As Roswell, New Mexico sets up Bitcoin strategic reserve, why more US cities could follow suit

- New Mexico's city of Roswell is the first US city to establish a strategic Bitcoin reserve with a target of $1 million.

- President Trump’s embrace of Bitcoin and crypto throughout his administration could push more cities to experiment.

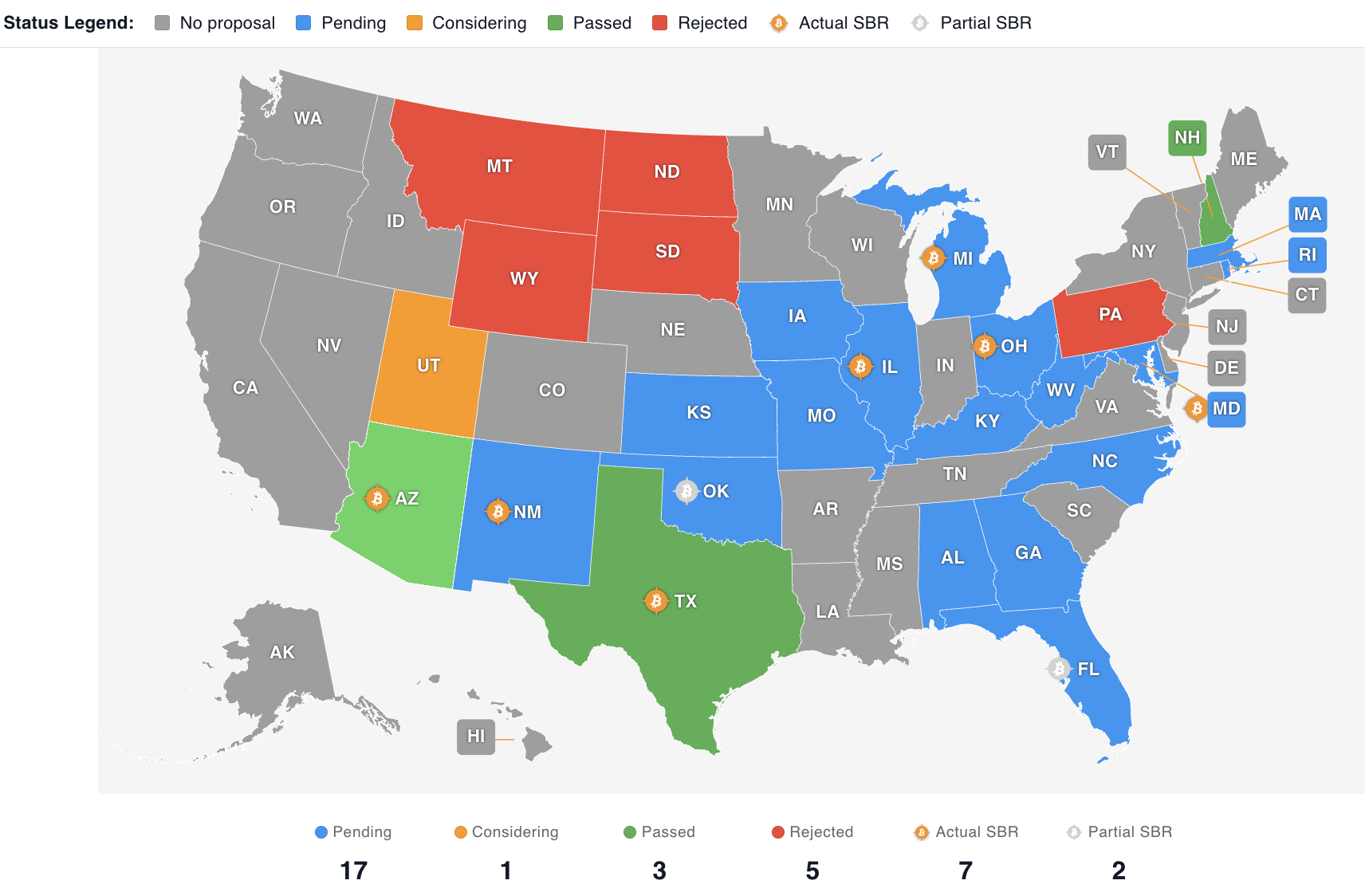

- Three US states have passed Bitcoin strategic reserve or related bills, and they are pending in 17 others.

New Mexico’s city of Roswell was the first city in the US to establish a Bitcoin reserve in April 2025. The city established the reserve with the first donation of $3,000 toward the Bitcoin strategic reserve. The city’s target for the reserve is $1 million.

Bitcoin traders are awaiting progress on the strategic reserves in 17 other states as well, while three states, New Hampshire, Arizona and Texas, have made progress.

City in New Mexico is first in the US to set up a Bitcoin strategic reserve

Roswell, a city in southeastern New Mexico and popular as the site of the alleged 1947 UFO crash, has set up a Bitcoin strategic reserve. Roswell’s target is $1 million, and the reserve was kicked off with a $3,000 donation of Bitcoin.

Seventeen US states are currently considering the establishment of a Bitcoin reserve, while three, New Hampshire, Arizona and Texas, have signed it into law. New Hampshire led the way, among the three, while Texas’ Bitcoin strategic reserve bill was enacted on June 20.

Bitcoin strategic reserve status | Source: Bitcoin reserve monitor

Trump’s pro-crypto policy could empower US states and cities

US President Donald Trump’s administration has supported Bitcoin and cryptocurrencies through changes within regulatory agencies like the Securities & Exchange Commission (SEC). Lawsuits against crypto firms like Coinbase and Ripple ended or neared their conclusion after long legal battles that negatively impacted cryptocurrencies.

President Trump’s crypto dinner, meme coin launch, NFT collections and his family-backed DeFi firm World Liberty Financial are all evidence of the pro-crypto regulation. With the GENIUS Act, a stablecoin regulation bill is awaiting final approval in the House of Representatives after the US Senate nodded on June 17.

https://x.com/justinsuntron/status/1924676460461310008

Senator Cynthia Lummis proposed a Bitcoin strategic reserve nearly a year ago in July 2024, and it is currently pending on the Federal level. As New Hampshire, Arizona and Texas make strides with the passage of similar bills, it is likely that more states and cities follow suit and embrace Bitcoin.

Bitcoin strategic reserve bill | Source: Sen. Cynthia Lummis, Wyoming

You May Also Like

Gold continues to hit new highs. How to invest in gold in the crypto market?

Layer Brett Picked As The Best Crypto To Buy Now By Experts Over Pi Coin & VeChain