3000 BTC Transferred to Binance, Capriole Warns of Sub-$50K in This Case

Bitcoin BTC $86 384 24h volatility: 0.0% Market cap: $1.72 T Vol. 24h: $44.06 B price continued trading below the key $90,000 level on Dec. 17 when a large Bitcoin transfer of 3,000 BTC from an unknown wallet to Binance was flagged by Whale Alert. The transaction is valued at roughly $260 million.

Meanwhile, a different wallet transferred 1,000 BTC, worth $87.3 million. At the time of writing, Bitcoin is trading around $86,000, down by more than 6% over the past week, according to CoinMarketCap data.

Capriole Founder Issues Warning

Charles Edwards, the founder of the quantitative crypto fund Capriole, has raised alarms about Bitcoin’s preparedness for the rise of quantum computing. He believes that if Bitcoin does not become quantum-resistant within the next few years, the market could face severe consequences.

Quantum computing is widely viewed as a future threat to cryptography. In theory, sufficiently powerful quantum machines could break current encryption standards, expose private keys, and put user funds at risk.

This came soon after Grayscale also acknowledged that quantum computing poses a future risk to blockchain security. It explained that most public blockchains will have to adopt post-quantum cryptography.

However, the financial giant believes that it is unlikely to affect Bitcoin and top altcoins in 2026.

While many consider the quantum computing threat to be far off, Edwards argues that the timeline may be much shorter than most expect.

According to his forecast, 2028 would be a critical deadline. If Bitcoin’s network does not implement a quantum-resistant upgrade by then, he expects the price to fall well below $50,000 and continue declining until the issue is resolved.

He also suggests that fear around quantum risk could eventually be flushed out through a major bear market.

Edwards believes that action needs to happen even sooner. A quantum security patch should be rolled out by 2026 to avoid what he describes as the most severe Bitcoin bear market on record.

Bitcoin could be an early target for quantum attacks because traditional banks are already transitioning toward post-quantum encryption. Legacy systems can often reverse or block fraudulent transactions, explained Edwards.

A Very Important Technical Level

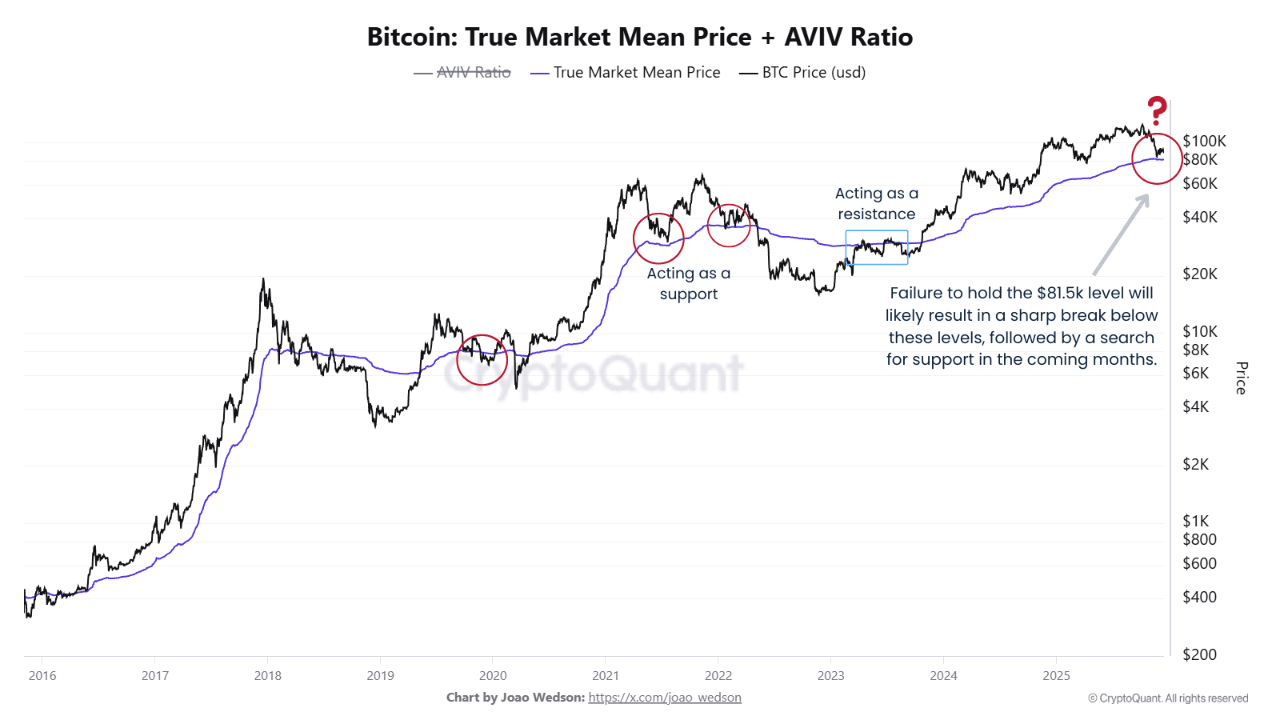

Onchain data from CryptoQuant shows that currently, the Bitcoin True Market Mean Price (TMMP), a key metric, is around $81,500.

When Bitcoin trades above the TMMP, investors tend to feel comfortable holding their positions, and pullbacks often attract buyers. When price drops below it, that same level frequently turns into resistance.

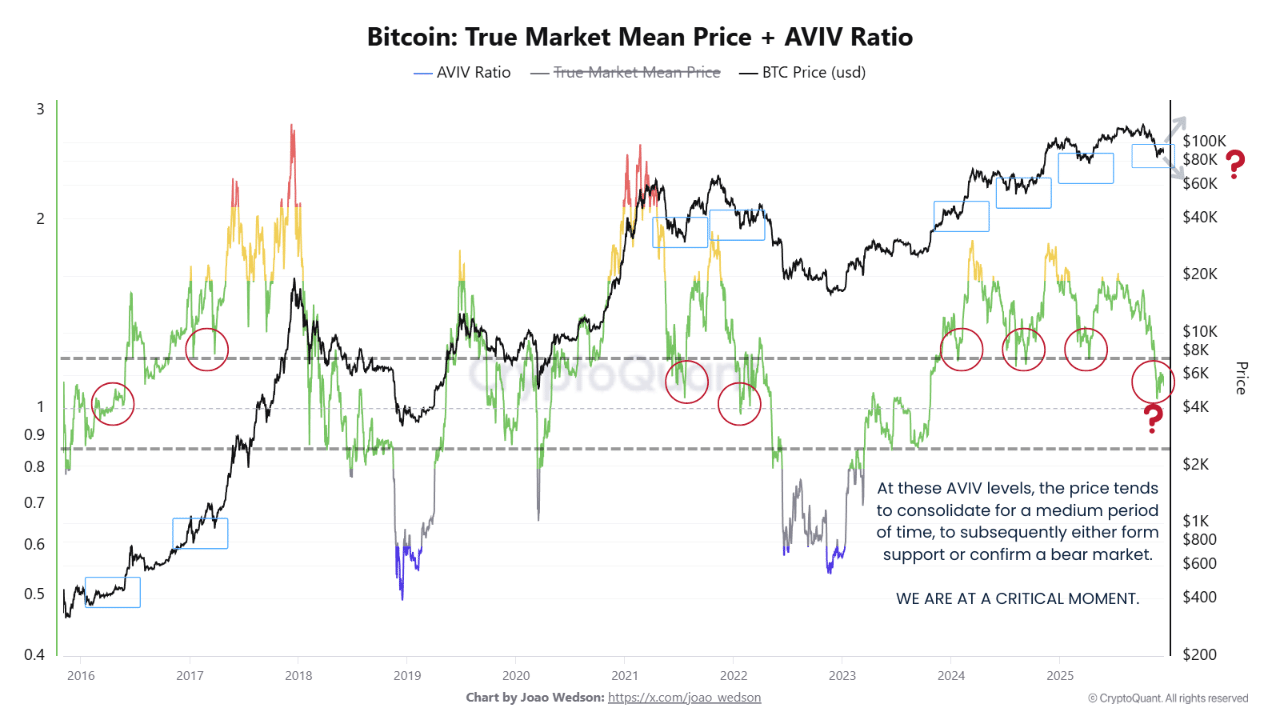

Similarly, the AVIV Ratio is reading levels from past mid-cycle transition phases, where the market neither collapsed nor trended strongly higher. Instead, price tends to move sideways, volatility declines, and investors quietly rebalance.

BTC TMMP | Source: CryptoQuant

If Bitcoin can stay above the TMMP while the AVIV Ratio stabilizes in the 0.8 to 0.9 range, it would suggest that investors are defending their cost basis and absorbing supply. That behavior typically supports longer-term trends.

BTC AVIV Ratio | Source: CryptoQuant

However, if Bitcoin loses the TMMP and AVIV doesn’t recover, a deeper search for demand could follow for the world’s largest digital asset.

nextThe post 3000 BTC Transferred to Binance, Capriole Warns of Sub-$50K in This Case appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

Singapore Entrepreneur Loses Entire Crypto Portfolio After Downloading Fake Game