Anthropic’s Claude AI Predicts the Price of SOL, XRP, and SUI by the End of 2025

Anthropic’s Claude AI, widely regarded for its conservative and transparent analytical style, has released forward-looking price projections for Solana (SOL), Ripple’s XRP, and Sui (SUI) as 2025 draws to a close.

According to the model, all three assets are entering a period of heightened volatility, with the potential for sharp price movements beginning around Christmas and extending into early 2026, a window historically marked by thin liquidity and exaggerated market reactions.

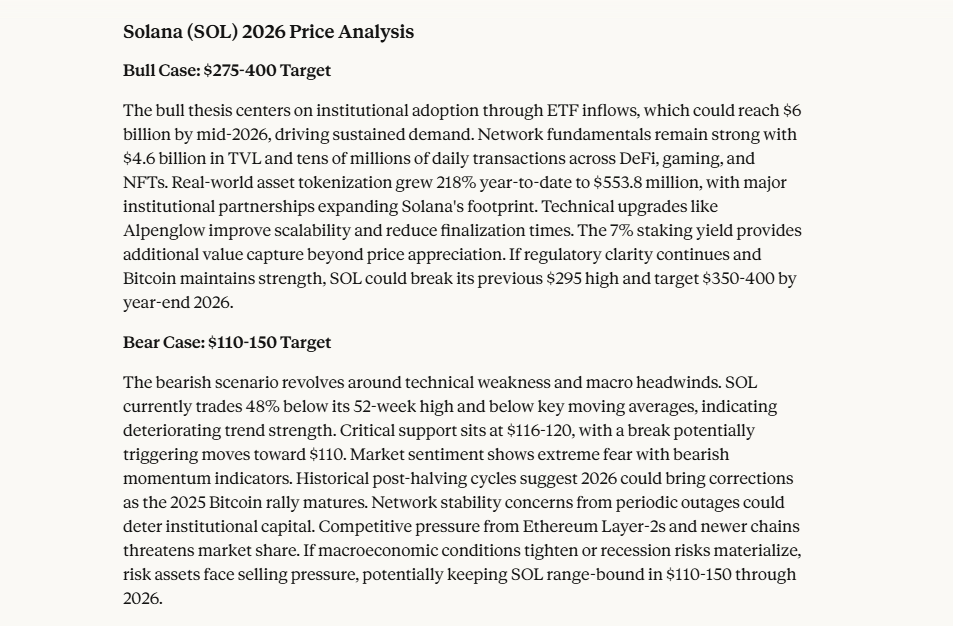

Claude AI Projects SOL $275–$400 Bull Case vs $110–$150 Bear Range

Claude AI’s bullish outlook for Solana aligns closely with projections from Bitwise and other institutional analysts who expect SOL to set new all-time highs by 2026, with upside targets ranging between $275 and $400.

This thesis is anchored on three core drivers: accelerating ETF adoption, improving technical infrastructure, and growing real-world asset tokenization.

Source: Claude AI

Source: Claude AI

By mid-2025, Solana-linked ETFs had already attracted more than $2 billion in inflows, with JPMorgan estimating that figure could reach $6 billion by mid-2026.

On-chain fundamentals further reinforce this optimism, as Solana’s total value locked surged to $4.6 billion, while the network processes tens of millions of daily transactions across DeFi, gaming, and NFT ecosystems.

However, Claude’s bearish scenario highlights technical fragility and macro risks. Key support at $116–120 remains critical, with a breakdown potentially opening a move toward $110–150.

Claude AI Says XRP Targets $5–$8 Upside With $1.40–$2.15 Downside Risk

Claude AI identifies regulatory clarity and ETF-driven institutional demand as the backbone of XRP’s bullish case.

Following Ripple’s settlement with the SEC, XRP ETFs reportedly attracted over $1 billion within weeks, with projections of $4–8 billion in inflows by late 2026.

This surge has removed roughly 15% of the circulating supply from exchanges, introducing structural scarcity.

The launch of Ripple’s RLUSD stablecoin adds another layer, as increased stablecoin activity could drive XRP liquidity demand.

Tokenized real-world assets on the XRP Ledger reached $394.6 million, while Ripple has stated ambitions to capture 14% of SWIFT’s $20+ trillion payment volume over the next five years.

Under supportive macro conditions and continued regulatory clarity, Claude projects XRP could reach $5–8 by the end of 2026.

The bearish outlook, however, centers on declining on-chain usage. Monthly transaction volumes have trended downward for two years, raising doubts about XRP’s role as a bridge currency.

Competition from stablecoins like USDC and high-performance chains such as Solana and Cardano further pressures adoption.

XRP remains 48% below its July 2025 high of $3.66, and failure to break resistance near $2.35 could see it consolidate between $1.40 and $2.15 through 2026.

Anthropic’s Claude AI Says SUI Targets $4–$7 Growth Despite $1.10–$1.70 Consolidation Risk

Claude AI assigns SUI a bullish target range of $4–7, driven by explosive DeFi growth and rising institutional interest.

Sui’s TVL has surged from $25 million at launch to over $2.6 billion, making it the fastest-growing non-EVM Layer-1.

Daily DEX volumes reached $367.9 million, while stablecoin market capitalization surpassed $415 million following native USDC integration.

Institutional momentum is building, with Grayscale launching SUI Trust products and 21Shares filing for a spot ETF.

Still, SUI trades 67% below its $4.33 all-time high and below its 200-day moving average, signaling technical damage.

Despite strong ecosystem metrics, price weakness reflects investor caution. Claude’s bearish scenario places SUI in a $1.10–1.70 consolidation range if macro conditions deteriorate post-2025.

Maxi Doge (MAXI) Presale Draws $4.4M in Early Capital

While Claude’s analysis focuses on large-cap assets, early-stage presales can offer asymmetric upside.

Maxi Doge ($MAXI) has raised nearly $4.4 million and positions itself as a next-generation Dogecoin alternative on Ethereum’s proof-of-stake network.

The presale offers staking rewards of up to 71% APY, with the token currently priced at $0.0002745 ahead of scheduled stage increases.

To get into the presale, visit the official presale website and stay updated through Maxi Doge’s official X and Telegram channels.

Visit the Official Maxi Doge Website HereYou May Also Like

Fed Q1 2026 Outlook and Its Potential Impact on Crypto Markets

Taiko Makes Chainlink Data Streams Its Official Oracle