling. Below $340, liquidation intensity declines, indicating less leveraged exposure deeper down. This typically reduces cascade risk unless fresh short positions accumulate aggressively.

Open interest behavior further supports this interpretation. During the breakdown, OI contracted rather than expanded, signaling long liquidations instead of new short buildup. That dynamic often marks a positioning reset instead of trend reversal. Spot flows appear relatively neutral, with no evidence of sustained exchange inflows that would imply large-scale distribution. Instead, the volatility spike aligns with derivatives-driven activity rather than heavy spot market exits.

Final Thoughts

Monero price now trades in a narrow corridor between $340 support and $365 resistance. The broader crypto market remains cautious, with sentiment oscillating between defensive and opportunistic as Bitcoin consolidates. If XMR reclaims $365 with expanding volume and rising open interest driven by fresh longs rather than forced covering, momentum could rebuild toward $390 and potentially $410 in extension. A sustained break below $340, however, would expose the $315–$325 region, where larger historical demand sits.

At present, the evidence leans toward a liquidity event rather than structural breakdown. The next directional move will likely depend on whether bulls can convert today’s rebound into a higher low formation. Until then, Monero remains in a volatility reset phase, not a confirmed trend reversal.

You May Also Like

SEC Clears Path for ‘Waves’ of Crypto ETFs With New Listing Standards

royalwelt.com Reinforces Platform Reliability Measures Amid Heightened Global Market Volatility

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more