Cardano’s Midnight (NIGHT) Struggles as Price Faces Reversal

- Midnight’s price dips 8%, signaling potential market uncertainty ahead.

- Privacy hype fades, leaving Midnight’s momentum in question.

- Trading volume drops 18%, adding to Midnight’s volatile outlook.

Cardano’s Midnight (NIGHT) has seen a significant reversal in its price movement, with the asset experiencing an 8% drop in the last 24 hours. This marks a sharp contrast to its previous over 18% weekly gain. As the price slips, many investors are left questioning whether Midnight can maintain its momentum and possibly shed a zero to continue its bullish trajectory.

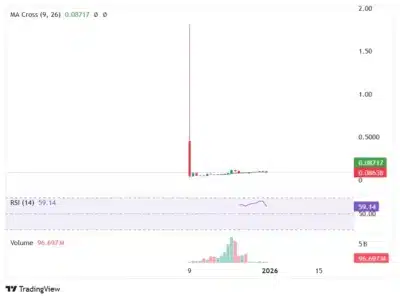

The Relative Strength Index (RSI) for Midnight recently hit 67, indicating overbought conditions following the sharp rally. Traders seized the opportunity for profit-taking after the price failed to break through the $0.09 resistance level. This decline in price has been accompanied by a drop in trading volume, which fell by 18.53% to $94.68 million, adding to the asset’s increasing volatility.

Also Read: Roundhill Files Updated XRP ETF Amendment with SEC: A Step Forward for Ripple

Price Movement and Market Impact

Midnight’s recent price dip has left the market with a sense of uncertainty. At the time of writing, NIGHT is trading at $0.08814, a decrease of 8.56% in the past 24 hours. The asset had surged earlier to a daily high of $0.1015, but it soon reversed its course. The significant loss of momentum has raised concerns that the price could further dip below the $0.085 support level, potentially bringing it down to the $0.075–$0.08 range.

Source: Tradingview

This sharp decline follows a meteoric rise for Midnight, which reached an all-time high of $1.81 on December 9, 2025. At its peak, the asset experienced massive trading volumes, even exceeding $3.5 billion. However, as of now, Midnight’s price is substantially lower than it was at its height, and its momentum seems to have faded quickly.

Despite the recent downturn, the asset has still managed to enter the top 100 cryptocurrencies, thanks to its impressive performance within just three weeks of its launch. However, the loss of enthusiasm for privacy coins, including Midnight, is likely to continue contributing to its price struggle.

Shifting Sentiment as Privacy Hype Fades

The initial surge in Midnight’s price was largely attributed to the growing hype around privacy coins. As other assets like Zcash faced fluctuations, Midnight became a prominent player in the privacy-focused cryptocurrency sector. Before the holidays, Midnight surged by 20%, outperforming the broader crypto market, which saw a more modest 0.98% increase. However, this boost has now faded, and many investors appear to be capitalizing on the gains made during the asset’s bullish run.

While Midnight’s potential remains, its future price trajectory is uncertain. Without the sustained interest in privacy-focused assets and amid growing market volatility, the likelihood of Midnight returning to its December highs looks increasingly slim. The continued shift in investor sentiment away from privacy coins leaves Midnight in a precarious position.

The current market uncertainty, paired with the fading hype around privacy protocols, may leave Midnight struggling to regain its former momentum. As the asset faces increased pressure, traders and investors will closely monitor its next moves, especially in the face of potential further price drops.

Also Read: Pundit: “They Are Manipulating XRP Again, and it Shows,” Here’s What Happened

The post Cardano’s Midnight (NIGHT) Struggles as Price Faces Reversal appeared first on 36Crypto.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Craft Ventures Opens Austin Office