Bitcoin (BTC) Price Tanks Toward $80K as Liquidations Approach $1B

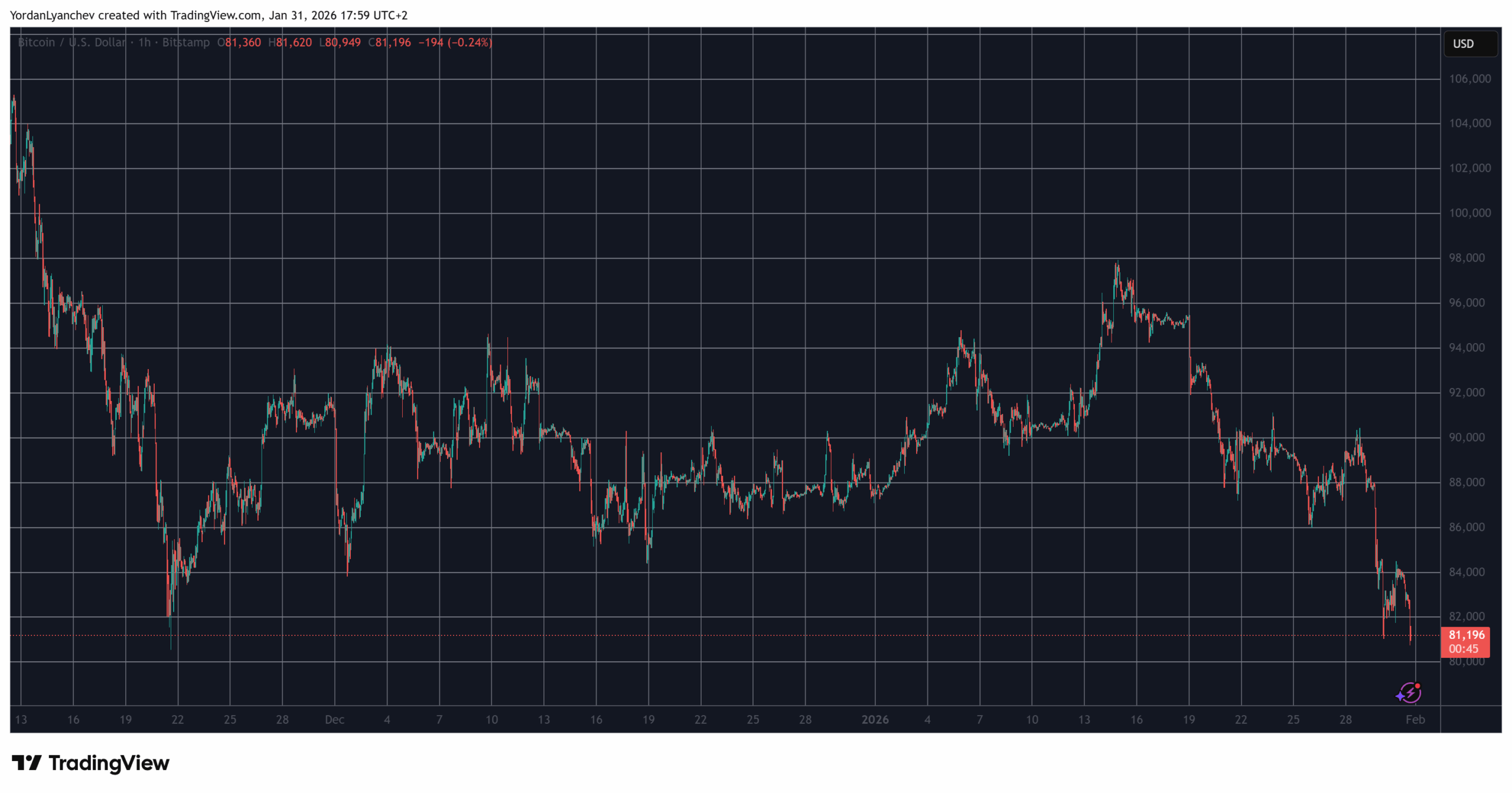

After a relatively calm and untypical Friday, in which BTC remains sideways around $83,000 and $84,000 while the precious metal market tanked, the cryptocurrency is dumping hard once again on Saturday.

Recall that the asset’s overall calamity began on Thursday when it was rejected at $90,000. In the following hours, it dropped by nine grand to a then-two-month low of $81,000.

It recovered some ground yesterday when it rebounded to $84,000, which now appears as a dead-cat bounce. At the same time, silver and gold plunged by 40% and 16%, respectively, erasing roughly $7 billion of their respective market caps within just a day.

However, the past few hours have brought more pain to the bulls, with BTC slipping to just under $81,000. This became its lowest price tag since November 21.

BTCUSD Jan 31. Source: TradingView

BTCUSD Jan 31. Source: TradingView

Most altcoins are also deep in the red now. Ethereum is down by 7% in the past 24 hours alone, slumping toward $2,500. BNB and XRP have plummeted by 5-6% daily as well.

It’s no wonder that the total value of wrecked positions is on the rise, approaching $1 billion in the past 24 hours alone. Naturally, longs are responsible for the lion’s share (over $850 million), while the number of liquidated traders has shot up to roughly 240,000, shows data from CoinGlass.

The single-largest wrecked position took place on Hyperliquid and was worth over $13 million. Interestingly, it involved ETH, which is among the poorest performers in the past day.

Liquidation Data on CoinGlass

Liquidation Data on CoinGlass

The post Bitcoin (BTC) Price Tanks Toward $80K as Liquidations Approach $1B appeared first on CryptoPotato.

You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

![[Time Trowel] Zamboanga City and ‘Chief of War’](https://www.rappler.com/tachyon/2026/01/zamboanga-chief-of-war-time-trowel-01312026.jpg)

[Time Trowel] Zamboanga City and ‘Chief of War’