Is the Bitcoin ecosystem returning? A quick look at recent hot project developments

Original/Odaily Planet Daily

Author/Golem

The Bitcoin ecosystem has seen increased activity recently, with many projects with long development cycles entering delivery or reaching new milestones, such as RGB, SAT 20, and BRC 2.0. In this article, Odaily will briefly review the progress of these projects, allowing ecosystem players to explore their potential.

RGB Protocol: The first token on the mainnet will be available for claiming again on August 14th

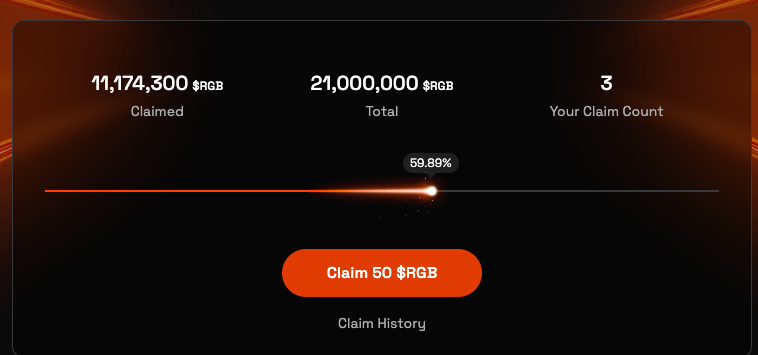

The RGB protocol was launched on the Bitcoin mainnet on August 7, and the first token RGB on the mainnet was issued simultaneously, with a total of 21 million tokens. It adopts a fair claim model, but each claim requires a fee of approximately US$4.

The community estimated that it would take approximately 24 hours for RGB tokens to be fully claimed. However, as of now (after five days), only 60% of RGB tokens have been claimed. This is likely due to the overwhelming popularity of the event, resulting in excessive website traffic and long claim queues. Bitlight Labs has repeatedly upgraded its servers and suspended claims to strengthen its defenses against bots.

According to the official announcement, Bitlight Labs has basically completed the defense measures against robot claims, and plans to release Bitlight Wallet v 1.1.3 and reopen RGB token claims at 17:00 on August 14, 2025. However, only 10% of the tokens will be open for claim testing this time. If the test results are satisfactory, the remaining progress of RGB tokens will be reopened in succession.

Although the RGB protocol's mainnet launch did not meet user expectations and even attracted significant FUD, the claiming process demonstrates that Bitlight Labs is continuously developing and improving the system and actively combating bot claims. This has, to a certain extent, maintained fairness in claims and dispersed token holdings, preventing a large concentration of tokens in the hands of a few individuals, which is beneficial to future community development.

While there's no official trading market yet, distributed RGB tokens can be transferred directly through wallets. Currently, a single RGB (50 tokens) costs $10-13, representing a 2-3x return on the claiming cost. Therefore, competition for claims is likely to intensify after the claiming period reopens on August 14th. For more information on the RGB protocol and a tutorial on claiming, please read this previous article on Odaily. (Related reading: After a two-year wait, is this the end of the RGB protocol's mainnet launch?)

BRC 2.0 upgrade: Phase 1 postponed to September 2

BRC 2.0 is an upgrade to the BRC20 protocol launched by Best in Slot, aiming to enable EVM-compatible smart contract functionality for all BRC20 tokens. Best in Slot originally planned to launch the first phase of the BRC2.0 upgrade on the mainnet at block height 909969 (approximately August 14th), enabling the use of six-character BRC20 tokens and launching the launchpad. However, due to insufficient preparation, the upgrade was postponed to block height 912,690, approximately September 2nd.

Perhaps due to the delayed upgrade date, the overall market capitalization of pre-BRC 2.0 assets has also declined. The first BRC 2.0 concept NFT, Adderrels, currently has a floor price of 0.0076 BTC (approximately $900), a 60% drop from its peak. However, the Adderrels project remains operational and has updated the details of the token airdrop for staking NFTs. The airdrops will be distributed over three seasons, releasing 8%, 9%, and 10% of the total supply respectively. The first quarter's token airdrop will take place on September 2nd, the launch of BRC 2.0.

Another project, LIQUID, which claims to be the first Pre-BRC 2.0 token minted on Ordinals, has moved to a community CTO. Previously, the original LIQUID project planned to sell the entire project to the public, causing a wave of panic. The current price of LIQUID is 0.00006 BTC, close to the minting cost.

For more information about the BRC 2.0 upgrade, please read Odaily's previous article. (Related reading: Mainnet Countdown, BRC 2.0 Upgrade Explodes BTC Ecosystem, Leading NFTs Rise Hundredfold in Month | BTC Ecosystem)

SAT 20 Protocol: SatoshiNet Mainnet Launch

The SAT20 protocol is a Bitcoin-native asset issuance and circulation protocol, two years in development. Its core feature is the binding of assets to Satoshis, allowing them to flow freely with Satoshis. SatoshiNet is a Bitcoin-native Layer 2 built on the SAT20 protocol. Built on Lightning Channels and a parallel Bitcoin network, its purpose is to expand the liquidity of native assets on the BTC mainnet, supporting Ordinals, Runes, OrdX, BRC20, and other protocol assets. The SatoshiNet mainnet officially launched on August 8, 2025.

The core of SatoshiNet lies in its four contract capabilities: asset launch contract (LaunchPool), asset crossing contract (Transcend), AMM trading contract (Swap) and limit trading contract (LimitOrder). These capabilities enable SatoshiNet to have the functions of instant settlement, extremely low transaction fees and compatibility with Bitcoin assets.

Currently, SatoshiNet has deployed four cross-chain contracts: BTC, pearl, rarepizza (ordx assets), and DOG GO TO THE MOON (Runes asset). ordx is the native asset issuance of the SAT 20 protocol, an enhanced version of the Ordinals protocol. The issued assets are called Sat 20 assets, which are bound to Satoshi and have Satoshi properties. Pearl is the first token of the ORDX protocol and serves as the governance token of the SatoshiNet network.

The SAT20 protocol's publicly available team members include Huige, who leads market operations and English-language business development, and Jiangangshan, who leads technology. SATSWAP is SatoshiNet's first decentralized exchange (DEX), offering features like token launches, a trading market, and limit orders.

Although the SAT 20 protocol has been under construction for two years and has formed a solid community, it has not yet generated a wealth effect large enough to break through the circle and attract more attention.

Bitcoin-native Layer 2 Spark: Launchpad Launched

Spark claims to be a Bitcoin native L2 built for payments and settlements, but does not support smart contracts and has its own token issuance standard LRC 20. On August 11, one of the only two node operators of the Spark protocol and the Spark browser sparkscan Flashnet conducted LRC 20 AMM function testing on Spark, but the test was not smooth. It is estimated that it will take some time before the official launch of DEX.

Meanwhile, on August 1st, Luminex, a Bitcoin ecosystem token launch platform, announced a partnership with Spark to launch a launchpad, which briefly excited ecosystem players. However, the launch has yet to take place. However, on August 11th, another LRC20 launchpad, utxo.fun, launched simultaneously with Flashnet's AMM test. However, it still encountered serious issues, leading the platform to process user refunds and temporarily prohibit token issuance.

Despite this, the LRC 20 flagship token, FSPKS (ending with b 55 e), still has a floor price of $100 per unit, representing a 50x return on its initial minting cost of $2. For more information on the Spark protocol, please read Odaily's previous article (Related reading: Detailed Explanation of Spark and its Ecosystem: A 16 Z Support, PayPal Helps Create New Bitcoin L2).

BitVM 2 Bitcoin Bridge Fiamma: Mainnet Launch

Fiamma is a Bitcoin wealth management platform. Its core products are Fiamma One, a non-custodial superapp that allows users to earn BTC with one click, and Fiamma Bridge, built on BitVM 2. Fiamma officially launched on August 6th, enabling BTC transfers to 11 chains, including Ethereum, Arbitrum, Aptos, BNB Chain, and Base.

To encourage user participation, Fiamma launched a points-earning program on August 8th. Minting 0.00001 FIABTC earns 1 Alpaca Point, holding 0.00001 FIABTC earns 3 Alpaca Points per month, and depositing FIABTC in DeFi protocols earns 12 Alpaca Points per month. FIABTC is natively pegged 1:1 to BTC and utilizes BitVM 2 technology for trust minimization. Combined with Fiamma Bridge and Fiamma One, Fiamma is expected to secure BTC holders' funds while generating additional on-chain returns.

You May Also Like

Three dormant wallets, suspected to belong to the same entity, purchased 5,970 ETH eight hours ago.

NVIDIA Stock Price Analysis as OpenAI Issues Concerns About its Chips