Best Memecoins to Buy Today, January 21 – Dogecoin, Apecoin, MemeCore

Highlights:

- The next memecoins to explode are Dogecoin, ApeCoin, and MemeCore, which have strong technical indicators of growth.

- The Dogecoin has broken a downward trendline, indicating potential positive movements with the increase in buying pressure.

- MemeCore continues rising with a high volume and bullish indicators, indicating a potential breakout toward higher resistance zones.

The crypto market has continued to extend its downtrend as asset prices record further losses following the uncertainty regarding Trump’s tariffs on European nations. The global market capitalization has declined by 2% to $3 trillion, while the 24-hour trading volume surged to $130 billion. Meanwhile, Bitcoin has dropped below the $90,000 region, dragging the major altcoins and the memecoin sector. Despite the overall bearish sentiment, let’s discuss the next memecoins to explode, such as Dogecoin, ApeCoin, and MemeCore.

Best Memecoin to Purchase

1. Dogecoin (DOGE)

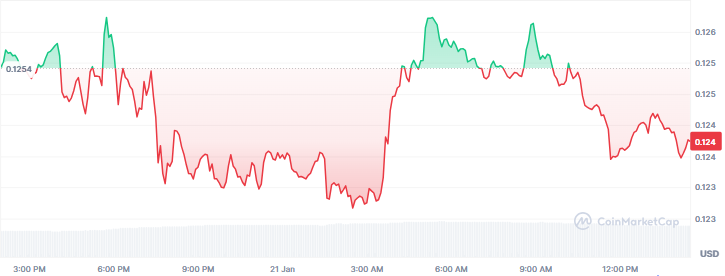

As of this writing, Dogecoin is trading around $0.1245, down by 1% over the last 24 hours. The memecoin has undergone continuous pressure, recording a decline of 15% and 6% on the weekly and monthly charts. Meanwhile, its market cap has dropped to $20 billion despite the trading volume surging by 20% to $1.24 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Crypto analyst Trader Tardigrade has pointed out a significant breakout in Dogecoin’s price on its 4-hour chart. This chart indicates that DOGE has surpassed a major downward trendline, indicating the possibility of higher momentum. The breakout is accompanied by a bullish divergence in both price and the RSI, which strengthens the idea of rising buying pressure.

Such a breakout might be the start of a long-term bullish trend for Dogecoin. Traders need to watch the market closely to determine if the move is confirmed. With the strong indicators, Dogecoin is emerging as one of the next memecoins to explode.

2. ApeCoin (APE)

ApeCoin is consolidating around the $0.1900 region after failing to break past the $0.2400 region at the start of the week. Currently, the price has declined by 2.50% to trade at $0.1913 following the broad market downturn. Its market cap and trading volume stand at $144 million and $28 million, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

Jonathan Carter, a crypto analyst, has shared insights regarding ApeCoin’s price movement. At the moment, APE is testing the bottom of a descending channel on its weekly chart. The price remains above a support zone that is historically quite important and has previously served as a strong base. The volume is increasing, which is indicative of possible buyer interest and could lead to a price bounce from this very level.

Carter suggests that the chances of APE falling to new lows are decreasing. Instead, a recovery seems more likely as the downward pressure wanes. The recovery process may be slow, but the expectation is for gradual upward movement, with key targets at $0.35, $0.55, $0.79, $1.06, $1.90, and $2.70.

3. MemeCore (M)

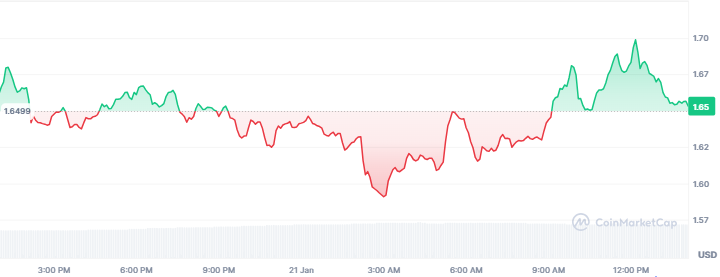

MemeCore has shown strong resilience recently despite the volatility witnessed in the market. The memecoin is up by 18% over the past 30 days, pushing the price to $1.65. While today the price has faced a modest decline of 0.20%, its trading volume has surged by 20%, climbing to $16 million.

Source: CoinMarketCap

Source: CoinMarketCap

Technical indicators on the daily chart suggest that bullish momentum is building in M’s price. The price is looking to challenge the immediate resistance at the $1.80 region, as green candlesticks continue forming. A break above this point could see the memecoin retest resistance at the $2.0 and $2.5 regions.

Source: TradingView

Source: TradingView

Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) support this upcoming upward rally. The MACD line has initiated a crossover above the signal line with the histogram shifting positive. Meanwhile, the RSI is climbing upwards, hovering around the neutral zone.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

United States Building Permits Change dipped from previous -2.8% to -3.7% in August