Markets and Crypto Eye Policy Reforms As Japan’s Sanae Takaichi Secures Historic Victory

Japan’s Prime Minister Sanae Takaichi, often dubbed the country’s “Iron Lady,” has secured a historic landslide victory in the February 8, 2026, snap parliamentary elections. Her Liberal Democratic Party (LDP) is projected to win between 274 and 326 of the 465 seats in the lower house, marking the largest post-war electoral margin for any Japanese party.

The decisive result consolidates Takaichi’s authority and positions her to pursue ambitious economic and regulatory reforms.

Japan’s Sanae Takaichi Secures Landslide Win, Sets Stage for Crypto Tax Reform

Markets reacted swiftly to the outcome. The dollar/yen climbed 0.2% to 157, while the BTC/JPY trading pair rose almost 5%, signaling investor confidence in Takaichi’s pro-growth agenda.

USD/JPY and BTC/JPY Price Performance. Source: TradingView

USD/JPY and BTC/JPY Price Performance. Source: TradingView

This so-called “Takaichi trade” draws momentum from expectations of fiscal stimulus, loose monetary policy, and increased liquidity.

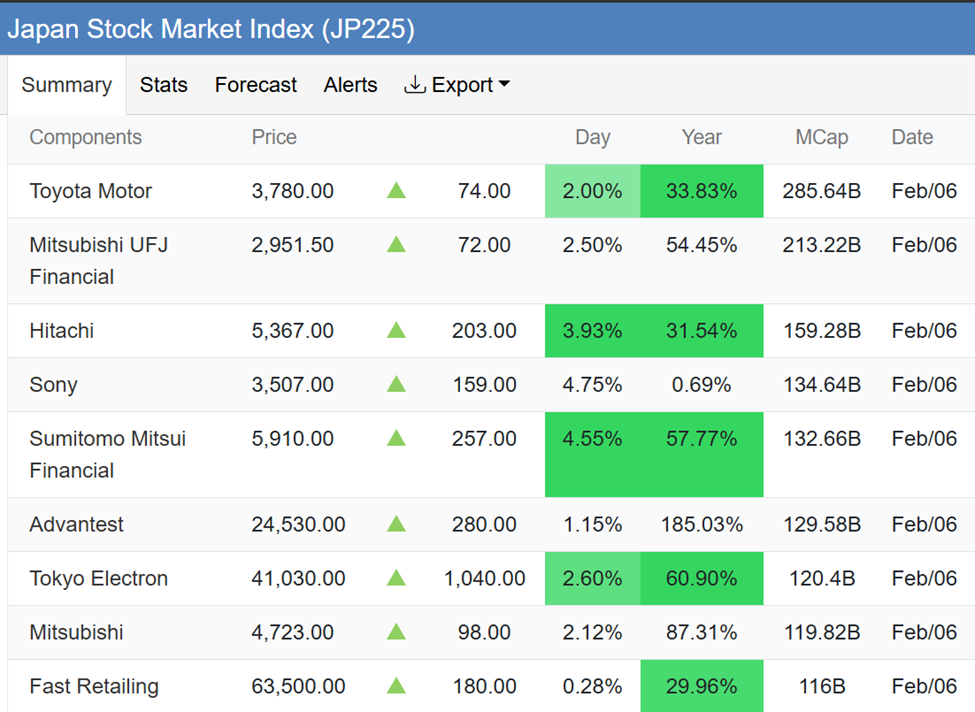

It has already lifted Japanese equities to record highs, while government bonds and the yen have faced pressure.

Japanese Equities Performance. Source: Trading Economics

Japanese Equities Performance. Source: Trading Economics

US officials quickly weighed in on the result, with Treasury Secretary Scott Bessent calling the victory “historic” and emphasizing the strength of US-Japan relations under Takaichi’s leadership.

Days before, President Donald Trump also offered a full endorsement, highlighting her leadership qualities and recent trade and security successes.

In turn, Takaichi expressed gratitude, reaffirming plans to visit the White House in spring 2026 and describing the US-Japan alliance as having “unlimited potential” built on deep trust and cooperation.

Takaichi’s Mandate Signals Potential Crypto Tax Overhaul and Blockchain-Friendly Policies

Takaichi’s electoral mandate is widely seen as a green light to accelerate Japan’s crypto reforms. The country currently taxes crypto gains as miscellaneous income at rates up to 55%.

This framework has driven some investors abroad despite Japan’s leading position in blockchain adoption.

Under discussion for fiscal year 2026 are reforms that could:

- Reduce gains tax to around 20%

- Allow loss carryforwards for three years, andReclassify certain digital assets as financial products.

The general sentiment is that her pro-growth policies and willingness to collaborate with crypto-friendly opposition parties, such as the Japan Innovation Party and the Democratic Party for the People, could finally push these long-awaited measures through by 2028.

Earlier in her tenure, Takaichi endorsed policies supporting technology, innovation, and economic security, aligning with broader blockchain and Web3 development.

While she has not made crypto a central campaign issue, her aggressive fiscal stance, modeled after her mentor Shinzo Abe’s “Abenomics,” could create an economic environment that favors risk assets, including Bitcoin, Ethereum, and Japan-related digital projects.

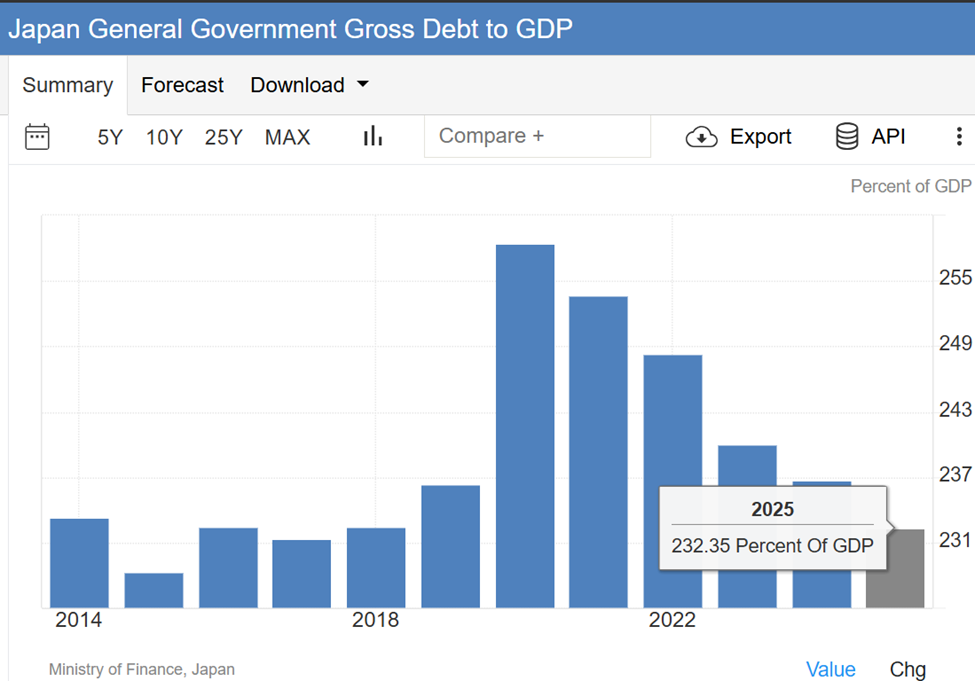

Indeed, uncertainties remain. Japan’s national debt exceeds 250% of GDP after topping out at 232.35% in 2025. Meanwhile, recent spikes in government bond yields have raised investor concerns about fiscal sustainability.

Japan General Government Gross Debt to GDP. Source: Trading Economics

Japan General Government Gross Debt to GDP. Source: Trading Economics

Key cabinet appointments and regulatory priorities will be critical in shaping the pace and scope of crypto reform. Finance Minister Katsunobu Kato’s continued role could maintain policy continuity, though his limited engagement on crypto issues may temper ambitious changes.

Digital Minister Masaki Taira has yet to articulate specific positions on crypto or Web3.

Nevertheless, the Financial Services Agency’s ongoing proposals, combined with Takaichi’s strong political mandate, suggest a turning point for Japan’s digital asset sector.

If successful, reforms could provide clearer regulatory frameworks, tax relief, and legal recognition for crypto, laying the groundwork for a more innovation-friendly ecosystem.

You May Also Like

SEC approves generic listing standards, paving way for rapid crypto ETF launches

Quantum Computing Crypto Threat Is Exaggerated: CoinShares Reveals Sobering Reality