Bitcoin shows potential for more growth after hitting new all-time high

- Bitcoin surged past $118,000 on Friday, driven by strong institutional accumulation.

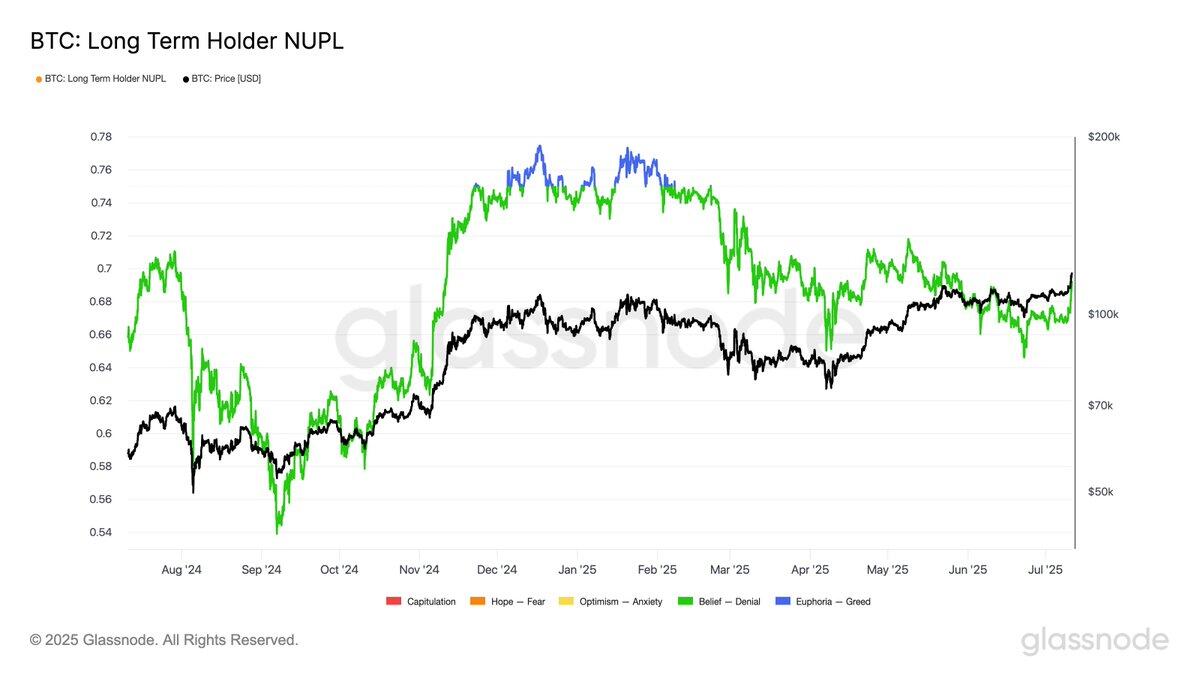

- Bitcoin's long-term holder NUPL metric remains below the euphoria zone, which highlights further upside potential.

- BTC funding rates remain around neutral levels, signaling low FOMO-driven activity.

Bitcoin (BTC) smashed the $118,000 mark for the first time in its history on Friday. Despite the rally, Bitcoin has seen little indications of Fear of Missing Out (FOMO) activity among traders in the past two days, signaling that the top crypto asset has more price growth potential in the current market cycle.

Bitcoin holders show reluctance to take profit despite all-time high rally

Bitcoin briefly surged above $118,000 over the past 24 hours following $1.18 billion net inflows into US spot BTC exchange-traded funds (ETFs) on Thursday, according to SoSoValue data. The strong inflows combined with rising prices have boosted the total net assets of the products past $141 billion as of the time of publication.

Despite Bitcoin's recent peak, on-chain metrics reveal that market optimism remains cool compared to previous cycles.

The Long-Term Holder (LTH) Net Unrealized Profit and Loss (NUPL) metric is at 0.69, slightly below the 0.75 threshold, which is typically associated with euphoric market conditions, blockchain analytics firm Glassnode stated in an X post on Friday. The current cycle has only seen 30 days above that level, compared to 228 days during previous bull cycles.

BTC Long-Term Holder NUPL. Source: Glassnode

The current NUPL level highlights that while long-term holders are already realizing profits, they are yet to reach extreme selling levels, as seen in previous price tops. This points to the possibility of further upside if LTHs continue to accumulate.

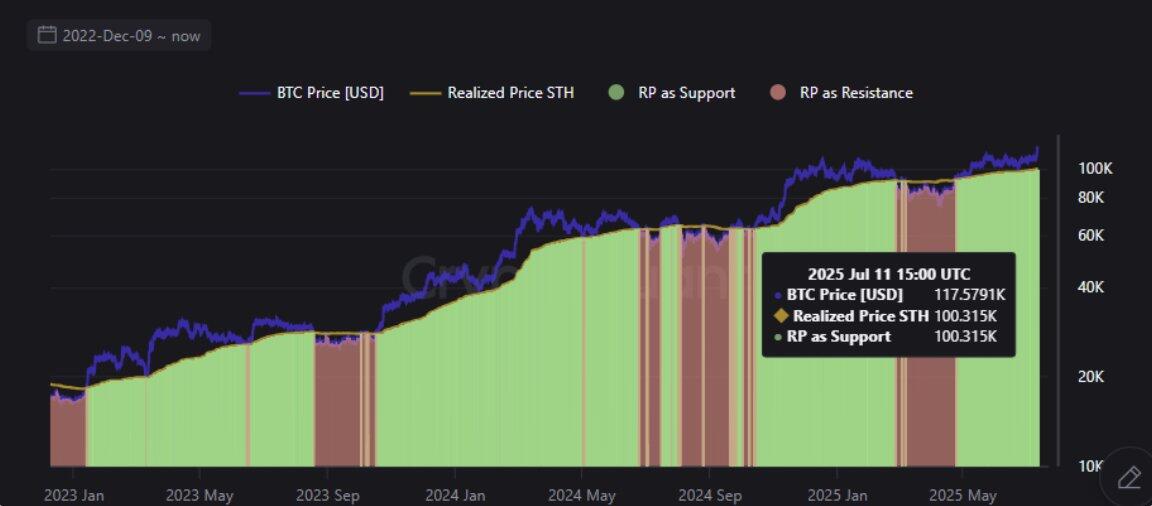

Likewise, short-term holders (STHs) have resisted the urge to lock in profits despite Bitcoin's push to a record high. The Short-Term Holder Realized Price — used to track the average acquisition cost for coins held for less than 155 days — is currently hovering around $100,000, according to a CryptoQuant report on Friday.

BTC Short-Term Holder Realized Price. Source: CryptoQuant

Usually, with Bitcoin's current rally, STHs should be locking in portions of their unrealized gains. However, the reluctance from this cohort reflects a broader decision to hold, similar to LTHs. "The market doesn't show signs of being overheated with excessive selling from profitable short-term holders," analyst CryptoMe wrote in the report.

CryptoQuant analysts also highlighted the notable rise in Bitcoin open interest, which spiked to $81.4 billion on Friday following BTC's rally above its previous peak of $112,000. Despite this rise, funding rates have remained near neutral levels, signaling a low FOMO-driven environment among traders.

"This means investors are not opening aggressive long positions using high leverage with FOMO," the report states.

This restrained behavior suggests that, despite Bitcoin's climb to new highs, market sentiment remains below elevated levels seen in the November and January all-time high run as the current uptrend is not yet driven by excessive speculation.

Bitcoin is trading near $117,400, up 1.3% over the past 24 hours, at the time of publication.

You May Also Like

The Role of Technology in Effective Decision Processes

Sonitor Recognized as Best in KLAS for RTLS for the Second Time in Three Years