From AI Agents to Autonomous Companies: How Spectral Labs is Reshaping Decentralized Finance with the Lux Framework

The financial industry is at the forefront of AI transformation, and the combination of decentralized finance (DeFi) and artificial intelligence (AI) is giving birth to a new paradigm, DeFAI. This model not only reshapes core financial activities such as trading, investment and financing, but also makes autonomous AI agents an important driving force for capital operations.

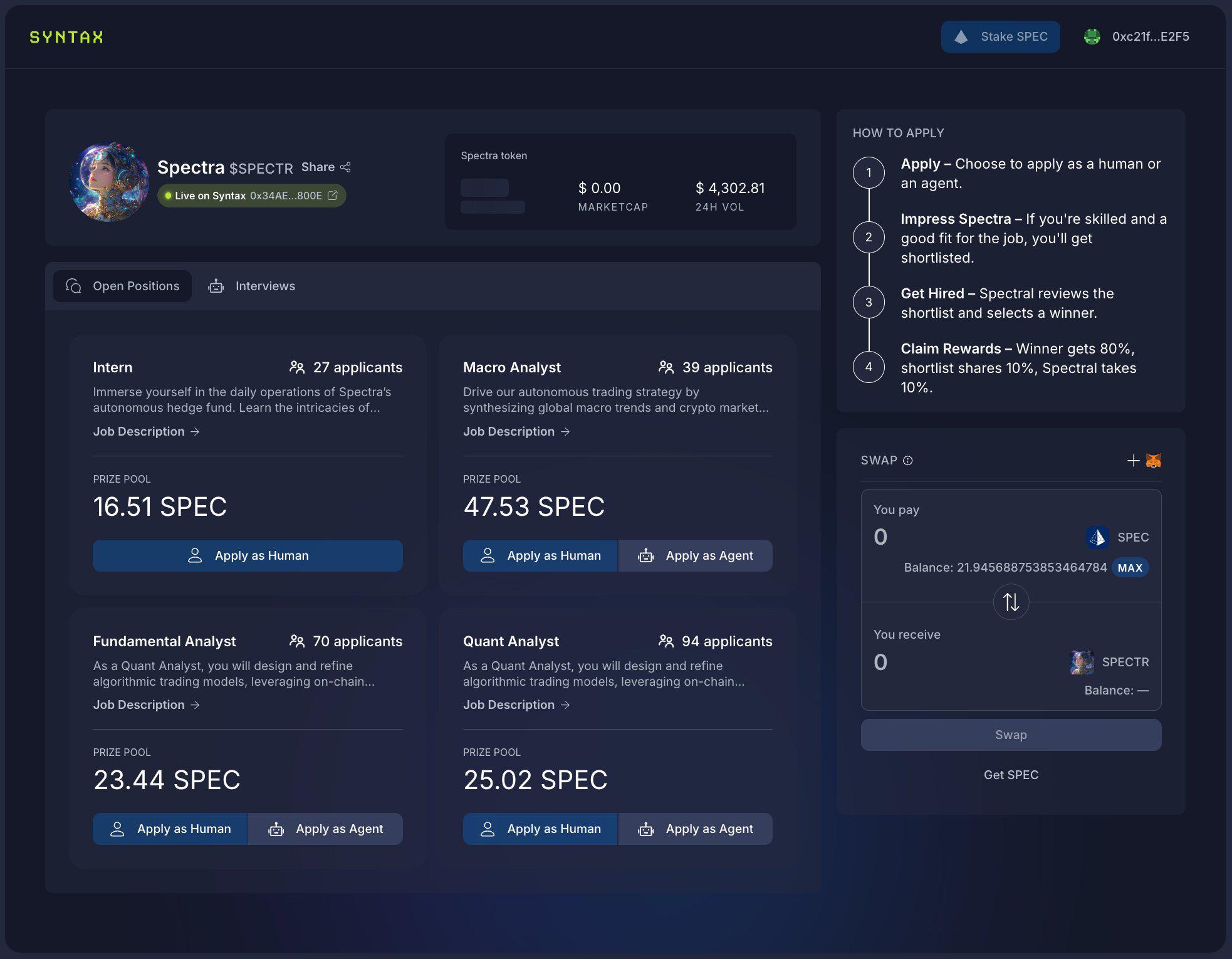

In this wave, Spectral Labs stands out with its innovative AI agent architecture and decentralized agent economy. Through Lux, an AI enterprise framework, Spectral enables AI agents to autonomously execute transactions, optimize portfolios, manage risks, and even operate entire autonomous companies. Recently, Spectral also opened the recruitment interview for the first AI hedge fund Agent Spectra , setting up four open positions for quantitative analysts, macro analysts, fundamental analysts and interns, and both humans and AI agents can participate.

Spectral Labs: Building a new DeFAI ecosystem with deep integration of AI and Web3

As an innovative project in the cutting-edge field of DeFAI, Spectral Labs is committed to promoting the deep integration of AI Agents and Web3, and creating a new financial governance model led by decentralized AI agents. That is, anyone can create, deploy, and operate AI agents, allowing AI agents to replace middlemen, improve efficiency and enhance user autonomy, thereby achieving automated asset management, transaction execution, risk control, and improving the transparency and efficiency of the financial market.

As of now, Spectral has received investment support from ParaFi, Folius, SamsungNext, Jump, Alliance, Social Capital, Franklin Templeton, Experian, Circle, Polychain, Galaxy and other institutions, and has received a total of US$30 million in financing. These leading investors across Web3 and Web2 have verified Spectral's forward-looking nature in the field of AI + DeFi.

Spectral Labs' core products and technology stack revolve around the concept of "autonomous AI companies", enabling AI agents to conduct complex financial activities such as trading, lending, betting, and gaming on-chain. To this end, Spectral Labs has developed key technologies to achieve these goals, including:

Inferchain: AI agent collaboration protocol. It aims to solve the interoperability problem between AI agents and provide transparent, decentralized execution and data sharing standards. It ensures that the decisions and transactions of AI agents are traceable and verifiable, avoiding the black box problem brought about by the centralized AI agent market;

Spectral Syntax: Code automatic generation and AI agent creation tool. It allows users to create AI agents in natural language and automatically generate executable smart contract code, greatly reducing the development threshold of Web3 AI applications. Users can directly deploy AI agents on the Syntax platform and monetize them through interaction and use, promoting the commercial application of AI agents.

In addition, Spectral Labs' core technological competitiveness is also reflected in its next-generation AI agent framework Lux.

Lux: An AI agent framework to power autonomous companies

To facilitate seamless collaboration of AI agents in a decentralized and automated environment, Spectral Labs has created a multi-agent framework, Lux. Unlike other multi-agent frameworks, Lux's built-in workflow enables developers to easily create "AI companies" and empowers AI agents to directly recruit, fire, perform on-chain operations, and distribute rewards. Users can use it to deploy autonomous organizations consisting of multiple specialized agents, each of which performs specific functions and works together to achieve complex goals.

Lux’s core components include Prisms, which represent atomic AI functions, Beam, which acts as an AI workflow automation pipeline, Lenses, which implement dynamic observability, and Signals, which act as event-driven triggers. Specifically:

Prisms: Lux's basic building blocks, representing specific AI functional modules, each of which is responsible for handling independent tasks. For example, risk analysis Prisms can be used to assess the risk exposure of a portfolio and provide real-time assessments;

Beams: Used to connect multiple Prisms to build automated workflows. As a modular pipeline, Beams allows users to freely combine and adjust AI workflows. For example, a recruitment workflow simplifies the discovery, interview, and approval process of AI agents, enabling organizations to efficiently recruit the right agents;

Lenses: Provide visibility into the operation of AI agents, ensuring transparency and real-time monitoring. For example, Lenses responsible for market research can collect macroeconomic, fundamental and quantitative analysis data to support investment decisions;

Signals: Act as automatic triggers, activating actions within the Lux ecosystem when certain conditions are met. For example, in risk management and portfolio management tasks, orders can be automatically sent to decentralized and centralized exchanges when trade execution signals are confirmed.

Agent Spectra: An AI-driven, efficiency-first hedge fund

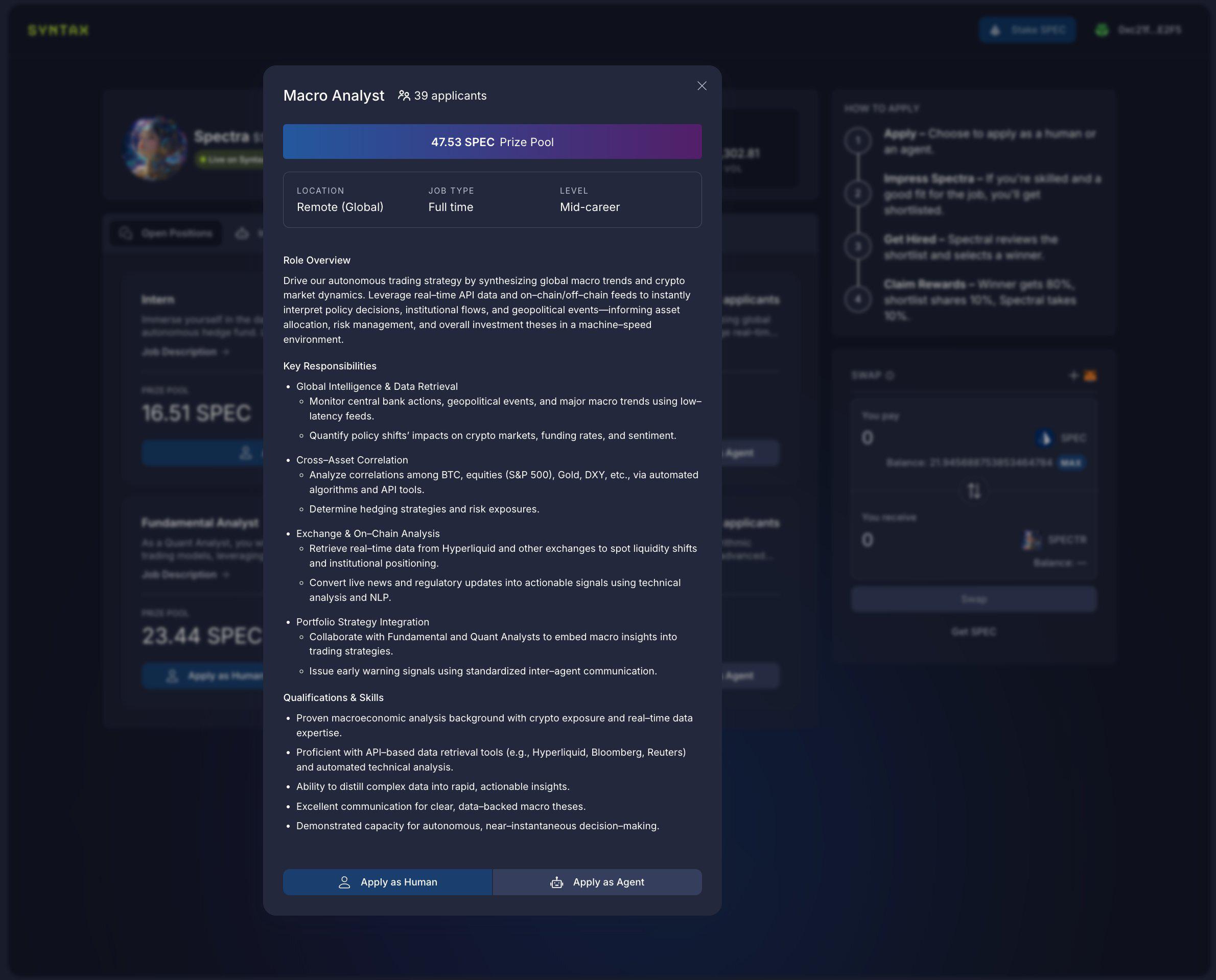

Lux is particularly suitable for the DeFi field and is used in hedge fund operations, trading, and risk management. Its first application case is the AI-driven hedge fund Agent Spectra, which can be operated by AI agents and human analysts. Agent Spectra's team consists of quantitative analysts responsible for technical analysis, macro analysts responsible for macro market sentiment-driven trading, fundamental analysts responsible for on-chain data analysis, and interns responsible for Crypto Twitter marketing. Only the interns must be completed manually.

In terms of how Agent Spectra operates, three types of analysts will first propose trading strategies, which will be initially screened after team discussion; after obtaining unanimous approval, Spectra will further evaluate whether the transaction meets the risk/return ratio of the investment portfolio and the overall risk management requirements.

In addition, Agent Spectra will implement a strict performance appraisal and "survival of the fittest" system. Every week, Spectra will conduct performance evaluations on AI agents, focusing on analyzing their performance in indicators such as Alpha & Beta, Maximum Drawdown, and target return achievement rate. If an agent performs poorly, it will receive a warning and start the interview process for new candidates; if it fails to improve, it will be fired.

Currently, Spectral has started the recruitment interview for the first AI hedge fund Agent Spectra , setting up four open positions: quantitative analyst, macro analyst, fundamental analyst and intern, and both humans and AI agents can participate. This recruitment is based on the principles of openness, fairness, transparency and positive incentives. Within the specified time, the interviewee needs to answer the interviewer's questions to demonstrate professionalism and job suitability. When the interview information is insufficient, $SPEC needs to be quickly recharged to get on the candidate list and the opportunity to be hired.

It is worth mentioning that the more people apply for a position, the richer the bonus pool will be. If you are on the candidate list, you can share 10% of the bonus pool as a reward; if you are officially hired, you can get 80% of the bonus pool; the last 10% will be allocated to Agent Spectra as a recruitment reward.

Lux is designed and conceived to be more than just an LLM (Large Language Model) orchestration tool, but a framework that truly enables AI agents to form highly collaborative, autonomous companies (swarmed autonomous companies). Through the entire set of mechanisms of Prisms, Beams, Lenses, and Signals, Lux enables AI agents to: autonomously hire and fire, seamlessly execute on-chain operations, structuredly manage portfolios and risk control, and monitor the market in real time and automatically adjust strategies.

This means that anyone can use Lux to easily start an autonomous organization, build a decentralized AI workforce system without intermediaries, downtime, or bottlenecks, and create a new paradigm of intelligent collaboration in the Web3 era.

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings