Crypto Damus: Bitcoin Astrology Is Back In 2026, What To Know

Bitcoin traders are used to charts, funding rates, and Fed dot plots. But top astrologer Crypto Damus is also making predictions.

Better known online as @AstroCryptoGuru, he’s been making the rounds arguing that 2026 will be a structural inflection point for , markets, and geopolitics.

His thesis blends financial astrology with technical analysis and macro context, and while it won’t convince everyone, it has found an audience precisely because traditional signals feel more like BS.

DISCOVER: Top 20 Crypto to Buy in 2025

Crypto Damus: Why February 2026 Keeps Showing Up on Traders’ Radar

Damus points to mid-February 2026 as a convergence window. A solar eclipse on February 17 coincides with the beginning of the Chinese Fire Horse year, followed days later by a rare Saturn–Neptune conjunction on February 20. Historically, he argues, those alignments have clustered around periods of upheaval rather than clean market trends.

Vibes, serendipity, gut feelings, intuition, TA, astrology. Hey, you gotta follow something!

Fire Horse years are often cited in Chinese astrology as unstable or disruptive. Damus links prior examples to events like the 1906 San Francisco earthquake and the 1966 Cultural Revolution. Whether correlation or coincidence, the point he makes is simpler. Markets tend to break when multiple stressors hit at once.

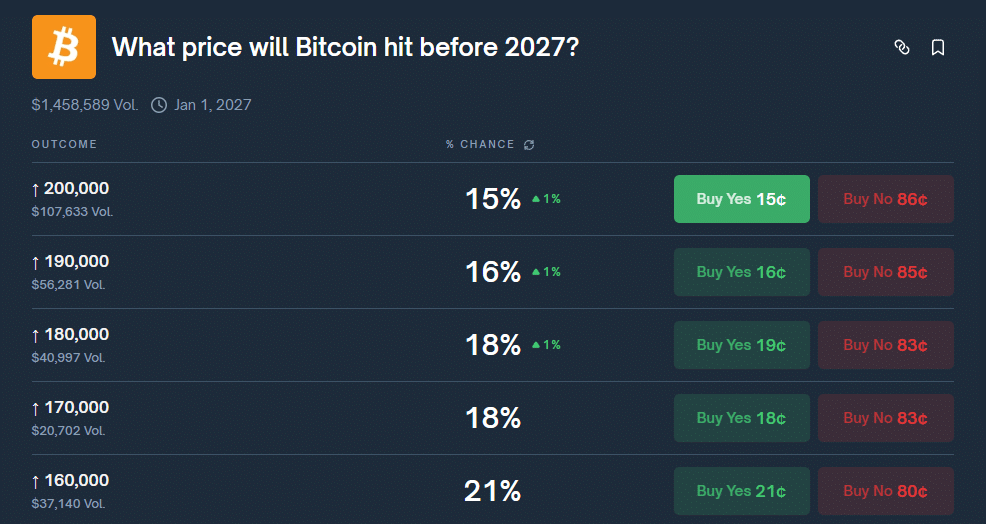

(Source: Polymarket)

(Source: Polymarket)

Bitcoin has spent much of late 2025 consolidating below prior highs, even as gold and silver continue to show relative strength. CoinGecko data shows Bitcoin dominance holding steady, but with RSI trending towards 80, or “overbought.”

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Astrology as a Risk Lens, Not a Trading System

Damus’ method is not pure astrology. He combines planetary transits with Bitcoin’s so-called natal chart, technical levels, and macro indicators. Saturn transits, he argues, often coincide with drawdowns or stagnation phases. Mars and Mercury alignments can signal bursts of momentum. He has pointed to correct calls in past cycles, including mid-2024 weakness tied to Saturn transiting Bitcoin’s Uranus.

TA has the same effect as astrology on markets, i.e., some..

I am not suddenly trading based on planets, but I understand why this resonates. When markets feel over-financialized and under-explained, people reach for frameworks that emphasize timing over narrative.

EXPLORE: Seeking a Career Change? Become a Bitcoin Bounty Hunter in Fordow, Iran

Key Takeaways

- Damus points to mid-February 2026 as a convergence window.

- BTC has spent much of late 2025 consolidating below prior highs, even as gold and silver continue to show relative strength

The post Crypto Damus: Bitcoin Astrology Is Back In 2026, What To Know appeared first on 99Bitcoins.

You May Also Like

Hong Kong Backs Commercial Bank Tokenized Deposits in 2025

TechCabal’s most definitive stories of 2025