Ripple Unlocks 1 Billion XRP Worth $1.63 Billion: Will Price Recover?

Ripple unlocked 1 billion XRP XRP $1.63 24h volatility: 1.5% Market cap: $99.32 B Vol. 24h: $5.61 B —worth approximately $1.63 billion—on February 2, as part of its funding strategy. 300 million XRP—worth half a billion dollars—are now reserved at its main treasury account, reserved for the company’s sales this month. Coinspeaker researched this information via publicly available, on-chain data retrieved from Ripple-owned accounts, labeled by XRPScan.

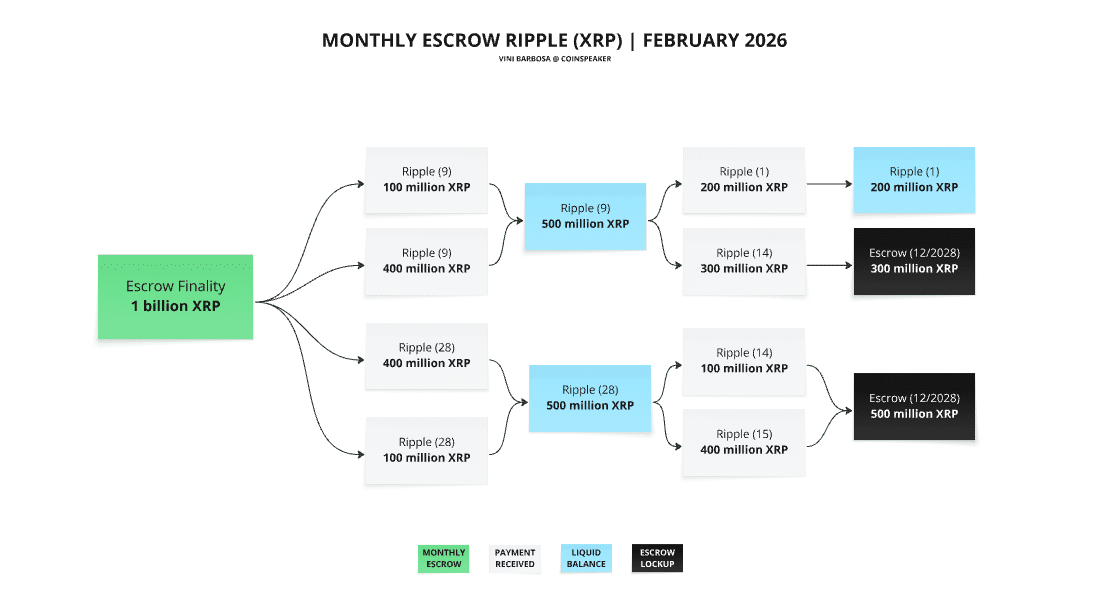

Notably, the funds come from previously locked XRP tokens via escrows created in 2022 that date back to XRP’s pre-mint and initial distribution. February 2026’s unlocks happened from the accounts labeled as Ripple (9) and Ripple (28), with four escrows reaching finality on Feb. 1.

Each account unlocked 500 million XRP in total, out of which came from escrows of 100 million and 400 million XRP tokens. These were then reallocated to three other accounts, following a pattern observed in previous months.

The Ripple (28) account sent 100 million XRP to Ripple (14) and 400 million XRP to Ripple (15), which have been re-locked in new escrows set to finish (and unlock) in December 2026. Meanwhile, the Ripple (9) account sent 200 million XRP to Ripple (14) for the same reason, plus 300 million tokens to Ripple (1), identified as the company’s liquid treasury account—used for funds distribution operations like OTC sales and exchange deposits.

Ripple on-chain data flow | Monthly Escrow Unlock February 2026 | Source: Coinspeaker / XRPScan

XRP Price Analysis

As of this writing, XRP is trading at $1.63 per token, with accumulated losses of 18% in the past 30 days, following macro uncertainty and a trend also seen in most of the other cryptocurrencies. For example, crypto products recorded a net outflow of $1.7 billion in the last week alone, affecting the supply side of their underlying assets in open markets.

According to data from CoinMarketCap, XRP has a market capitalization of nearly $100 billion, positioned as the fifth-largest crypto by market cap. With a currently circulating supply of 60 billion XRP, the recent unlock represents 1.66% of that amount and the 300 million reserved for February operations represents 0.5% of that active supply.

XRP price (30D chart) as of Feb. 2, 2026 | Source: CoinMarketCap

On the other hand, Ripple, the company behind XRP’s issuance, unlocks, and ongoing developments, continues to push and advance in many areas, with a highlight to compliance-related movements. In the most recent development, Ripple has been granted a full Electronic Money Institution (EMI) license by Luxembourg’s CSSF, as Coinspeaker reported.

nextThe post Ripple Unlocks 1 Billion XRP Worth $1.63 Billion: Will Price Recover? appeared first on Coinspeaker.

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings