Why Is Bitcoin Crashing Today? Analysts Say Synthetic BTC Supply Is the Real Problem

The post Why Is Bitcoin Crashing Today? Analysts Say Synthetic BTC Supply Is the Real Problem appeared first on Coinpedia Fintech News

Bitcoin briefly crashed toward $60,000 on February 6, wiping out over $2.6 billion in leveraged positions in 24 hours. That makes it the worst single-day drop since the FTX collapse in November 2022. Most outlets are blaming macro pressure and weak sentiment.

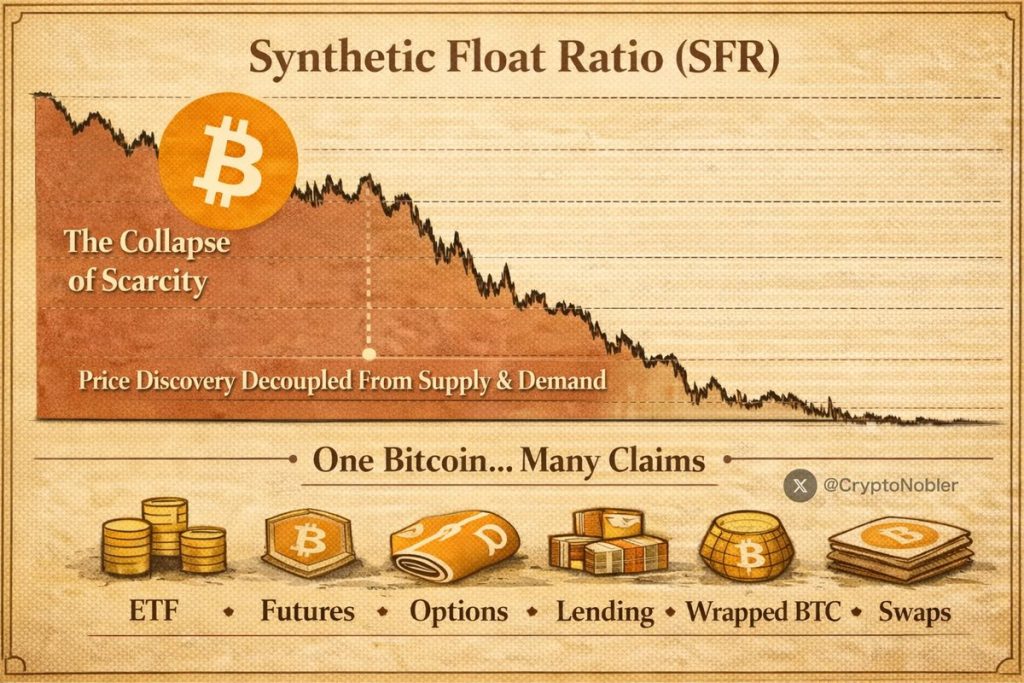

But DeFi researcher CryptoNobler says the real issue is structural, and it has been building for months.

According to CryptoNobler, Bitcoin no longer trades like a supply-and-demand asset. Derivatives have taken over price discovery entirely.

What Happened to Bitcoin’s 21 Million Hard Cap?

The hard cap still exists on-chain. But Bitcoin’s original value proposition relied on two things: fixed supply and no rehypothecation.

That framework broke the moment Wall Street layered cash-settled futures, perpetual swaps, options, ETFs, prime broker lending, wrapped BTC, and total return swaps on top of the chain.

Bob Kendall, creator of PortfolioXpert and a technical analyst, backed the same argument.

The Six-Layer BTC Problem

CryptoNobler pointed to what he calls the Synthetic Float Ratio (SFR). The idea is simple: one real BTC can now simultaneously back an ETF share, a futures contract, a perpetual swap, an options delta, a broker loan, and a structured note. All at the same time.

He added that this is the same structural break that already happened to gold, silver, oil, and equities once derivatives took over those markets.

Wall Street’s Playbook

Both researchers described a cycle that keeps repeating: create unlimited paper BTC, short into rallies, force liquidations, cover at lower prices, and do it again. CryptoNobler called it “inventory manufacturing.”

Today’s crash fits that pattern. Of the $2.6 billion in liquidations, over $2.1 billion came from long positions being force-closed. Derivatives markets led the selloff while spot activity stayed relatively calm.

What Does This Mean for Bitcoin Holders?

Bitcoin is trading around $66,000 after bouncing from the $60,000 floor.

The question now is how long this cycle continues before the market catches up.

You May Also Like

XAU/USD picks up, nears $4,900 in risk-off markets

The 1inch team's investment fund withdrew 20 million 1INCH tokens, worth $1.86 million, from Binance.