Crypto Market Shows Strength Ahead of FOMC Meeting as Powell Sets Tone

Just hours before the FOMC meeting on Jan. 28, the crypto market is showing strength with Bitcoin BTC $89 643 24h volatility: 2.2% Market cap: $1.80 T Vol. 24h: $49.38 B and top altcoins gaining anywhere between 2-3%. This comes ahead of the FOMC meeting, although the odds of Fed rate cuts stand almost close to nil. Investors are keen to know the tone of Fed Chair Jerome Powell for the possibility of future rate cuts.

Crypto Market Bounces Back Ahead of FOMC

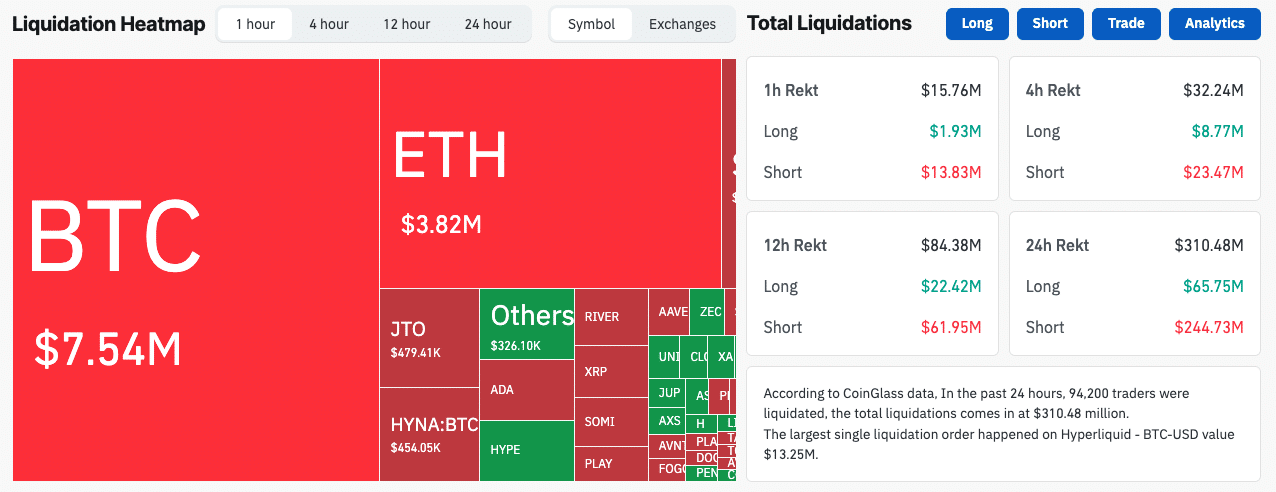

Despite a mild reaction to the US Dollar Index crashing, the broader cryptocurrency market has now started moving ahead of the FOMC meeting on Jan. 28. As per the CoinGlass data, short liquidations dominate over the 1-hour, 4-hour, and 12-hour charts.

Crypto market liquidation data | Source: CoinGlass

Some reports also suggest that the US Federal Reserve could intervene in the Japanese bond markets. This could mean overall liquidity infusion into the market, driving risk-on assets higher.

Popular analyst Kyledoops noted that markets are bracing for a busy session, with investors focused on central bank signals and major corporate earnings. The Federal Open Market Committee (FOMC) will announce its policy decision on Jan. 28, while rate-cut expectations currently stand below 3%.

Attention will then shift to Jerome Powell, with investors remaining more focused on Powell’s tone and guidance than on the rate decision itself. On the other hand, the US Senate Agriculture Committee is scheduled to vote on a major crypto market structure bill on Jan. 29.

BTC Price Attempts to Breach $90,000

Bitcoin price is up by 2.6% in the last 24 hours, and is currently attempting to break past the $90,000 resistance. Moreover, the daily trading volume has also surged by 15% to $42 billion. It shows that the overall trader sentiment is moving towards the bullish side.

Crypto analyst Crypto Gerla said Bitcoin is trading below a key support level and remains exposed to heightened volatility.

The analyst warned that if Bitcoin fails to reclaim the $92,000 level, prices could slide toward the $85,000-$86,000 range, with a stronger support zone seen between $75,000 and $77,000.

Bitcoin Hyper Hits $31 Million Presale Milestone

Bitcoin Hyper (HYPER), the Layer-2 scalability solution for the Bitcoin mainnet, has recently hit the milestone of more than $31 million in pre-sale fundraise. Investors are attracted to the project’s DeFi ecosystem, which offers 38% staking yields.

Bitcoin Hyper (HYPER) is positioning itself as a solution to improve Bitcoin’s transaction speed and cost efficiency, aiming to deliver a smoother user experience.

The platform uses the Solana Virtual Machine (SVM) to enable high-throughput processing and lower fees. It also supports cross-chain interoperability with Solana and Ethereum networks, and provides access to smart contracts and a broader range of DeFi applications around BTC liquidity. Here’s our guide on how to buy Bitcoin Hyper.

nextThe post Crypto Market Shows Strength Ahead of FOMC Meeting as Powell Sets Tone appeared first on Coinspeaker.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk