XRP Army Rift: Zach Rector Accuses Jake Claver Of Misleading The Community

A loud internal fight is spilling out across the XRP Army, with Zach Rector accusing Jake Claver of using high-certainty price narratives, most notably the “$100 XRP by end of 2025” call, to pull attention, credibility, and capital from the community.

Rector released a two-part video series on Dec 31, aimed at “addressing Jake Claver’s lies.” Claver, the CEO of Digital Ascension Group, ist one of the louder XRP bulls. While the $100 XRP call by Jan. 1, 2026 clearly failed, Rector argues that the miss wasn’t just a bad call, it was the certainty and urgency behind it, sold into a community that has spent years marinating in catalyst talk, NDA hints, and timeline debates.

The $100 XRP Call

Rector said he has challenged the $100 XRP claim throughout 2025 and was surprised Claver continued doubling down into the final days of the year. In Rector’s telling, the problem is not prediction-making, he said he has missed targets too, but the way extreme outcomes were marketed as near-certain, with the implication of privileged information.

He played a clip from Claver’s live show after Rector criticized the $100 call. When confronted, Claver did not concede, instead implying he may “know something.”

“If I was going to pivot, should have pivoted by now,” Claver said in the clip Rector quoted. “Unless I know something. Why wouldn’t I? … We’ll see what ends up happening by the end of the year. We’ll see where the price is. And I think the results will speak for themselves.”

Rector argued that this kind of messaging: NDA-coded, “trust me” signaling becomes a lever inside XRP culture, where many holders have learned to treat timelines and insider claims as tradable narratives. Rector calls this behaviour “manipulation,” saying Claver’s “business model is so reliant upon that manipulation” that he “can’t back out now.”

Serious Allegations

Rector’s sharper allegations go beyond price talk and into what he described as XRP-focused funds offered through Digital Wealth Partners (DWP). He claimed the community has sent “so much XRP” into Claver’s orbit and that there is “a massive discrepancy from what he’s saying publicly and what investors are telling me privately.”

“Jake and his scheme, his business has grown so big they’ve taken in so much XRP from our community,” Rector said. “There’s a massive discrepancy from what he’s saying publicly and what investors are telling me privately.”

Rector said he has received fund reports and performance updates and claimed he is not sharing them publicly out of concern about retaliation, alleging investors have been warned not to share reporting and that reports are being watermarked with timestamps. He also made a specific performance claim: “one of the funds… has been losing money all year,” he said, adding it “lost over 4% on the year,” before fees, including “AUM fees of 2% in some cases.”

Rector’s broader point was that XRP holders are being asked to accept a “trust me bro relationship” around returns, even as he says he has not heard from any investor who can confirm “payments and distributions coming out” in a way that matches the marketing.

To explain why he views the trust gap as serious for XRP holders, Rector leaned on a prior legal dispute involving Claver and Digital Ascension. Rector said the case is public record and described it as “VeriVend versus Jacob Levi Claver and Digital Ascension Group” in the Western District of New York. He read from what he described as court filings and emphasized that the allegations and admissions, as he presented them, involve fabricated wire confirmations and impersonation.

“This is a serious deal,” Rector said, arguing the behavior he described should matter to XRP holders being asked to trust performance claims, NDAs, and time-sensitive narratives. He urged viewers to review the “answer to the complaint,” which he said includes admissions such as registering a VeriVend-related domain and fabricating purported wire transfer confirmations.

Rector also said the case settled, pointing to a “mediation certification” dated Feb. 12, 2025. He claimed, separately, that Claver paid the opposition in XRP to settle, an assertion Rector stated as a confirmation.

Rector framed his goal as containment rather than escalation, saying he wants the community “to stay together” and “not be divided,” but he also laid down an explicit remedy: third-party verification. “I want a third-party audit of those funds,” he said, arguing that absent audited financials he will not trust performance reporting tied to XRP strategies.

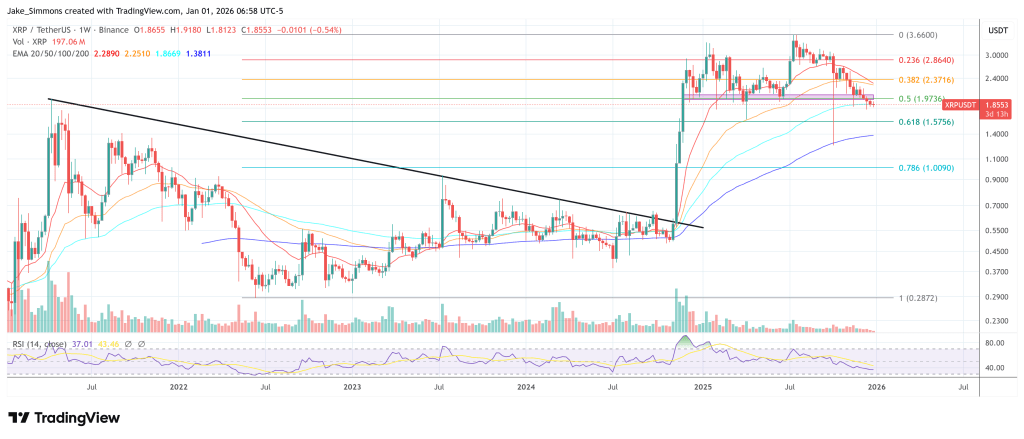

At press time, XRP traded at $1.85.

You May Also Like

The Channel Factories We’ve Been Waiting For

400 Dolar Altından Ethereum Toplayan Balinalarıyla İlgili Gizli Sinyal Ortaya Çıkarıldı!