Bitcoin at Record Undervaluation Amid ETF Outflows, Bitwise

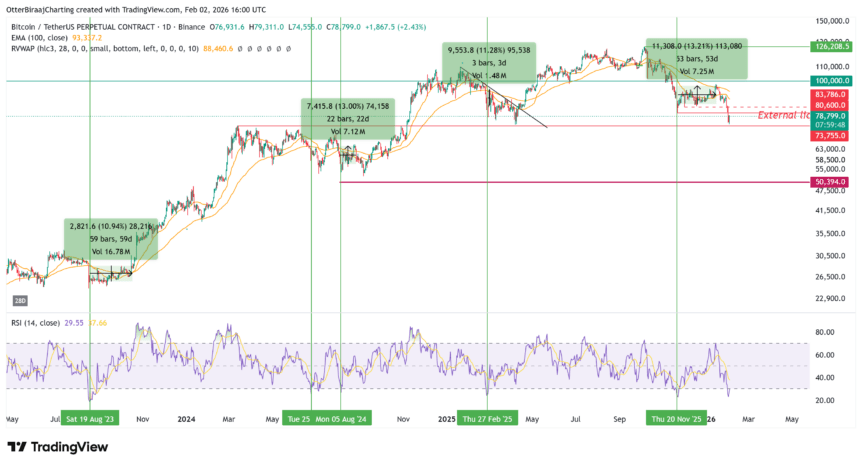

Bitcoin price fell to a year-to-date low of $74,555 on Monday, marking a roughly 40% retracement from its all-time high. The decline arrived as global Bitcoin exchange-traded products (ETPs) logged heavy outflows, underscoring a risk-off mood that has persisted through the market. While the move has sparked bearish sentiment and muted valuation metrics, some observers see an asymmetric payoff setup developing in the background—one that could catalyze a meaningful reversal if demand returns while liquidity remains supportive.

Key takeaways

- Bitcoin’s 2-year rolling MVRV z-score has fallen to the lowest level on record, signalling extreme undervaluation and potential for a corrective bounce if macro conditions improve.

- Global Bitcoin ETPs saw approximately $1.35 billion in weekly net outflows, with US spot ETFs contributing the majority of the exits.

- Bitcoin’s daily RSI slipped into the 20–25 zone, a range historically associated with subsequent double-digit rebounds in most cycles since mid-2023.

- Crypto asset sentiment deteriorated alongside price action, with Bitwise’s Cryptoasset Sentiment Index reaching levels last seen during prior deep liquidity events.

- Broader outflows extended to the crypto-ETP space, with $1.73 billion pulled from global crypto ETPs in the week, and notable outflows from flagship products like the Grayscale Bitcoin Trust and the iShares Bitcoin Trust.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Negative. The price slide reflects renewed risk-off sentiment and a drying up of near-term upside catalysts.

Trading idea (Not Financial Advice): Hold. Near-term downside risks persist, but objective measures showing extreme undervaluation could set up a potential, conditional rebound if liquidity returns.

Market context: The pullback comes amid a broader backdrop of reduced risk appetite in digital asset markets, with related ETF flows and on-chain metrics signaling a cautious stance from investors while liquidity remains a key determinant of the path forward.

Why it matters

The current price action matters because it tests Bitcoin’s resilience against a backdrop of thinning liquidity and rising reserve requirements among players across both traditional and crypto markets. The record-low MVRV z-score suggests the market is pricing in a larger loss relative to the realized cost basis than at any comparable point in history. For long-term holders, this can be interpreted as a potential opportunity, but it comes with the caveat that recovery requires a reacceleration of demand and a stabilization of macro conditions that have driven outflows from ETP structures this year.

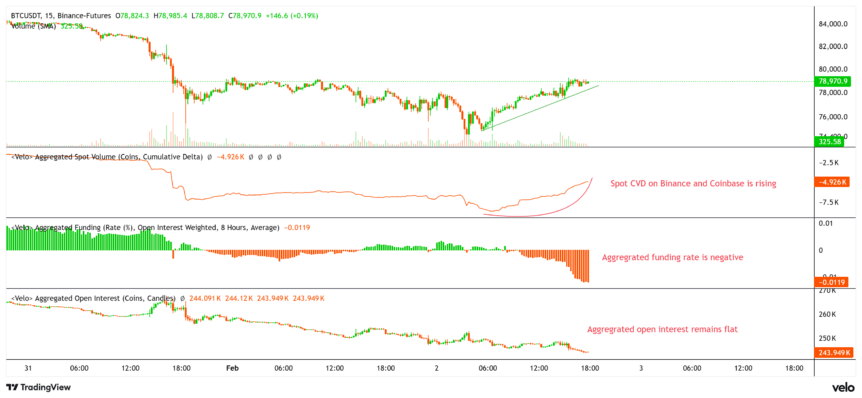

On-chain and liquidity signals reinforce the delicate balance facing the market. The spot market has shown pockets of constructive buying as price drifted toward higher intraday levels, but this pressure has been uneven, with leveraged exposure remaining a risk factor until funding conditions improve. The literature from Bitwise’s Market Compass and Sentiment Index underscores a broader erosion in confidence; but at the same time, some metrics that historically preceded rebounds — such as turning spot buying pressure into price momentum — have begun to reemerge in limited form. The juxtaposition of bearish headlines with selective bullish signals paints a nuanced picture: the next move could hinge on whether demand can outpace continued selling pressure from a wary audience.

From a portfolio perspective, the outflows from major BTC-tracking vehicles have been pronounced. The Grayscale Bitcoin Trust and the iShares Bitcoin Trust posted weekly outflows of $119 million and $947 million, respectively, illustrating that traditional investors remain hesitant to maintain or increase exposure in a volatile environment. This macro flow pattern matters because it can shape secondary liquidity and price discovery, particularly if macro catalysts or regulatory clarity alter risk appetite. The connectivity between ETF dynamics and spot markets means that a sustained capitulation in product-level demand could prolong the path to a sustainable floor, even as on-chain metrics show pockets of value in the underlying network.

In addition to price-based considerations, the market is watching data points that have historically signaled a readiness to rebound. The two-year MVRV z-score, which compares market value against the aggregate cost basis of holders, is currently in uncharted territory on the downside. This metric implies that net investors may be sitting in losses that are deeply out of step with realized costs, potentially setting the stage for a rapid repricing should buying pressure return. Analysts point to the possibility that a buy-the-dip dynamic could reassert itself if volatility quiets and liquidity cycles normalize, particularly as spot markets begin to absorb demand from new entrants and yield-seeking funds seeking Bitcoin exposure in a beta-friendly environment.

For readers tracking risk management and liquidity dynamics, CoinGlass data on long liquidations last week—net tallies exceeding $1.8 billion—illustrate that while some speculative positions were cleared, the current liquidity environment remains supportive of a counter-move rather than a run on liquidations. The broader market narrative continues to hinge on the tug-of-war between a potential relief rally on improving liquidity and the risk-off posture that has dominated flows. In this context, a notable divergence has emerged between the speed of price moves and the steadiness of spot buying, suggesting that any upside could be asynchronous across different market segments, with some traders positioned to capitalize on short-covering and others still seeking confirmation through additional data points.

Bitcoin MVRV 2-year rolling z-score. Source: BitwiseThe current configuration of indicators has led some analysts to describe the environment as a potential contrarian setup: extreme undervaluation could converge with a shift in sentiment if market participants re-enter risk positions in a measured, orderly fashion. The interplay between on-chain valuations, ETF outflows, and macro-driven liquidity will likely dictate whether this is a bridge to a rally or a deeper pause as participants await clearer directional cues. As always, the market remains reactive to external developments, including regulatory signals, policy decisions, and the pace at which corporate treasury strategies and fund flows adapt to evolving risk tolerances.

Bitcoin price, RSI, and correlation indicators. Source: Cointelegraph/TradingView

Bitcoin price, RSI, and correlation indicators. Source: Cointelegraph/TradingView

The market narrative continues to evolve as traders scrutinize the relationship between price momentum, on-chain activity, and the flow dynamics of BTC-focused products. A notable theme is that the rebound potential could be amplified if price declines fail to accelerate into fresh low ranges and if spot buyers re-enter with disciplined risk management. The presence of negative funding rates and flat open interest suggests that this move is more about spot demand than a cascade of leveraged positions, which could reduce the risk of a rapid, broad-based liquidation scenario should demand return in the near term.

To understand the broader implications, readers can consider related analyses that assess how policy signals, including the pace of regulation and central-bank actions, may influence liquidity and investor behavior. A piece exploring mixed signals from policy nominations highlights the sensitivity of Bitcoin liquidity to macro news and how such developments can affect both spot and derivatives markets. This context is crucial for market participants looking to gauge the conditions under which a recovery could gain traction.

Looking ahead, traders and investors will be watching key price levels, indicator readouts, and ETF flow patterns to determine whether the trend remains sequentially negative or begins to tilt toward stabilization and a potential upturn. As with any cycle, the combination of valuation metrics, market sentiment, and liquidity dynamics will shape the tempo and scale of the next move in Bitcoin and the broader crypto complex. The data points from Bitwise, Bitwise’s sentiment metrics, and the ongoing ETF flow narrative will likely converge to inform the next decisive step for market participants.

What to watch next

- Monitor Bitcoin price action around the $74,500–$75,500 range for a potential stabilization or breakdown, with attention to whether price can reclaim higher levels such as $79,000.

- Track the 2-year MVRV z-score for any meaningful uptick, which could signal a shift from undervalued to fairly valued and support a risk-on stance.

- Observe spot cumulative volume delta (CVD) trends on major venues (e.g., Binance and Coinbase) for signs of sustained buying pressure that could precede a bounce.

- Watch open interest alongside funding rates to gauge whether the current move is liquidity-driven or fueled by leveraged positions that could amplify or cap a rebound.

- Note ETF outflows trends and any reopening of demand from institutional and retail participants, as these flows can influence price discovery and liquidity conditions.

Sources & verification

- Bitwise Weekly Crypto Market Compass and Bitwise’s Cryptoasset Sentiment Index data and commentary.

- Outflow figures from global Bitcoin ETPs and US spot ETFs reported in Bitwise’s market updates.

- Bitcoin liquidity and funding data from CoinGlass and related market analytics referenced in the article.

- Related market commentary and charts published by Cointelegraph, including data visualizations from TradingView.

Market reaction and key details

Bitcoin price action has moved in step with a wave of outflows from Bitcoin-tracking vehicles, highlighting how ETF dynamics can influence spot markets even when macro conditions remain the primary driver of risk appetite. The price slide to the year-to-date low coincided with another week of outsized redemptions across the space, including a notable pullback in flagship products. The breadth of the outflows across the sector underscores a cautious mood among asset allocators, even as specific on-chain metrics hint at value accumulation opportunities for buyers who can weather near-term volatility. The convergence of declining valuation signals and persistent fund withdrawals paints a complex landscape where the next directional move will depend on whether demand can re-enter without reigniting speculative excess.

Bitcoin price, aggregated spot volume, funding rate, and open interest. Source: Velo.data

Bitcoin price, aggregated spot volume, funding rate, and open interest. Source: Velo.data

In the near term, traders will be watching for a plausible relief rally that could emerge if the market finds footing around the current lows and if spot demand—rather than leveraged positioning—drives the next leg higher. Recent data shows that a significant portion of the selling has been driven by risk-off sentiment and outflows from ETPs, indicating that for a sustained rebound, buyers may need to prove their commitment beyond a temporary squeeze. The interplay between ETF flow dynamics, on-chain indicators, and macro signals will define whether Bitcoin can re-enter a regime of constructive price action or whether the market drifts into a prolonged consolidation phase amid ongoing uncertainty.

As the ecosystem adapts to shifting liquidity conditions, market participants will also keep an eye on policy developments and macro outcomes that could influence risk appetite and capital allocation within the crypto space. A nuanced understanding of the relationship between ETF flows, on-chain fundamentals, and price action will remain essential for interpreting the next phase of Bitcoin’s cycle, particularly as the market tests new valuation milestones and navigates the evolving regulatory landscape.

This article was originally published as Bitcoin at Record Undervaluation Amid ETF Outflows, Bitwise on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings