Trust Bank Singapore Guide: Credit Card & Cashback Card Review (2026)

If you’ve been shopping at FairPrice or scrolling through digital banking options in Singapore, you’ve probably come across Trust Bank.

Launched in 2022 as a partnership between Standard Chartered Bank and FairPrice Group, Trust Bank has quickly gained traction with its no-annual-fee credit cards and cashback rewards.

Its two flagship products – the Trust Credit Card and the Trust Cashback Card – promise everyday savings, NTUC integration, and digital-first convenience. But how do they really stack up, especially against travel-focused options like YouTrip?

This review breaks down everything you need to know: from Trust Bank interest rates and credit card benefits to cashback exclusions, eligibility requirements, and whether the Trust card or the YouTrip card makes more sense for you.

Stay Up To Date:

Stay Up To Date:

– Touch ‘n Go Guide In Malaysia: Everything You Need To Know (2026)

– Sapa Vietnam Travel Guide (2026): Weather, Hanoi to Sapa, Best Things To Do

– Taiwan Cherry Blossom Guide 2026: Forecast, Top Sakura Spots & Tips

TL;DR – Quick Takeaways

- Trust Bank Singapore is a digital bank formed by Standard Chartered and FairPrice Group.

- Trust Credit Card & Cashback Card: No annual fees, cashback on eligible spend, up to 15% cashback in select categories (conditions apply).

- March 2026 Update: The S$1,000/month tier (10% cashback) has been removed; foreign spend in non-preferred categories now earns 0.5% (down from 1%).

- Trust Bank interest rate: Up to 2.5% p.a. on savings (conditions apply).

- Ideal for local spenders and NTUC Union members.

- For overseas spending, the YouTrip card is generally preferred for its real-time wholesale exchange rates, zero fees, and multi-currency support.

Table of Contents:

Table of Contents:

- What is Trust Bank Singapore?

- Trust Credit Card: Benefits & Features

- Trust Cashback Card: Review & Key Details

Important Updates Effective 1 March 2026

Important Updates Effective 1 March 2026 Cashback Structure

Cashback Structure Bonus Structure

Bonus Structure Trust Cashback Card Exclusions

Trust Cashback Card Exclusions Trust Cashback Card Verdict

Trust Cashback Card Verdict

- Trust Bank Interest Rates & Credit Card Fees

Savings Account Interest Rate

Savings Account Interest Rate Trust Credit Card Interest Rate

Trust Credit Card Interest Rate Trust Credit Card Annual Fees

Trust Credit Card Annual Fees

- Trust Card Eligibility & Requirements

- Overseas Spending: Trust Card vs YouTrip

- Which Card Should You Choose?

- FAQs

What is Trust Bank Singapore?

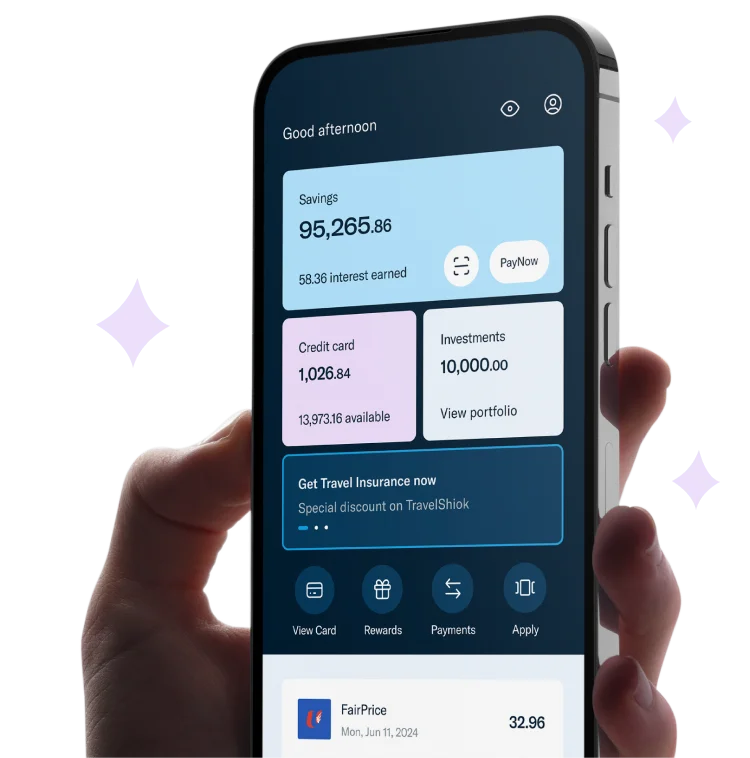

Image Credits: Trust Bank

Trust Bank is a digital-first bank in Singapore, launched in 2022, a joint venture between Standard Chartered Bank and FairPrice Group. It’s designed for shoppers at FairPrice outlets, NTUC Union members, and anyone looking for a digital-only banking experience.

Check out this guide to Revolut Singapore: The Ultimate Guide To The Revolut Card, Account & Fees

Check out this guide to Revolut Singapore: The Ultimate Guide To The Revolut Card, Account & Fees

Trust Credit Card: Benefits & Features

The Trust Credit Card is ideal for local spenders, everyday groceries, and NTUC members.

Key features:

- Digital-first management & tracking

- No annual fee

- Instant rewards via the Trust app

- NTUC integration: Extra perks for NTUC Union members & FairPrice shareholders

- Cashback: Cashback on eligible spending, *up to 15% cashback on select categories (e.g. groceries, transport, dining)

Discover the Best Miles Credit Card in Singapore: The Ultimate Guide

Discover the Best Miles Credit Card in Singapore: The Ultimate Guide

Trust Cashback Card: Review & Key Details

The Trust Cashback Card is a popular choice for Singaporeans seeking everyday cashback rewards.

Important Updates Effective 1 March 2026:

Important Updates Effective 1 March 2026:

1. Mid-tier removed: The S$1,000/month tier (10% cashback, S$100 cap) has been eliminated

2. Reduced foreign spend cashback: Foreign eligible spend in non-preferred categories now earns 0.5% (down from 1%)

3. Enhanced preferred category: Your preferred category now earns additional unlimited cashback on top of the quarterly bonus:

- 1% extra on local spend

- 0.5% extra on foreign spend

4. Expanded Shopping category: Now includes more merchants (electronics like Apple and Best Denki, telco providers like Singtel and StarHub, home goods like IKEA and Courts, retailers like Popular and Amazon)

Cashback Structure:

Cashback Structure:

Preferred Category Cashback:

- Unlimited 1% cashback on local eligible spend in your preferred category

- Unlimited 0.5% cashback on foreign eligible spend in your preferred category

- PLUS up to 15% bonus cashback quarterly (conditions apply)

Non-Preferred Category Cashback:

- Unlimited 1% cashback on local eligible spend

- Unlimited 0.5% cashback on foreign eligible spend

Bonus structure (from 1 March 2026):

Bonus structure (from 1 March 2026):

| Bonus Cashback | Min. Spend per Month (3 months) | Quarterly Cap |

|---|---|---|

| 5% | S$500 | S$30 |

| 10% | S$1,000 REMOVED | S$100 |

| 15% | S$2,000 | S$250 |

How the 15% Bonus Cashback Works:

To qualify for the bonus cashback, you must:

- Spend S$500 or S$2,000 per month for three consecutive months.

- Pick one bonus category (e.g., dining, travel, shopping, wellness, entertainment, transport).

- Stay within the quarterly cashback cap: S$30 / S$250, depending on your spend tier.

What this means:

Spending S$6,000 over three months (S$2,000 x 3) might look like you’ll earn S$900 cashback (15%). However, due to the cap, only the first S$1,667 in your chosen category qualifies for 15%.

The rest gets 1% unlimited cashback (if in preferred category), 1% on local, or 0.5% on foreign (if in non-preferred categories).

Example (from 1 March 2026):

- S$1,667 in preferred category at 15% bonus cashback = S$250 (cap reached)

- Remaining S$4,333 in preferred category at 1% unlimited cashback = S$43.33

OR

- Remaining S$4,333 in non-preferred categories:

- Local spend at 1% = S$43.33

- Foreign spend at 0.5% = S$21.67

- Total cashback: S$293.33 on S$6,000 spend (~4.9% effective cashback if all in preferred category

Trust Cashback Card Exclusions:

Trust Cashback Card Exclusions:

Like most credit cards, certain spend does not qualify for cashback:

- Insurance payments

- AXS/SAM/ATM transactions

- Loan installments

- Late fees & interest charges

Trust Cashback Card Verdict:

The Trust Cashback Card can still deliver a decent return if you plan your spending carefully, but the 15% figure is more of a headline rate than a reasonable outcome. Most users will likely earn closer to 1-3% once caps and conditions are considered.

Best For:

Best For:

- Those who can consistently hit S$2,000/month spend

- Strategic category selection matching your highest spend

- Maximising preferred category rewards (1% unlimited + up to 15% bonus)

Less Ideal For:

Less Ideal For:

- Moderate spenders who previously benefited from the S$1,000 tier

- General overseas spending outside your preferred category (now only 0.5%)

Read all about the Best Multi-Currency Cards In Singapore: A Full Comparison Guide

Read all about the Best Multi-Currency Cards In Singapore: A Full Comparison Guide

Trust Bank Interest Rates & Credit Card Fees

Savings Account Interest Rate:

Savings Account Interest Rate:

- Up to 2.5% p.a. on deposits (up to S$1.2M) if conditions are met (e.g. min. spend & account balance)

- Three plans available: Flex Plan, Signature Plan, and Zen Plan

Trust Credit Card Interest Rate:

Trust Credit Card Interest Rate:

- 27.9% p.a. effective interest rate if balances are not fully paid

- Standard for Singapore credit cards, but avoidable if you pay in full

Trust Credit Card Annual Fees:

Trust Credit Card Annual Fees:

- No annual fee

Trust Bank Singapore: CashChanger.co Vs YouTrip: Where To Get The Best Exchange Rate In Singapore?

Trust Card Eligibility & Requirements

To qualify for a Trust Credit Card in Singapore:

Trust Debit Card:

At least 16 years old & above

At least 16 years old & above  Singaporean citizen / PR / Foreigner with a valid work pass

Singaporean citizen / PR / Foreigner with a valid work pass

Trust Credit Card:

21-55 years old (Min. annual income): Singaporean citizens/PR: S$30,000

Singaporean citizens/PR: S$30,000  Foreigner with a valid work pass: S$60,000

Foreigner with a valid work pass: S$60,000

Above 55 years old (Min. annual income): Singaporean citizen/PR: S$15,000

Singaporean citizen/PR: S$15,000  Foreigner with a valid work pass: S$60,000

Foreigner with a valid work pass: S$60,000

Find a Money Changer Near Me: 14 Best Money Changers In Singapore

Find a Money Changer Near Me: 14 Best Money Changers In Singapore

Overseas Spending: Trust Card vs YouTrip

Here’s a comparison between the Trust card and YouTrip when it comes to overseas spending:

| Feature | YouTrip | Trust Card |

|---|---|---|

| Card Type | Pre-paid Mastercard, multi–currency e-wallet | Dual Visa credit & debit functionality |

| Annual Fee | None | None |

| FX Fees | Zero FX fees across 150+ countries | Zero FX fees anywhere Visa is accepted |

| Currencies available for holding & exchange |  12 wallet currencies 12 wallet currencies  SGD, MYR, JPY, THB, USD, EUR, AUD, NZD, GBP, HKD, CHF, SEK SGD, MYR, JPY, THB, USD, EUR, AUD, NZD, GBP, HKD, CHF, SEK |  Not supported Not supported |

| Exchange Rates | Real-time wholesale exchange rates | Visa rates |

| FX Markup Protection |  Blocks Dynamic Currency Conversion (DCC) Blocks Dynamic Currency Conversion (DCC) |  DCC may apply if merchant converts to SGD DCC may apply if merchant converts to SGD |

| ATM Withdrawals Overseas | *Free S$400 ATM withdrawals per month *2% fee applies thereafter | None |

| Cashback/Rewards | Partner cashback via YouTrip Perks, HLAS travel insurance cashback | Partner cashback with NTUC, FairPrice & more |

| Able to send money overseas? |  Remittance to 40+ countries Remittance to 40+ countries |  Not available Not available |

With the foreign eligible spend in non-preferred categories now earning 0.5% cashback (reduced from 1%), this makes the Trust Card less competitive for general overseas spending.

With the foreign eligible spend in non-preferred categories now earning 0.5% cashback (reduced from 1%), this makes the Trust Card less competitive for general overseas spending.

Optimal card strategy:

- Use Trust Card for local spending → earn 1% unlimited cashback + up to 15% bonus on preferred category

- Use YouTrip for overseas spending → lock in competitive real-time wholesale FX rates with zero fees and no markup.

Read Trust Card Vs YouTrip for a more in-depth comparison

Read Trust Card Vs YouTrip for a more in-depth comparison

What is YouTrip?

YouTrip is a multi-currency e-wallet and prepaid Mastercard designed for travellers. It supports spending in over 150 countries with 0% foreign transaction fees and allows users to lock in competitive rates across 12 currencies.

YouTrip is especially useful if you want to lock in favourable exchange rates before your trip, spend without worrying about DCC, or withdraw money overseas without hefty fees.

How to use YouTrip overseas?

- Top up your YouTrip wallet in SGD using PayNow, a linked bank account, or credit/debit card.

- Lock in foreign exchange rates in the app before your trip for 12 popular currencies

- Use the YouTrip Mastercard overseas for shopping, dining, and transport — it’ll automatically deduct from the right currency wallet or auto-convert SGD at wholesale rates.

- Withdraw cash overseas (free up to S$400/month*).

- Avoid DCC by always choosing to pay in the local currency.

Find out what’s up with the SGD To MYR Rate Today: Best Exchange Rates, Forecast & Where to Change Money

Find out what’s up with the SGD To MYR Rate Today: Best Exchange Rates, Forecast & Where to Change Money

Which Card Should You Choose?

- Trust Card is ideal for local spending in Singapore – maximize everyday cashback with strategic category selection, NTUC benefits, and 1% unlimited cashback on local eligible spend. From March 2026, it’s best used for your highest local spending categories.

- YouTrip is the superior choice for overseas spending – lock in competitive exchange rates across 12 wallet currencies in-app before your trip and enjoy real-time wholesale FX rates with zero fees and no markup.

Ready to Try YouTrip?

Find a card that suits your needs best — whether you’re looking for the best rates in town or one with zero fees.

Not a YouTrooper yet? Singapore’s go-to multi-currency wallet helps you save with great FX rates and zero fees. Skip the money changer and get a free YouTrip card + S$5 YouTrip credits with code <YTBLOG5>.

Then, head over to our YouTrip Perks page for exclusive offers and promotions — we promise you won’t regret it. Join our Telegram (@YouTripSG) and Community Group (@YouTripSquad) for travel tips, event invites, and more!

Happy travels!

FAQ: Trust Bank

1. Trust Bank is under which bank?

Trust Bank is a joint venture between Standard Chartered Bank and FairPrice Group, not UOB.

2. Does a Trust Card have cashback?

Yes. The Trust Cashback Card offers cashback on eligible spending: 1% on local spend / 0.5% on foreign spend (non-preferred categories), with up to 15% bonus cashback quarterly on your selected preferred category.

3. Trust Credit Card Review: Is it worth it?

Yes, if you shop often at FairPrice or want a no-fee card for local spending. From March 2026, it’s most valuable for those who can hit S$2,000/month spend and strategically choose their preferred category. Less ideal for frequent travellers – use YouTrip for overseas spending instead.

4. What is the benefit of a Trust Card?

$0 annual fees, cashback rewards, NTUC perks, and digital-first features.

5. Trust Credit Card Interest Rate?

27.9% p.a. effective interest rate if not fully repaid.

6. Trust Cashback Card Exclusions?

Insurance, AXS, loan instalments, and late fees.

7. Is a Trust Card better than YouTrip?

From March 2026: Trust Card is better for local spending in Singapore (1% unlimited + up to 15% bonus on preferred category). YouTrip is better for overseas spending with real-time wholesale FX rates and zero markup. Best strategy: use Trust for local, YouTrip for travel.

8. What is the SWIFT/BIC code for Trust Bank in Singapore?

- Bank Name: Trust Bank Singapore Limited

- Bank Code: 9733

- SWIFT/BIC Code: TRBUSGSG

- Branch Code: 001

Related Articles:

Best Singapore Credit Card For Overseas Spending

Japan ATM Withdrawal Guide: Fees, Locations, Exchange Rates

DBS Multi-Currency Account (MCA) Guide: Features, Exchange Rates, Fees

YouTrip Vs Wise Card Comparison Guide

The post Trust Bank Singapore Guide: Credit Card & Cashback Card Review (2026) appeared first on YouTrip Singapore.

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings