XRP Price Analysis: XRP Holds Steady Above $2 as Its Open Interest Stabilizes at $3.72B

Highlights:

- The XRP price continues to trade sideways above the $2.00 support zone.

- XRP retail demand remains suppressed, as the open interest stabilizes at $3.72 billion.

- The XRP technical outlook indicates that only a close above $2.25 may fuel a rally towards $2.50 or even $2.60.

Ripple (XRP) price is still trading sideways above the support level of $2.00 as the Federal Reserve (Fed) decision dust settles. The crypto market failed to survive the increased volatility with investors digesting the hawkish interest rate cut by the Fed on Wednesday. Meanwhile, whales have sold approximately 280 million XRP over the past week.

In the meantime, the XRP derivatives have reached even lower levels, as the futures Open Interest (OI) stands at $3.72 billion. This is compared to $8.36 billion on October 10, when the crypto market crashed, liquidating 19 billion in assets in just one day. Meanwhile, the unrelenting decrease of a record high of $10.94 billion in July keeps the prices at the lows. In addition, a low OI indicates that investors do not believe that XRP could continue to be uptrending in the short term and are opting to remain on the side.

XRP Futures Open Interest: CoinGlass

XRP Futures Open Interest: CoinGlass

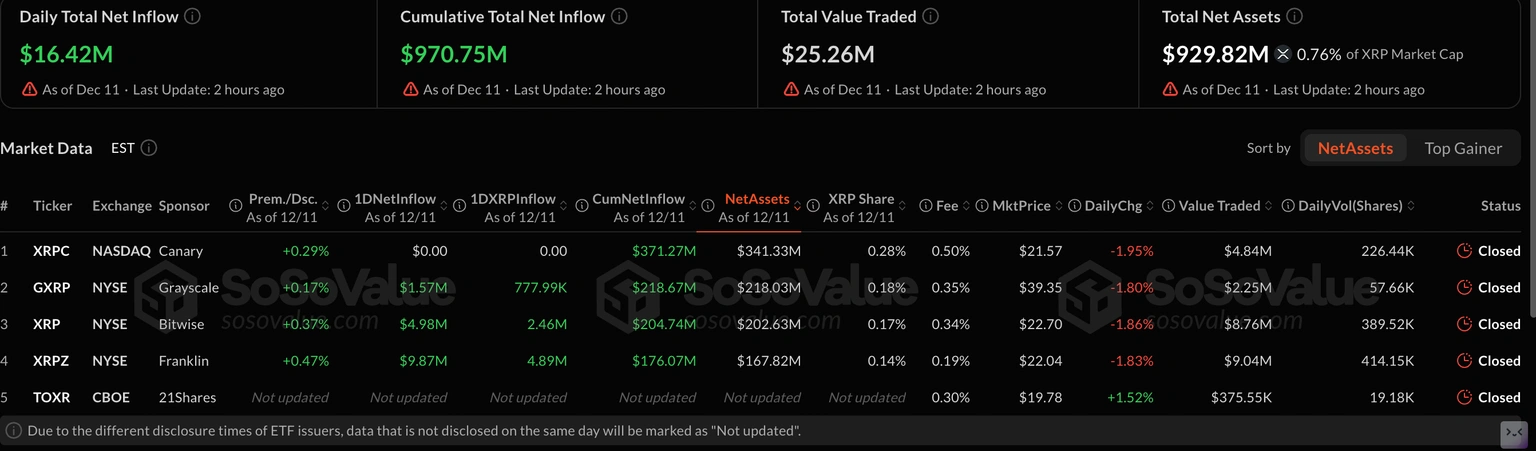

The demand for XRP Exchange Traded Funds (ETFs) is stable, as the inflows amount to about $16 million on Thursday. As the data provided by SoSoValue shows, the cumulative amount of the inflow has already reached $971 million, and it is soon approaching the mark of $1 billion mark. However, XRP ETFs contain net assets of $930 million.

Daily Total Net Inflow: SoSoValue

Daily Total Net Inflow: SoSoValue

XRP Price Holds Steady Above Key Support

XRP’s price action has caught attention on charts as it moves sideways, with strong support at $2.00. The price is now trading at $2.04, just under the 50-day Simple Moving Average (SMA) at $2.25 and the 200-day SMA at $2.60. This setup signals caution, as the bulls are attempting to regain momentum.

The nearest resistance sits at $2.25 (the 50-day SMA). If XRP can surge past this level, the price may target the next resistance near $2.50. A key psychological and technical zone where sellers have appeared before. Support is strong at $2.00. A drop below this could trigger more selling down to $1.96 and $1.80, but buyers are defending these levels tightly.

XRP/USD 1-day chart: TradingView

XRP/USD 1-day chart: TradingView

Technical indicators also point to a potential upside, as the RSI stands at 42.76, in the neutral territory. The MACD is slightly bullish, with a value of -0.0553 and the signal line at -0.0580, indicating buyers are gaining strength and have room to grow.

If XRP price closes above $2.25 in the coming days, it could quickly advance to $2.50-$2.60, especially if the crypto market flips positive. A rejection at resistance might see XRP fall toward support, but as long as it stays above $2.00, the overall trend looks positive.

Big institutional money could be coming in, and any news on spot XRP ETFs or major partnerships might add fuel to the rally. For now, as always, keeping a close eye on key support levels, especially near $2.00, is crucial for managing risk.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

U.S. Court Finds Pastor Found Guilty in $3M Crypto Scam

SEC Clears the Way for Spot Crypto ETFs with New Generic Rules