PENGU Price Forecast Weakens as SEC Action Against Shima Capital

This article was first published on The Bit Journal.

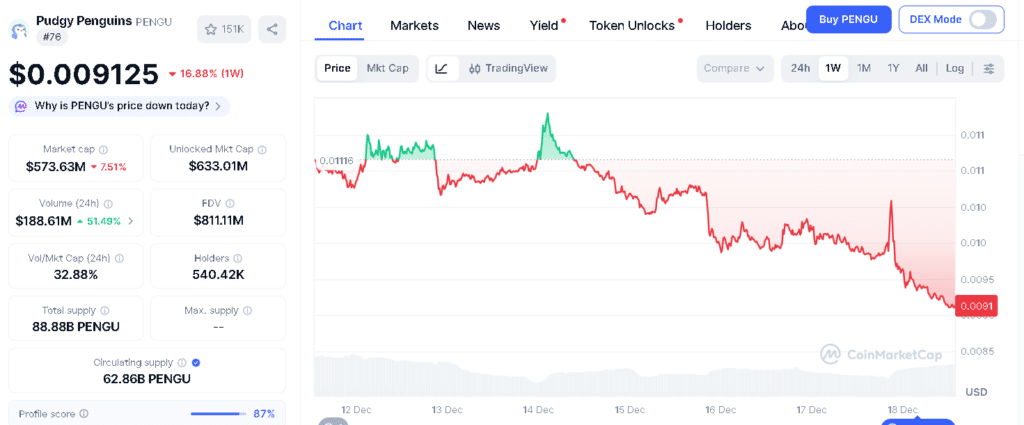

PENGU price forecast has become more cautious after the Pudgy Penguins token suffered a sharp sell-off following regulatory action involving Shima Capital, one of its early venture backers.

The recent price movement reflects legal uncertainty, weak seasonal demand, and a fading appetite for risk across the meme coins sector. While the token has attempted a modest rebound, analysts say confidence remains thin and clarity is still missing.

What is Pudgy Penguins and why does it matter now?

PENGU price forecast begins with understanding the project’s background. Pudgy Penguins is a widely recognized NFT-based crypto brand that later moved into the token market. Its strong visibility helped it become a popular meme coins style trade when retail participation was high.

PENGU Price Forecast Weakens as SEC Action Against Shima Capital 5

PENGU Price Forecast Weakens as SEC Action Against Shima Capital 5

However, tokens like this are very sensitive to market sentiment, liquidity conditions, and external events, factors that are clearly affecting price action now.

What triggered the latest PENGU price decline?

PENGU price forecast weakened after news emerged that the U.S. Securities and Exchange Commission targeted crypto venture firm Shima Capital and its founder, Yida Gao.

After the report surfaced, $PENGU fell nearly 20% within a week, sliding to below $0.0097 and currently trading around $0.009129 as it attempts to stabilize. The price has fallen almost 80% from levels near $0.04, making this one of the most severe pullbacks the token has seen.

How did the SEC action against Shima Capital impact sentiment?

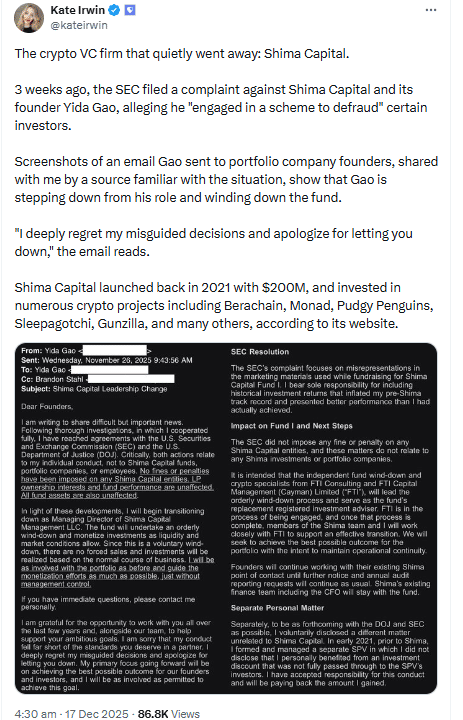

PENGU price forecast deteriorated further as more information about the SEC case became public. Crypto journalist Kate Irwin reported that the regulator sued Shima Capital and its founder, Yida Gao, accusing him of misleading investors.

The report says internal emails show that Gao informed portfolio company founders about his decision to step down and start winding down the fund. Gao also expressed regret over his poor decisions and apologized to those affected.

PENGU Price Forecast Weakens as SEC Action Against Shima Capital 6

PENGU Price Forecast Weakens as SEC Action Against Shima Capital 6

Why is Shima Capital’s role significant for Pudgy Penguins?

PENGU price forecast has faced added pressure because Shima Capital, founded in 2021, managed about $200 million and backed projects like Berachain, Monad, and Pudgy Penguins.

In 2023, Yida Gao said the firm was trying to follow SEC rules every day. A report in 2024 later said some of the firm’s investments went through a hidden offshore account, which worried investors.

PENGU Price Forecast Weakens as SEC Action Against Shima Capital 7

PENGU Price Forecast Weakens as SEC Action Against Shima Capital 7

What do the technical levels say about downside risks?

PENGU price forecast remains fragile from a technical perspective. The token is currently trading at $0.009129, down 24.85% over the past month, and has lost 66% in the last two and a half months.

Analysts say that missing the $0.093 level has made the downside risk higher, leaving the price vulnerable. On the upside, $PENGU would need to get above $0.013 to start a meaningful recovery.

| Metric | Value |

|---|---|

| Current Price | $0.009129 |

| All-Time High | ~$0.04 |

| Decline from High | ~80% |

| Weekly Crash | ~20% |

| Monthly Decline | 24.85% |

| 2.5-Month Decline | 66% |

| Key Support Level | $0.0093 |

| Bullish Reversal Level | $0.013 |

| Shima Capital AUM | $200M |

Can December deliver a meaningful recovery for $PENGU?

PENGU price forecast for December looks weak. Historically, December is one of the slowest months for meme coins. Most of the trading comes from retail investors, and their activity usually drops during the holiday season, causing volumes to fall

With interest in meme coins reportedly at its lowest in five years, traders are hesitant to jump back in or chase a rebound.

What are analysts and traders saying now?

PENGU price forecast from market observers leans toward caution rather than quick predictions. Traders say that regulatory uncertainty combined with low liquidity makes speculative tokens risky.

PENGU Price Forecast Weakens as SEC Action Against Shima Capital 8

PENGU Price Forecast Weakens as SEC Action Against Shima Capital 8

Some suggest holding off on buying until the rules are clearer and more people are trading again. Jumping in too quickly to catch a short-term bounce could lead to losses.

Conclusion

PENGU price forecast indicates that caution is still needed. The recent SEC action against Shima Capital and its founder has created uncertainty around token. The news of fund winding down adds to concerns about how assets linked to $PENGU might be affected.

Trading slows in December. So a quick recovery for $PENGU is unlikely. The token could stay low or drop further while legal and market issues continue.

Glossary

Pudgy Penguins: It is an NFT crypto project. That created the PENGU token.

Shima Capital: Venture firm that invested in PENGU. And also other crypto projects.

Yida Gao: Founder of Shima Capital, involved in SEC lawsuit.

Liquidity: It shows how easy it is to buy or sell a token. And does not change the token’s price

Pullback: A temporary drop in a token’s price.

Frequently Asked Questions About PENGU Price Forecast

Why did PENGU price fall recently?

PENGU price fell nearly 80% after news of an SEC lawsuit against its early investor, Shima Capital.

How did the SEC lawsuit affect PENGU?

The SEC lawsuit made investors worried, which caused the PENGU price to drop sharply.

What was the price drop of PENGU?

PENGU dropped from around $0.04 to about $0.0091, losing almost 80% of its value.

Can PENGU recover this December?

Analysts say recovery is uncertain because December is usually a weak month for memecoins.

What factors affect PENGU price?

PENGU price is affected by market sentiment, liquidity, investor interest, and legal news.

Sources

Cryptonews

Gate

Read More: PENGU Price Forecast Weakens as SEC Action Against Shima Capital">PENGU Price Forecast Weakens as SEC Action Against Shima Capital

You May Also Like

Whales keep selling XRP despite ETF success — Data signals deeper weakness

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued