Hayes argues Fed liquidity, not halving cycles, now drives Bitcoin’s price

Arthur Hayes says the old Bitcoin clock no longer matters. He says liquidity now runs everything. He ties Bitcoin’s future to how quickly dollars are created and how discreetly that creation is sold to the public.

In his latest essay, Arthur frames money printing as a language game run by politicians and central bankers, where new acronyms exist to hide inflation while keeping markets alive. He says Bitcoin no longer moves on a clean four‑year rhythm and instead reacts to how aggressively balance sheets expand.

Arthur traces this thinking back to the post‑2008 world. After March 2009, risky assets escaped what he calls a deflation trap. The S&P 500, Nasdaq 100, gold, and Bitcoin all surged as central banks pushed liquidity into the system.

The crypto leverage trader points out that when returns are normalized to a 2009 base, Bitcoin’s performance sits in a category of its own.

Central banks rename money printing and keep it moving

Arthur wrote:-

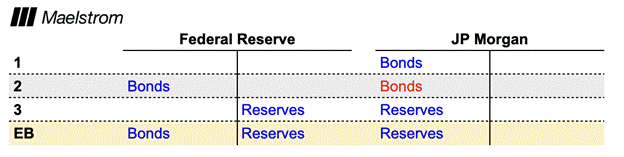

Arthur walks through how QE works in steps. He says the Fed buys bonds from a primary dealer like JP Morgan. He says the Fed creates reserves from nothing and credits the bank. He says the bank then buys new Treasury debt because yields beat reserves. He says the Treasury receives the cash into the TGA. He says spending follows. He says asset prices rise first. He says goods and services inflation comes later when the government spends.

Source: Arthur Hayes/Maelstrom

Source: Arthur Hayes/Maelstrom

Arthur then says money market funds hold about 40% of outstanding T‑bills, while banks hold around 10%. He uses Vanguard as an example. Under RMP, the Fed buys bills from a fund and credits its reverse repo account. That cash earns interest.

If new bills yield more than the reverse repo rate, the fund buys them. The Treasury receives that cash. Arthur says this directly funds government issuance.

If bill yields do not beat the reverse repo rate, Arthur says funds lend into the repo market. He describes repo loans backed by Treasury bonds. With the upper Fed Funds rate near 3.75%, funds can earn more in repo than at the Fed.

Housing, Bitcoin, and the end of the four‑year cycle

Hedge funds tend to borrow in repo to buy bonds, and the Bank of New York Mellon clears the trade, so that this so-called Fed‑created money ends up financing longer‑dated government debt. Arthur calls this “a thin disguise” for QE that still feeds both asset prices and spending.

Cryptopolitan verified that the Fed has always classified RMP as technical, not stimulative, so it can be expanded or shrunk without a clear public vote as long as reserves stay “ample,” though Treasury Secretary Scott Bessent still effectively controls the short end of the curve through issuance.

Arthur ties RMP to housing through Treasury buybacks. After Trump eased tariffs, Bessent said buybacks could calm markets. Arthur says bill issuance can fund buybacks of 10‑year bonds, pushing yields lower, which reduces mortgage rates.

You can see now that this structure forces continued bill reliance, which will logically kill the four‑year Bitcoin cycle.CoinGlass’ data shows that Bitcoin fell about 6% after RMP began, while gold rose 2%.

And whenever the Fed adds liquidity, the dollar weakens, and then China, Europe, and Japan will all respond with their own credit creation to protect exporters.

Arthur expects that to happen this time too and predicted that the synchronized balance sheet will see massive (perhaps even unprecedented) growth in 2026.

Arthur also believes that Bitcoin could trade between $80,000 and $100,000 while markets debate RMP, but sees a rally to $124,000 and shortly $200,000 after that once RMP is accepted as QE.

“$40 billion per month is great, but as a percentage of dollars outstanding, it’s much less in 2025 than in 2009. Therefore, we cannot expect its credit impulse at current financial asset prices to be as impactful. For this reason, the current misguided belief that RMP < QE in terms of credit creation,” said Arthur.

If you're reading this, you’re already ahead. Stay there with our newsletter.

You May Also Like

Regulation Advances While Volatility Masks the Bigger Picture

U.S. Labor Market Weakness Forecasts Potential Fed Rate Cuts