Chainlink price shows technical compression near $12 with fading momentum due to weaker whale demand and muted trading volume. After an ABC corrective decline from December highs to $11.8 support, it remains range-bound, awaiting confirmation above $13.80 or below $11.80.

-

Chainlink price consolidates sideways post-recovery from $11.8–$11.9 lows, aligning with 78.6%–88.7% Fibonacci retracement.

-

Technical resistance at $13.8–$14.0 and higher levels caps upside amid shallow rebounds.

-

Whale holdings have declined recently, with weekly protocol fees dropping sharply since September, signaling reduced network demand.

Chainlink price nears $12 compression amid weak whale demand & muted volume. Key support at $11.80 holds as market awaits breakout. Analyze technicals & on-chain trends for next crypto move – read expert insights now! (152 characters)

What is the Chainlink price outlook amid current consolidation?

Chainlink price is stabilizing in a tight range near $12 after completing an ABC corrective pattern from mid-December highs, with the C-wave bottoming at $11.8–$11.9. This zone matches key Fibonacci retracement levels indicating exhaustion, but muted volume and limited buyer conviction prevent a confirmed reversal. Traders eye $13.80 as pivotal for bullish momentum.

Why is Chainlink price facing resistance despite support holding?

Chainlink price struggles against overhead barriers at $15.1 and $17.6, which coincide with prior highs and retracement levels from the broader decline. Shallow rebounds reflect buyer hesitation, exacerbated by a gravestone doji on the daily chart signaling rejection at higher prices. Intraday chop ties closely to Bitcoin movements, with $12.80 acting as a key pivot. According to on-chain analytics platforms like Santiment, volume remains subdued, underscoring the lack of strong participation. A sustained close above $13.8–$14.0 is needed for structural bullishness; otherwise, lower highs risk forming.

$LINK back to sideways mode.

One more c-wave low seems likely.. you buying it? pic.twitter.com/DVGn5kKPTL

— More Crypto Online (@Morecryptoonl) December 29, 2025

More Crypto Online highlighted this neutral structure with a slight recovery bias, noting repeated defenses of the demand zone near $11.80, which bolsters its technical significance. The analyst emphasized caution despite stabilization.

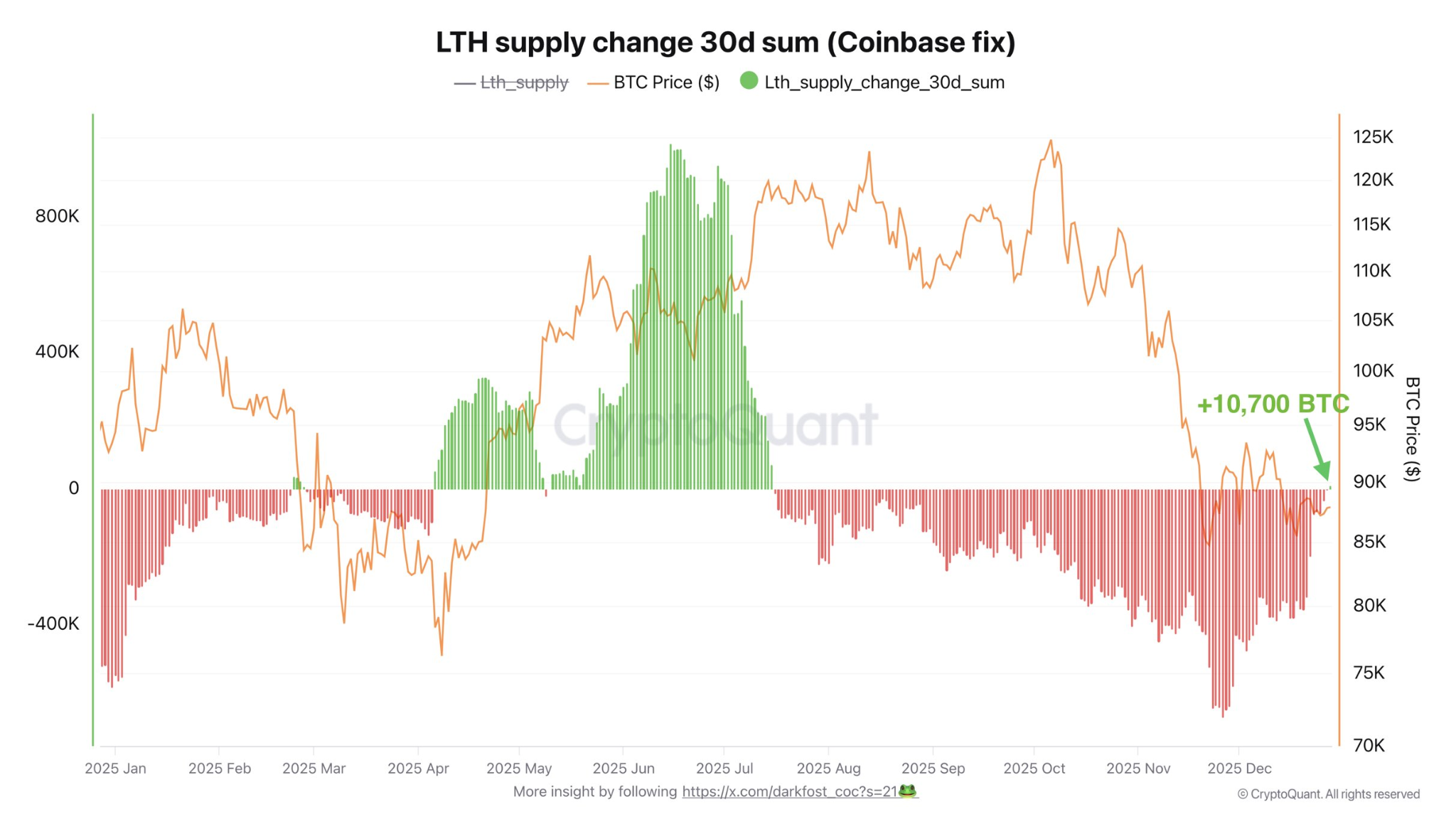

On the one-hour chart, Chainlink price exhibits indecision, compressed between firm support at $11.80 and resistance overhead. Broader market sentiment influences this range-bound action, as reduced whale accumulation signals caution among large holders. Data shows whale holdings peaked earlier in December before tapering, a pattern retail investors view as a cue for restrained positioning. Weekly protocol fees have fallen notably since September, per network reports, pointing to softer demand for Chainlink’s oracle services.

This combination of technical exhaustion and on-chain weakness keeps Chainlink price at an inflection point. Without expanded volume or a clear break, sideways trading persists as participants await directional cues from key levels.

Frequently Asked Questions

What factors are limiting Chainlink price upside near $12?

Key resistance at $13.8–$14.0, combined with declining whale demand and low trading volume, caps rallies. The price has formed shallow rebounds and a gravestone doji, indicating buyer rejection. On-chain metrics show reduced protocol fees, reinforcing consolidation until a breakout occurs.

Will Chainlink price break below $11.80 support soon?

Chainlink price currently holds firm support at $11.80–$11.90, a 78.6%–88.7% Fibonacci zone defended multiple times. While whale weakness adds pressure, no breakdown has materialized. A failure here could target lower, but sustained volume above $13.80 would invalidate bearish risks.

Key Takeaways

- Range-bound structure: Chainlink price consolidates post-ABC correction, with $11.80 support and $13.80 resistance defining the range.

- Muted momentum: Low volume and shallow rebounds limit upside, tied to broader market indecision.

- On-chain caution: Declining whale holdings and protocol fees suggest waiting for confirmation before new positions.

Conclusion

Chainlink price remains in technical compression near $12, shaped by post-correction consolidation, persistent resistance challenges, and weakening whale demand. Key levels at $11.80 support and $13.80 resistance will dictate the next move, with on-chain trends underscoring a cautious near-term outlook. Monitor volume expansion for breakout signals to position effectively in the evolving crypto landscape.

Source: https://en.coinotag.com/chainlink-price-may-stay-range-bound-near-12-amid-fading-whale-demand

![[ANALYSIS] Why Globe Telecom is a buy](https://www.rappler.com/tachyon/2025/07/PRESIDENT-MARCOS-MEETS-WITH-US-PRESIDENT-TRUMP-JULY-23-2025-08-scaled.jpg?resize=75%2C75&crop=487px%2C0px%2C1695px%2C1695px)