DeFi: The Next Generation of Finance

Traditional finance was built for a world of borders, intermediaries, and closed systems. Decentralized Finance is being built for a global, digital, and permissionless economy. Decentralized Finance, commonly known as DeFi, proposes a radically different model. One where financial services are built on open blockchains, governed by code, and accessible to anyone with an internet connection.

DeFi is not simply an upgrade to existing financial rails. It represents a rethinking of how money moves, how risk is priced, and who gets access to financial tools. In this article, you will learn what DeFi is, why it matters in 2025, how it works under the hood, and where infrastructure providers like OnFinality fit into the evolving DeFi ecosystem.

DeFi: The Next Generation of Finance

Traditional finance was built for a world of borders, intermediaries, and closed systems. Decentralized Finance is being built for a global, digital, and permissionless economy. Decentralized Finance, commonly known as DeFi, proposes a radically different model. One where financial services are built on open blockchains, governed by code, and accessible to anyone with an internet connection.

DeFi is not simply an upgrade to existing financial rails. It represents a rethinking of how money moves, how risk is priced, and who gets access to financial tools. In this article, you will learn what DeFi is, why it matters in 2025, how it works under the hood, and where infrastructure providers like OnFinality fit into the evolving DeFi ecosystem.

Table of Content

- What Is Decentralized Finance?

- Why Decentralized Finance Matters in 2025

- Key Benefits and Use Cases of Decentralized Finance

- How Decentralized Finance Works

- Common Questions About Decentralized Finance

- Key Takeaway

- About OnFinality

What is Decentralized Finance?

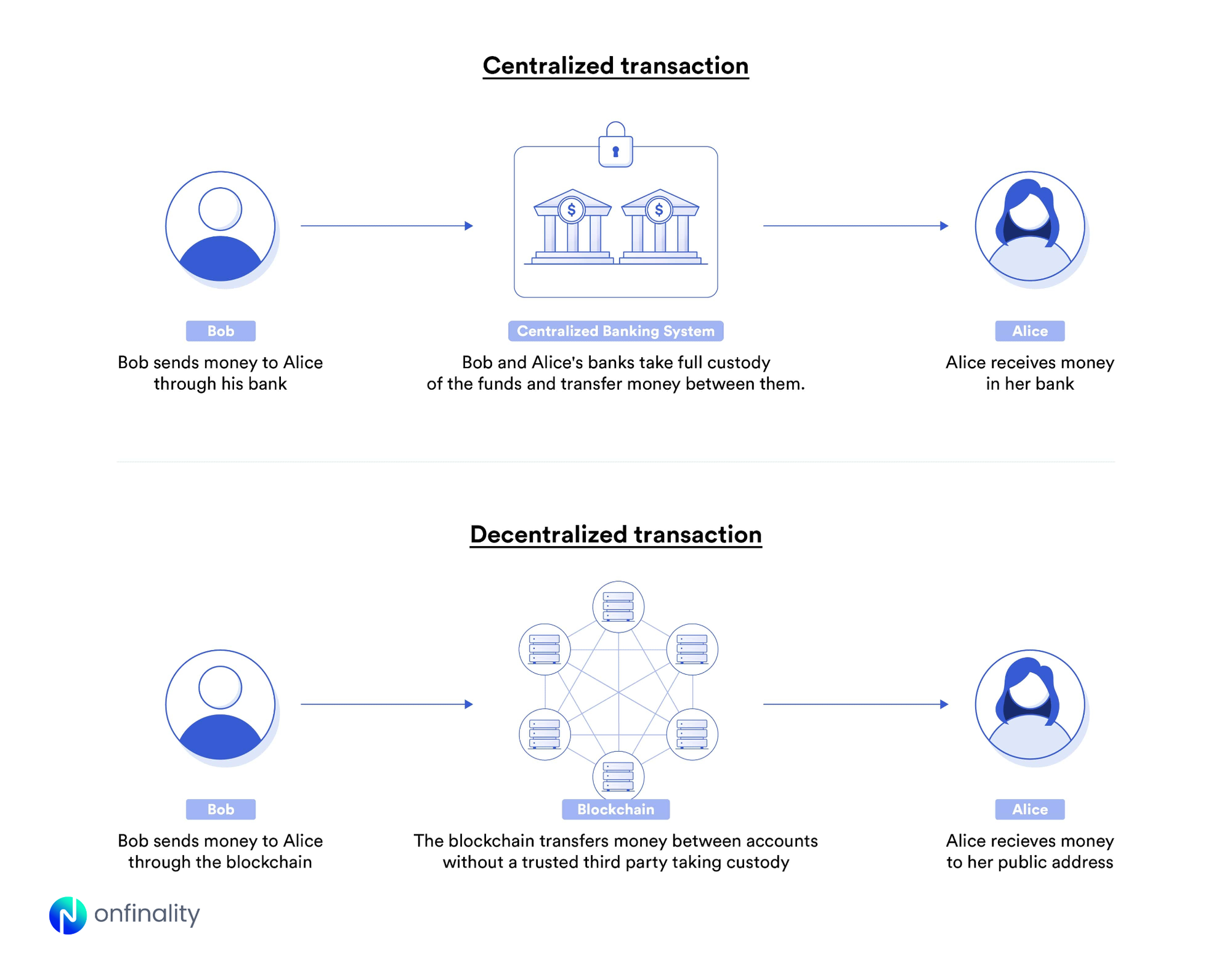

Decentralized Finance is a blockchain based financial system that replaces traditional intermediaries with smart contracts. Instead of banks, brokers, or clearing houses, DeFi protocols execute financial logic automatically on public networks.

Users interact with DeFi protocols through non custodial wallets, retaining full control of their assets. Common DeFi ecosystem components include decentralized exchanges, lending protocols, stablecoins, and derivatives platforms.

At its core, DeFi infrastructure enables trust minimization, transparency, and composability across financial services.

Why Decentralized Finance Matters in 2025

By 2025, DeFi is no longer experimental. It is becoming a financial infrastructure.

According to data from DeFiLlama, total value locked across DeFi protocols consistently measures in the hundreds of billions of dollars, despite market cycles. Major financial institutions are also exploring onchain settlement, tokenized assets, and blockchain based yield products, signaling convergence rather than replacement.

Key trends driving DeFi adoption include:

- Growth of stablecoin based payments globally

- Institutional interest in onchain yield and settlement

- Demand for transparent and real time financial systems

As noted by the World Economic Forum and reports from major financial publications, blockchain based finance is increasingly viewed as a foundational layer for future markets.

Reliable RPC access, indexing, and data availability are critical here, which is why production grade infrastructure remains a bottleneck and an opportunity.

Key Benefits and Use Cases of Decentralized Finance

- Lending and borrowing: Earn yield or access liquidity without selling assets. Example, Aave, Morpho

- Decentralized exchanges: Trade assets directly from wallets without custodians. Example, Uniswap, Pancakeswap

- Stablecoins: Enable price stable, programmable money for global payments. Example, USDC, USDT

- Derivatives and structured products: Create onchain exposure and hedging strategies. Example, LIDO, Beefy

- Cross border finance: Faster and cheaper global settlement. Example, CopperX, TransaK

Each use case depends heavily on uptime, data accuracy, and network reliability.

How Decentralized Finance Works

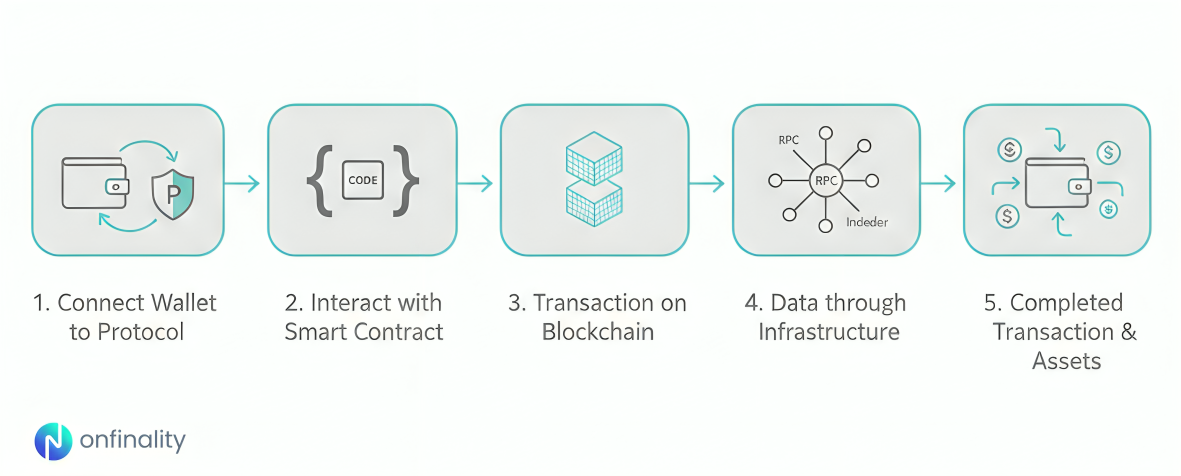

- Users connect a non custodial wallet to a DeFi protocol

- Smart contracts define financial logic and risk parameters

- Transactions are executed and settled on a blockchain

- The funds are moved from one account to another depending on the action performed by the user

- User can withdraw their funds anytime as it is fully onchain

- Data is fetched through RPCs and indexed services

At scale, DeFi applications rely on high throughput RPC infrastructure, fast indexing, and consistent uptime to support real time financial activity.

Common Questions About Decentralized Finance

Is DeFi safe to use?

DeFi security depends on smart contract audits, protocol design, and infrastructure reliability. Risks still exist, but transparency allows users to assess them directly.

How is DeFi different from traditional finance?

DeFi removes intermediaries, operates 24/7, and allows direct asset ownership without centralized custody.

Can institutions use DeFi?

Yes. Many institutions are exploring permissioned DeFi models, tokenized assets, and onchain settlement layers.

What role does infrastructure play in DeFi?

Without reliable RPCs, indexing, and data access, DeFi applications cannot scale or operate safely.

Key Takeaway

- Decentralized Finance is redefining how financial systems are built

- DeFi enables open, transparent, and programmable finance

- Infrastructure reliability is essential for DeFi at scale

- The future of finance is increasingly onchain

Decentralized Finance is not a passing trend. It is the foundation of the next generation of financial systems.

About Onfinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings