XRP Price Rebounds as Sentiment Shifts: Is a 2026 Rally in Play?

The post XRP Price Rebounds as Sentiment Shifts: Is a 2026 Rally in Play? appeared first on Coinpedia Fintech News

Ripple’s native token, XRP is once again at a familiar crossroads. After weeks of choppy price action and fading momentum, XRP price is showing early signs of potential rally ahead. During the intraday session, XRP staged a modest rebound of over 2% as price held above key support levels. While the move is not dramatic, ETF flows and on-chain sentiment are beginning to diverge from the chart, a combination that often signals early positioning rather than short-term noise.

ETF Flows and On-Chain Data Signal Accumulation

On-chain data from Santiment suggests that market fear around XRP has resurfaced across social and trading activity, with negative crowd sentiment climbing back to levels typically seen near local bottoms. Historically, such spikes in pessimism have tended to coincide with accumulation phases rather than extended sell-offs, especially when broader structural demand remains intact.

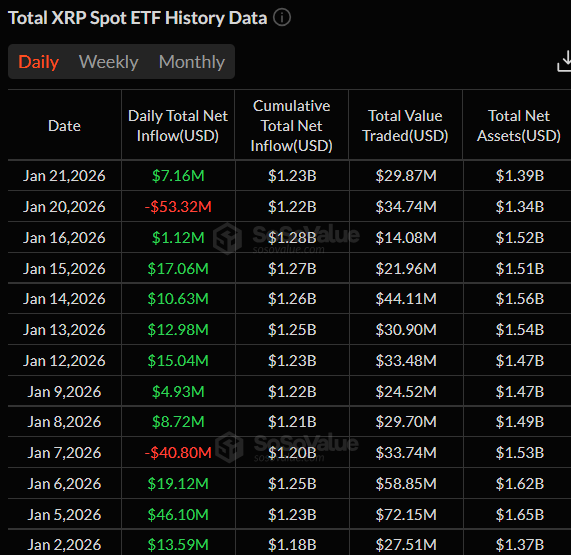

That structural demand is now clearly visible in ETF positioning. According to U.S spot XRP ETF flow data, institutional products currently hold approximately $1.39 billion in total net assets, while cumulative net inflows stand near $1.23 billion. Although the market recorded a notable $53.3 million outflow on January 20, the broader trend remains decisively positive. The past two weeks alone saw strong inflows, highlighting consistent institutional dip-buying behaviour.

XRP Price Holds Key Support as Structure Stays Intact

XRP price is currently consolidating above the former accumulation band between $1.30 and $1.90, which acts as the core structural support area. Looking at the higher timeframes, XRP price has broken out of a multi-year descending wedge (2020-2024), completing a long accumulation phase and delivering a 600%+ expansion from the $0.60 breakout region. This move confirms that XPR is now trading above a multi-year breakout zone, with its higher-timeframe bullish structure still intact.

As long as XRP token holds above the $1.80 region, the long-term trend remains technically bullish. A closer look at the short-term chart highlights that XRP has shifted its structure now and buyers have made their grip now. If XRP price decisively breaks the $2 hurdle, the next upside targets are $3.50 as the first major expansion level, followed by $5 as the next high-timeframe liquidity zone. On the other side, $1.30-$1.50 would act as a demand zone in case of retracement ahead.

As retail sentiment turns cautious and institutions continue building exposure, XRP’s price action suggests the market may be cooling for its next structural breakout rather than rolling over. In classic market cycles, this combination of fearful sentiment, rising institutional positioning, and strong price action often marks the transition from consolidation to expansion, not the end of the trend.

You May Also Like

Why Bitcoin Dominance Is Not Always a Reliable Market Signal

Grayscale Pushes Dogecoin ETF Plans Forward