Lighter Team Faces Scrutiny Over Alleged $7.18 Million Secret Token Sales

An investigation into the Lighter (LIT) token ecosystem has sparked concern among investors. It follows blockchain analytics revealing coordinated sales worth $7.18 million since the Token Generation Event (TGE).

The activity has raised alarms over potential insider selling and transparency issues within the Lighter project, a decentralized finance (DeFi) protocol built on Ethereum.

Coordinated Deposits and Suspicious Patterns Cloud Lighter Sentiment

Five interconnected wallets received nearly 10 million LIT tokens from a recent airdrop, comprising roughly 4% of the circulating supply. They have already begun offloading significant portions of their holdings.

Analysts note that the pattern of deposits, token allocation, and sales suggests a deliberate strategy rather than organic market behavior.

Blockchain researcher MLM first highlighted the activity, noting that an entity deposited approximately $5 million USDC into Lighter’s liquidity protocol (LLP) around April 2025.

The funds were evenly split across five wallets, which subsequently received a total of 9,999,999.60 LIT tokens (~$26 million at the time of distribution).

Main wallets used to deposit into LLP:

- 0x30cD78B301192736b3D6F27Bdad2f56414Eb6164

- 0x9A6D9826742f1E0893E141fe48defc5D61866caD

- 0x7c5d228B0EB24Ad293E0894c072718430B07Dfe3

- 0xc0562d68b7C2B770ED942D28b71Bc5Aa0209bbee

- 0xfdBf615eC707cA29F8F19B7955EA2719036044bf

The round allocation and uniform distribution immediately drew attention, as they represent 1% of the total LIT supply and 4% of circulating tokens. This gives the entity considerable market influence.

In addition to the airdropped tokens, the wallets accrued another $1–2 million from LLP yield, increasing the total value at the entity’s disposal.

$7.18 Million in Sales Raises Community Alarm

Since the TGE, the linked wallets have sold 2,760,232.88 LIT tokens, equivalent to roughly $7.18 million. The prevailing sentiment is that the methodical nature of these sales suggests intentional liquidation rather than reactionary trading.

Blockchain investigator ZachXBT’s comment implies that the activity may reflect opportunistic insider behavior. Meanwhile, analyst Henrik questioned the implications for the broader LIT community.

The central issue remains the Lighter team’s silence. Investors cite a lack of official communication regarding token allocation, vesting schedules, and distribution mechanisms.

Without transparency, it becomes difficult to distinguish between legitimate market activity and potential insider selling.

The controversy arises at a critical moment for DeFi, amidst risks associated with crypto airdrops and token distributions.

Airdrops are designed to reward early adopters and encourage decentralized ownership. However, coordinated deposits and uniform allocations can allow a single entity to claim disproportionate rewards.

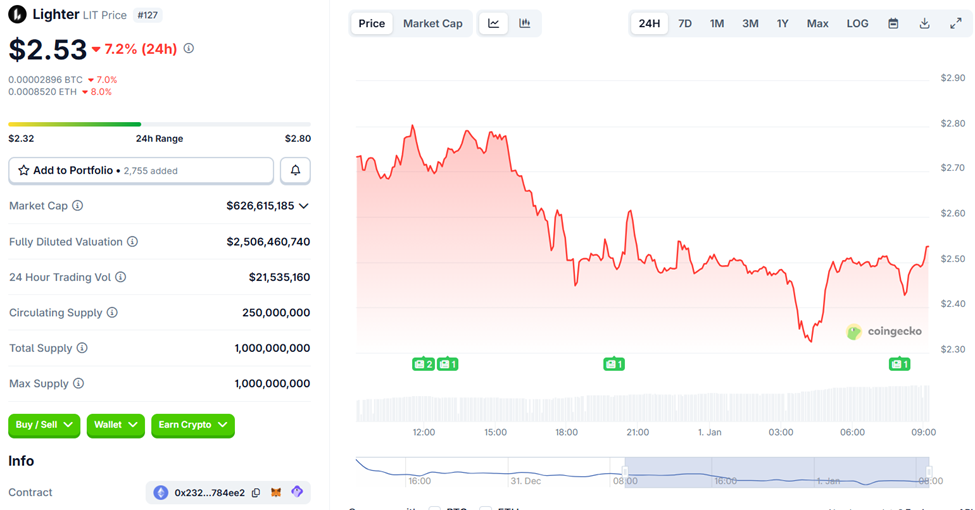

The reported sales are already putting downward pressure on the token’s price and fueling broader concerns about governance and leadership alignment. As of this writing, Lighter’s LIT token is down by over 7% and was trading for $2.53 as of this writing.

Lighter (LIT) Price Performance. Source: CoinGecko

Lighter (LIT) Price Performance. Source: CoinGecko

Additional sales from the remaining 7 million LIT in these wallets could further destabilize the LIT market.

You May Also Like

Coinbase verwacht versnelde crypto-adoptie in 2026 door ETF’s en stablecoins

a16z Outlines 17 Crypto Priorities for 2026, From Stablecoin Rails to Privacy