Data review of the changes in TRUMP's major holdings in the past three months, 86.9% of major investors liquidated their positions, and some suffered a floating loss of more than 30 million US dollars

Author: Frank, PANews

As the pinnacle of celebrity coins, the launch of the TRUMP token triggered extreme FOMO sentiment in the market and attracted many big players to enter the market. However, with the coldness of the entire MEME market and the exposure of insider teams one after another, the price of TRUMP plummeted from the peak of $75 to the lowest of $7.2, a drop of more than 90%. On April 18, 4% of the TRUMP tokens were unlocked, and the market estimated that this would intensify the panic of the token and trigger a new decline. On the other hand, on April 20, it was reported that Trump planned to hold a dinner for TRUMP token holders. With the combination of good and bad news, the TRUMP token seems to have stopped falling and started to rebound.

Previously, PANews conducted an in-depth analysis of the holdings of TRUMP tokens (Related reading: The truth about the wealth of TRUMP tokens: Big players compete in the arena, each buying $590,000 per person, and one address bought $1.09 million within one minute of the token issuance ). Three months have passed. How are the big players making profits and losses now? What new changes have taken place in the distribution of TRUMP tokens?

Even the big investors could not bear the sharp drop, and 86.9% of them have liquidated their positions

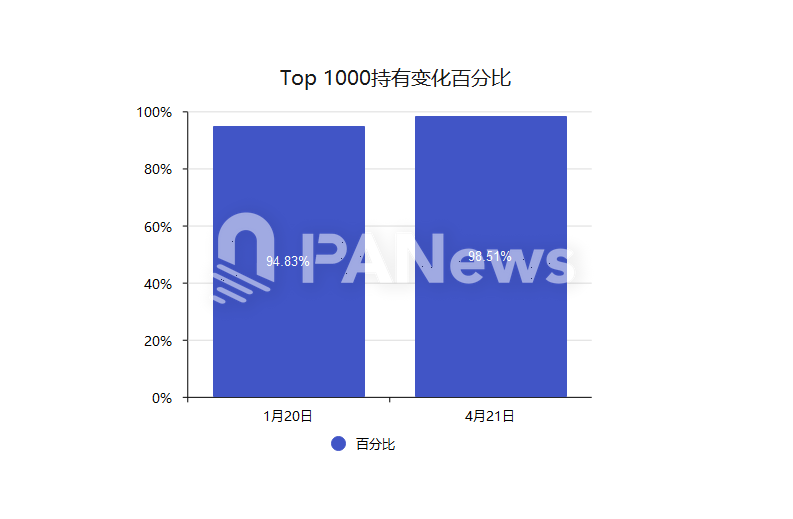

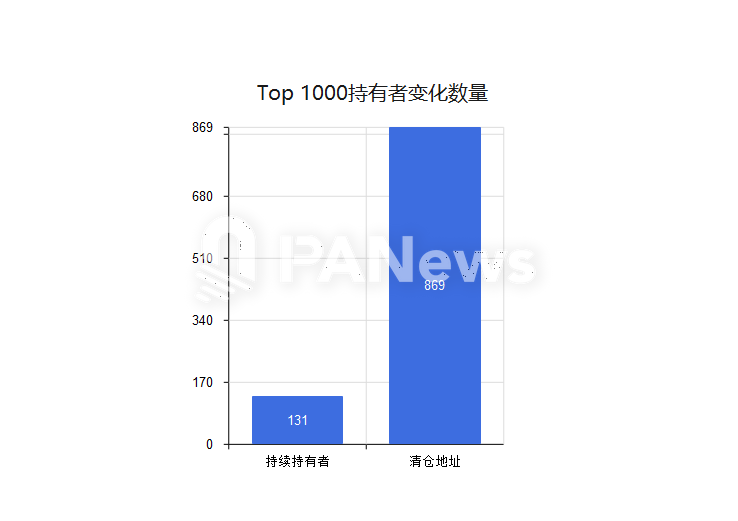

Compared with the overall data, TRUMP's major holders have frequently changed hands in the past three months. Compared with the data on January 20, among the top 1,000 major holders, 86.9% of them chose to liquidate their tokens, totaling 48 million tokens, accounting for 24% of the total circulation.

Data as of April 21 showed that the top 1,000 addresses held approximately 98.51% of TRUMP tokens, up 3.68% from 95.83% on January 20. The above data shows that TRUMP tokens have a significant turnover, and the chips seem to have become more concentrated at the trough stage.

In the past three months, among the newly added large addresses, Robinhood has become a relatively prominent new large address in the exchange, and its token holdings have increased by 1.44% in three months. In addition, the currency holdings of exchanges such as Crypto.com and Meteora, which are mainly in the US market, have increased significantly. Among the individual large accounts, many of them entered the market when the price of TRUMP was at its high point at the end of January. After being trapped, they are still increasing their positions, but overall they have suffered serious losses. In terms of the token holdings, these holding addresses bought 12.2% of the tokens after January 20.

Among the large addresses that continue to hold tokens, the token development address increased its holdings by approximately 1.38 million tokens. However, most of these tokens were transferred back from other small addresses, not purchased and increased.

Among the liquidation addresses, according to PANews observations, many of the top investors started buying around January 18 and chose to liquidate on or before February 1, and most of them made a lot of profit.

In general, the earliest profitable TRUMP big investors have basically exited the market. Many of the new addresses in the market are big investors who bought the bottom several times at the high price after January 20 and were trapped. However, judging from the trading behavior, many big investors seem to be optimistic about the future of TRUMP coin and are still increasing their positions.

Some people made a profit of 25 million, while others lost 33.66 million US dollars.

Among the big investors who cleared their positions, the one with the largest profit should be the address 2Fe47zbh8svDNGNehFy1NY8bsjQNtomvKFuq1jNgWSkv (hereinafter referred to as "2Fe47"). This address received 25 million TRUMP tokens from the founding address before TRUMP was launched for trading. After the launch, it was immediately distributed and sold on the market. Later, it received 27 million TRUMP tokens from the founding address 5e2qR and sold them again, with a total of more than 112 million US dollars. Finally, the remaining tokens were collected in the founding address 5e2qR. Data from January 20 showed that the address held more than 1 million tokens, all of which have been cleared. Judging from the operation path, this address is suspected to be the trumpet address of the TRUMP token project.

Another big user, 3AWDTDGZiW8joyfA52LKL7GUWLoKBCBUBLUE5JoWgBCu, started buying TRUMP as soon as it went online on January 18, spending $78.55 million to buy it, and finally sold $103 million, making a huge profit of $25.17 million. However, the last time he entered the market was between January 25 and January 27. The user believed that the TRUMP coin had fallen to a low level, and spent $12.78 million to build a position. By February 2, he might see no end to the decline, so he sold all his positions for $9.23 million. But overall, this address still made considerable profits on TRUMP tokens.

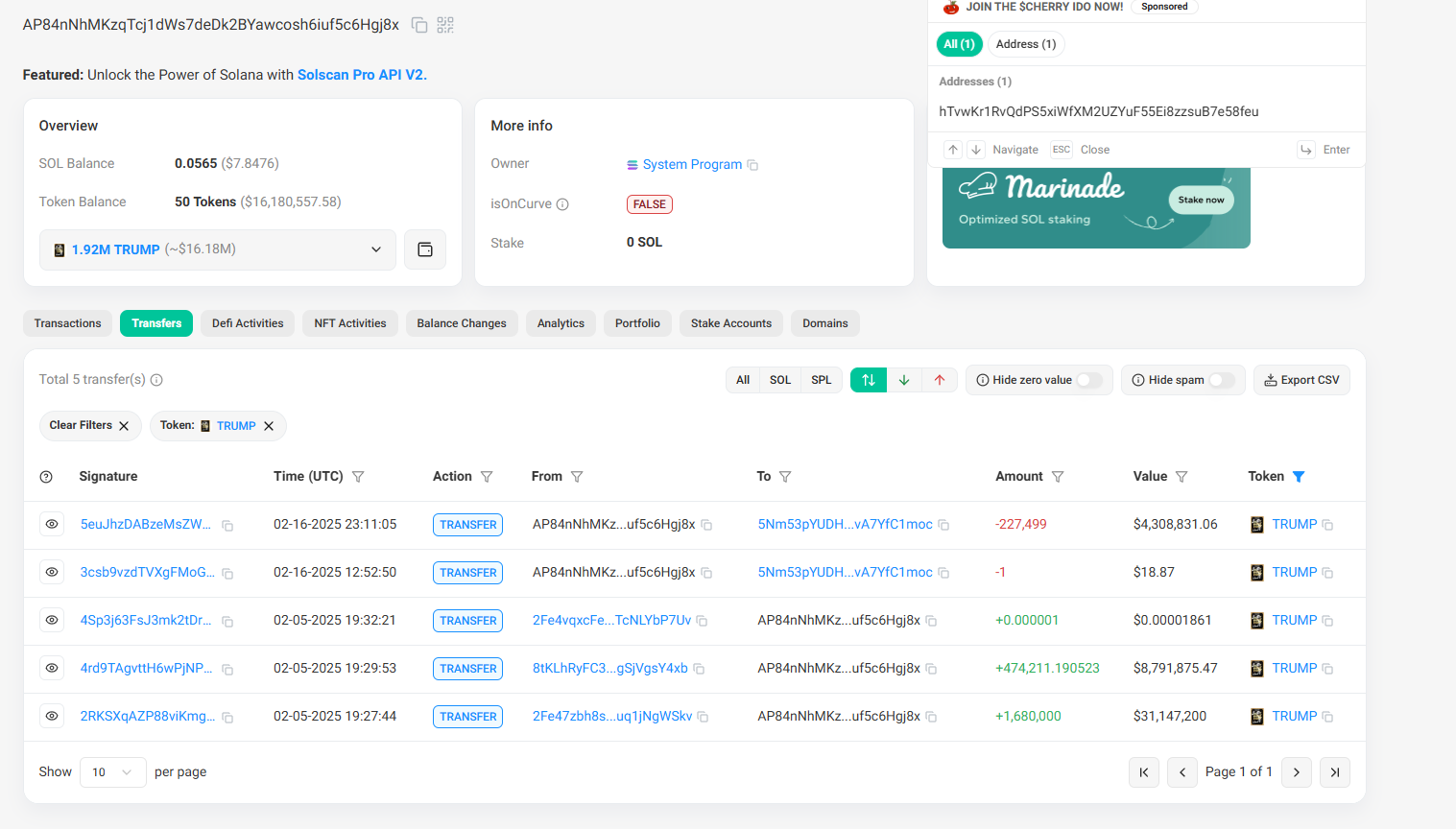

There is another large account that started to buy TRUMP tokens from various exchanges around January 20, spending a total of $45.73 million to buy 1.11 million tokens, with an average cost of about $41. After selling 300,000 tokens at $17.6 on February 7, he still holds 810,000 tokens, with a floating loss of about $33.66 million so far, and a loss rate of 73%. This is the address with the highest single loss among the new large accounts.

Coincidentally, the user of the address 6qgBGeZgPyxdobeHhcNtAqVe927zodpiuoufhwGN8BhP performed similar operations to the above-mentioned address. He also started hoarding coins through several associated addresses from January 20, spending a total of US$16.67 million. He currently still holds US$6 million in tokens, and his losses also exceed US$10 million.

The dramatic fluctuations of the TRUMP token are like a "reality show" in the crypto market, which not only shows the myth of getting rich quickly in the MEME coin speculation wave, but also reveals the cruel reality under the high-leverage game. From the precise cashing out of the early big players to the deep quagmire of the subsequent takeovers, the winners and losers in this game have been clearly divided by the market. Although Trump's "good news from the dinner" temporarily injected momentum into the token's rebound, the shadow of highly concentrated chips and suspected manipulation by the project party is always lingering. The current TRUMP token seems to have a respite after the bad news has been exhausted, but its fate is still firmly subject to the resonance of the celebrity effect and market sentiment. For retail investors, this roller coaster-like market is undoubtedly a risk education lesson: in the MEME coin battlefield lacking fundamental support, even the endorsement of "top traffic" may just be a gorgeous coat for capital harvesting.

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings