Scaramucci: Solana will ‘flip’ Ethereum

Anthony Scaramucci is once again singing Solana’s praises, telling attendees at the Breakpoint conference that he expects the public blockchain platform to eventually overtake Ethereum in market value.

- Scaramucci joked that he’s “not chain monogamous” and still supports multiple networks.

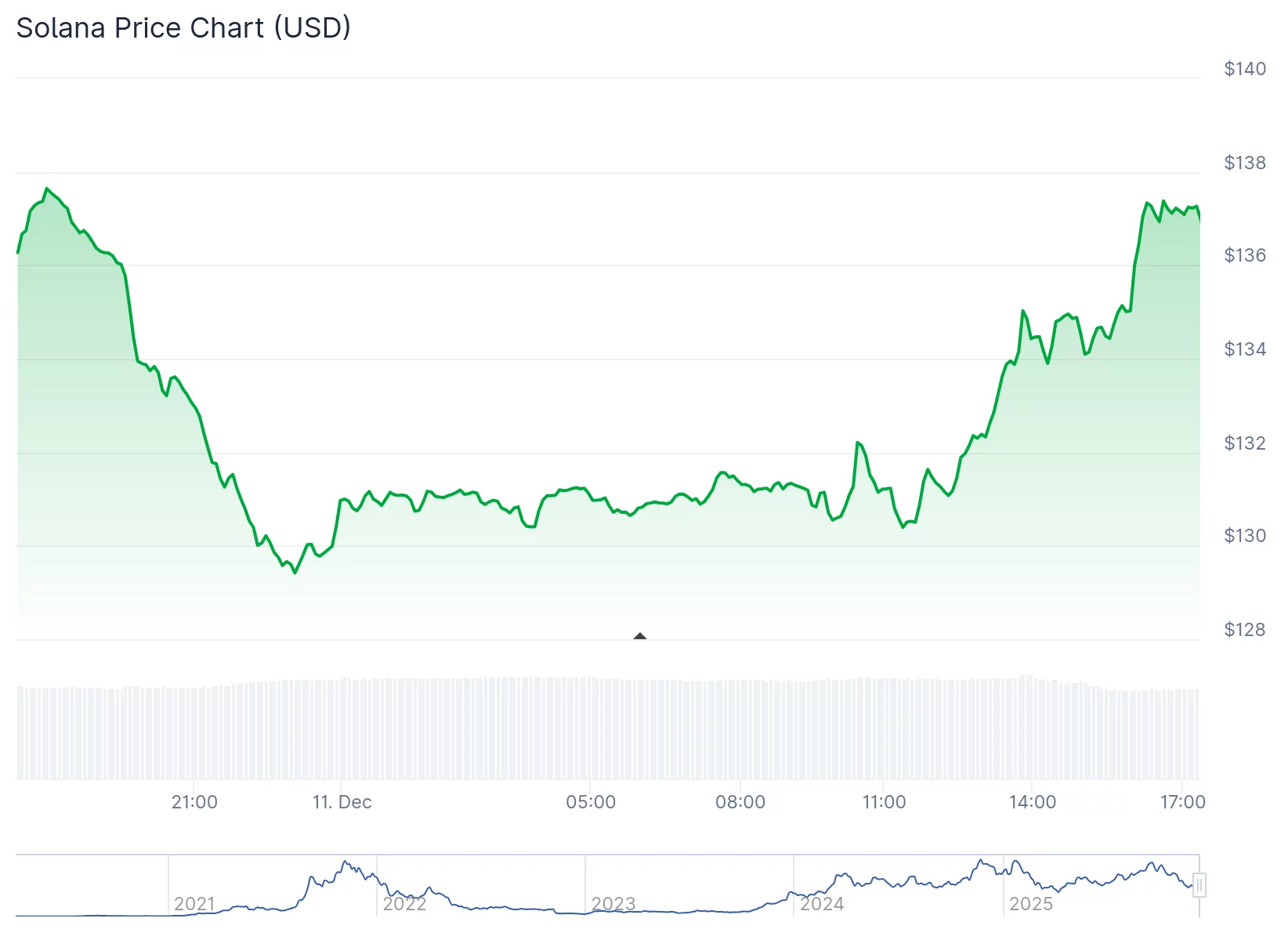

- His remarks came as ETH held key support near $3,121 despite heavy outflows, while Solana struggled near $137 amid bearish technical signals pointing toward a possible drop to $100.

- Despite the price pressure, Solana’s ecosystem has surged with new bridges, tokenized funds and major corporate integrations.

“I think it will flip Ethereum,” the SkyBridge Capital founder said, before quickly clarifying that he still loves ETH and Avalanche too, insisting he is “not chain monogamous.” See below.

In other words, it’s not you, Ethereum — it’s Solana’s blazing throughput, expanding developer base, and, presumably, its ability to make very loud entrances at conferences.

Why it matters

Scaramucci’s comments revived the long-running Layer-1 rivalry, which has intensified as Solana’s ecosystem continues expanding with new infrastructure, developer tooling, and institutional pipelines. But price charts painted a less romantic picture for both networks.

Ethereum traded around $3,200, hovering just above its 20-day EMA at $3,121 — a support zone that could launch bullish targets at $3,309, $3,382, and $3,453 if buyers show up. Despite $116 million in net outflows reported today by Coinglass, ETH has refused to set new lows, building a pattern of higher lows that suggests sellers are running out of steam. The Supertrend indicator remains red, however, warning the love story isn’t fully bullish just yet.

Solana, meanwhile, was last seen near $137 — down nearly 50% from its September highs and sulking near the bottom of its chart. Technical indicators point to possible further downside toward $100, with a bearish flag pattern and a death cross both flashing red. A break below $122 could cement the slide, while reclaiming $147 would invalidate the bearish setup.

Fundamentally, Solana has had plenty to brag about:

- A new bridge connecting Solana and Base via Chainlink

- Ondo Finance and State Street launching SWEEP, a tokenized liquidity fund

- Animoca Brands preparing to list its equity on Solana

- Bhutan rolling out the first sovereign-backed gold token on the network

- Coinbase unveiling trading access to the full suite of Solana tokens

Even ETFs appear smitten — Solana exchange-traded products have taken in more than $22 million this week alone, pushing cumulative inflows to $661 million and total assets to $950 million.

Despite the price slump, Scaramucci’s bullishness underscores a broader view shared by some crypto investors: both Solana and Ethereum can grow, coexist, and maybe even thrive together — even if one day, Solana ends up with “flip” bragging rights.

You May Also Like

Tether’s Uruguay Bitcoin Mining Plans Could Be Over

Oil jumps over 1% on Venezuela oil blockade