Trend Research Increase Ethereum Holdings to $1.8B, Remains Bullish for 2026

Highlights:

- Trend Research bought $35 million in Ether, now holding over 601,000 ETH worth $1.83 billion.

- Founder Jack Yi is bullish on crypto and expects positive market factors in 2026.

- Sharplink expects Ethereum TVL and tokenized assets to grow ten times next year.

Hong Kong-based investment firm Trend Research has increased its Ether holdings by $35 million. This brings its total ETH to over 601,000, valued at roughly $1.83 billion, according to blockchain analytics platform Lookonchain. The firm has borrowed $958 million in stablecoins from the decentralized lending platform Aave. The average purchase price for Ether was around $3,265.

Trend Research continues this strategy despite expected market fluctuations. Founder Jack Yi said he is bullish on crypto for early 2026. He will keep buying Ether until the bull market returns. He also holds a large amount of World Liberty Financial (WLFI) tokens linked to the Trump family.

Trend Research Stays Bullish While Fundstrat Predicts Ether Drop

Yi expects 2026 to bring positive factors like on-chain finance, stablecoins, rate cuts, and crypto-friendly policies. This shows strong confidence in crypto growth. Trend Research differs from firms that rely only on dollar-cost averaging, like BitMine Immersion Technologies, the largest corporate ETH holder. The firm is the third-largest Ether holder after BitMine and Sharplink Gaming. As an unlisted company, it often does not appear on tracking platforms like StrategicEthReserve.

While others remain optimistic, Fundstrat Global Advisors predicts a different outcome for Ether. Tom Lee, co-founder and managing partner, expects it could fall to about $1,800 in early 2026. Screenshots from December 21 revealed Lee’s note warning of a “meaningful drawdown” for BTC, ETH, and SOL during the first quarter of 2026. The internal Fundstrat note predicts BTC may fall to $60k–$65k, ETH to $1,800–$2,000, and SOL to $50–$75. This could create buying opportunities later in 2026.

Lee suggested a “durable low” might form in the first or third quarter. He said this could lead to a shallower bear market than previous cycles. This bearish outlook surprised some investors because Lee is also chairman of BitMine, which holds about $12.3 billion in ETH.

Moreover, crypto analyst Benjamin Cowen said Ether is unlikely to reach new highs next year. At the time of publication, Ether was trading at $2,969, down 1.17% over the past 30 days, according to CoinMarketCap.

Ethereum TVL Growth and Stablecoin Expansion

Following Trend Research’s optimistic 2026 outlook, Sharplink Gaming’s co-CEO Joseph Chalom expects Ethereum’s total value locked (TVL) to grow ten times in 2026. This growth will come from more institutions and wider use.

Sharplink holds 797,704 ETH, worth about $2.33 billion. This makes it the second-largest public Ethereum treasury. Chalom also said the stablecoin market could reach $500 billion by the end of 2026. This is up from around $308 billion today. Since 54% of stablecoin activity is on Ethereum, this growth could increase the network’s TVL.

Chalom expects tokenized real-world assets (RWAs) to grow a lot. He forecasts the market will reach $300 billion in 2026. He said tokenized assets will 10X in AUM in 2026. They will grow from individual funds, stocks, and bonds to full fund complexes.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

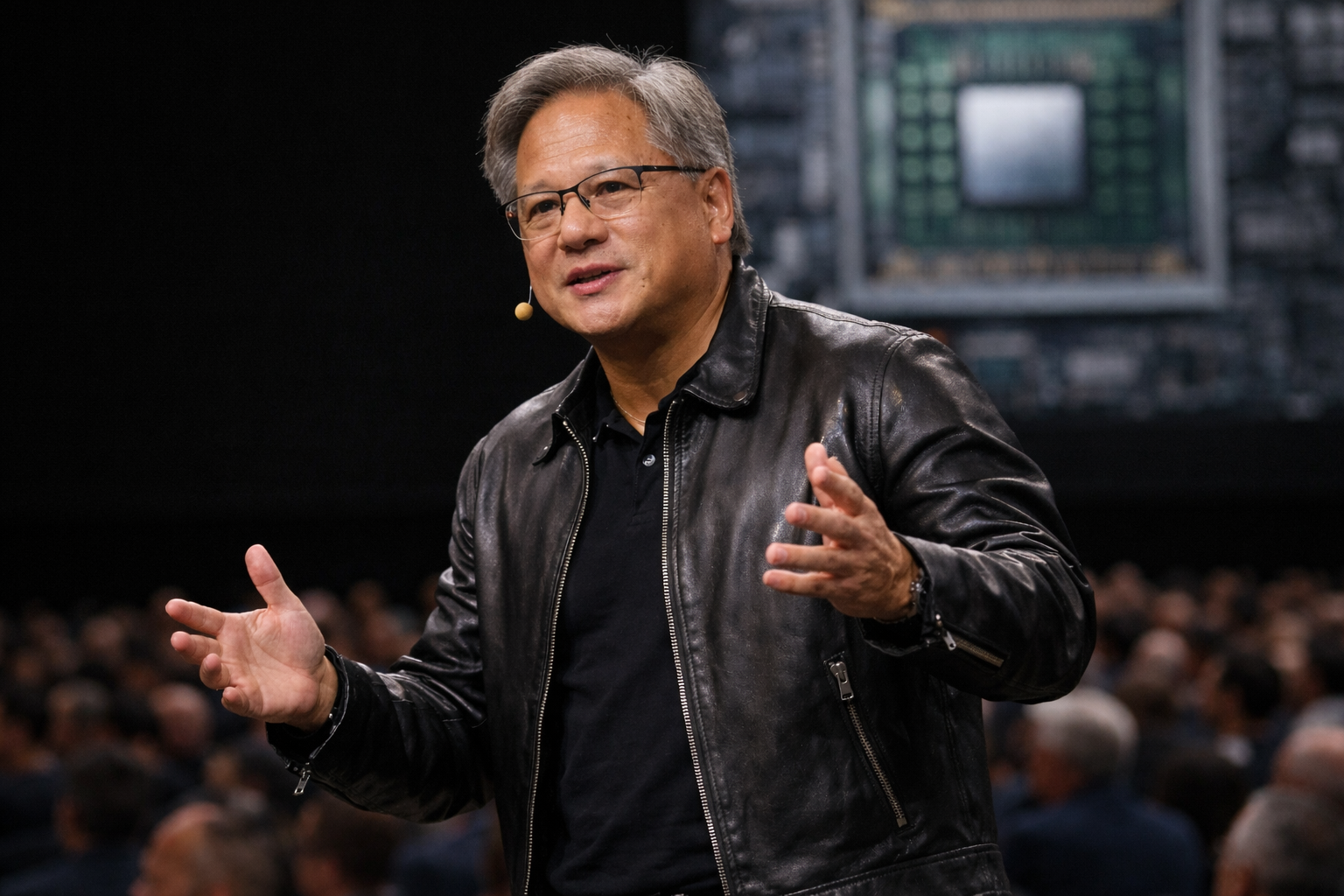

Nvidia’s Jensen Huang believes markets are wrong on software selloff

Stunning Three-Year High Against USD Fueled By Hawkish RBA Bets